Should I Sell My Stocks Now?

Should I Sell My Stocks if the Coronavirus Keeps Spreading?

“Could the coronavirus trigger a stock market crash?”

“Should I sell my stocks now?”

“What do I do?”

Those are the types of questions I have received over the past few days.

Each time the Dow Jones plummets a few hundred points, our customer service line lights up. Subscribers flood our call center with questions, suddenly in need of contact with us. They want reassurance.

I’ve been there. Watching thousands of dollars evaporate from your retirement account can make anyone feel nauseated and sleepless.

Talking heads on TV say it makes sense to keep money on the sidelines and wait for the dust to settle.

But as longtime readers may have already guessed, my strategy for handling this coronavirus outbreak is no different than any other crisis. Simply put, you should consider these events to be about as relevant to your investing plan as the outcome of the upcoming March Madness tournament.

Admittedly, traders have good reason to be worried. After chomping through China, COVID-19 got its passport and spread throughout the world.

Iran? Panic. South Korea? On lockdown. Italy? Non bene.

Health officials say it’s only a matter of time before we have a full-blown pandemic on our hands.

Thankfully, the expected mortality rate is low; COVID-19 likely won’t kill millions of people.

Quarantine efforts, however, will knock the air out of local economies. Shuttered factories will lay off millions of workers. Corporate supply chains will break down. The travel business will get smoked. Manufacturing output will crater.

That has triggered a stampede out of cowboy assets (stocks, commodities, real estate) and into anything that promises safety (gold, Treasuries, bunkers). No one can predict when it will end.

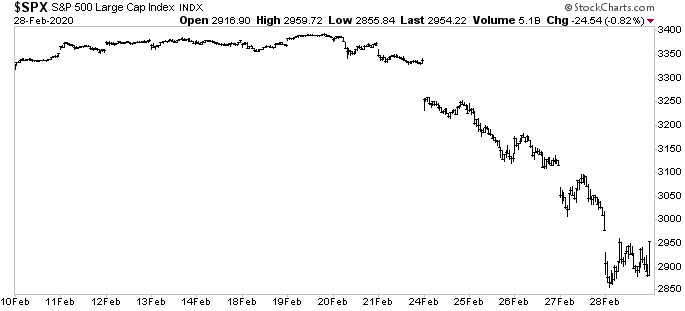

Chart courtesy of StockCharts.com

Time to start hoarding gold bullion and ammo clips? Nah.

First, let’s put the recent stock market crash in context. The S&P 500’s 8.2% February plunge doesn’t even make the list of the worst monthly returns in history. Not even close.

You’d have to go back to September 1931 to find the biggest 30-day decline (29%). Decades later, in October 2008, the index lost more than a fifth of its value.

So the current drop is the financial equivalent to a charley horse: painful but not fatal.

And pain is a normal state for investors.

Portfolio managers try to quantify pain with a metric called “drawdown.” This number indicates the stock market’s maximum high point to minimum low point in a calendar year.

Going back to 1970, investors have experienced an average drawdown on a calendar basis of -15.7%. In some years, shareholders feel only mild discomfort. In other years, like 2008 (the Great Recession), they suffer a Saw-style torture session.

But once again, February’s stock market crash doesn’t even put us in the extreme range of historical drawdowns. In fact, it sits well within the range of downturns you’d expect in any given year.

Yes, the coronavirus is real, spreading, and unpredictable. But it’s not the Black Death.

A vaccine will emerge. Factories will reopen. Business will resume.

This has all the hallmarks of a temporary sell-off, like the OPEC oil embargo, Russia’s invasion of Crimea, and a bunch of other crises you probably forgot about.

Short-term, officials will likely serve the stock market a big bowl of liquidy chicken soup.

Analysts have already started pricing in the possibility of several big interest rate cuts from the Federal Reserve in the coming months. That will pour trillions of dollars into the financial system, keeping a bid under asset prices.

And look for more stimulus packages from Europe, China, and Latin America.

Long-term, companies will eventually return to business as usual.

Think about it. In five years, do you really expect Coca-Cola Co (NYSE:KO) to stop selling soda. Do you think Clorox Co (NYSE:CLX) will stop selling bleach? Do you think McDonald’s Corp (NYSE:MCD) will stop selling burgers?

So why should investors worry about a five-day dip in their share prices?

Furthermore, such sudden dips have turned out to be buying opportunities.

Of course, no one can predict how the coronavirus will impact equities this go-around. But selling stocks in a panic has rarely paid off for investors (at least based on the data).

Over the weekend, I looked at how the S&P 500 performed following one-month plunges of eight percent or more. I’ve highlighted the results in the below table.

|

S&P 500 Returns After Drops of 8%+ |

|||

| Period | 1 Year | 3 Years |

5 Years |

| Average S&P 500 Return | 7.2% | 42.1% |

65% |

(Source: “S&P 500 (^GSPC),” Yahoo! Finance, last accessed March 2, 2020.)

So here’s what the numbers say.

Since 1926, the S&P 500 was higher 60% of the time over the 52 weeks following a one-month fall of eight percent or more. On average, the index posted a total return of 7.2% over the year after the drop. Moreover, shares rose by 42.1% and 65% over the three- and five-year periods, respectively.

In other words, waiting for the dust to settle may sound like savvy advice in theory. But in the real world, the future is always dusty. And it’s the people who step up during times of crisis who are usually rewarded.

Keep that in mind with all of the coronavirus stories making headlines.