Shell Midstream Partners LP: The 8.2% Dividend Yield That Keeps on Paying Out More

A Safe 8%-Plus Yield

You should avoid most high-yield stocks. In fact, of the companies I follow with the 25 highest yields, only a handful maintain decent safety ratings.

You just don’t often find companies with a big upfront payout and a reliable dividend history.

But today’s stock, which yields a tidy 8.2%, should inspire confidence, at least as far as we care about the distribution.

Shell Midstream Partners LP (NYSE:SHLX) is a master limited partnership that owns thousands of miles of oil and gas pipelines. And despite a short operating history, the partnership has developed an impressive track record.

Shell has paid a quarterly distribution since 2015. More importantly, management has boosted the payout every single quarter over that period.

Those small increases can really add up over time. Today, Shell pays out a quarterly distribution of $0.40 per unit. That comes out to an annual yield of 8.2%.

Shell Midstream Partners LP also stands in fine financial health.

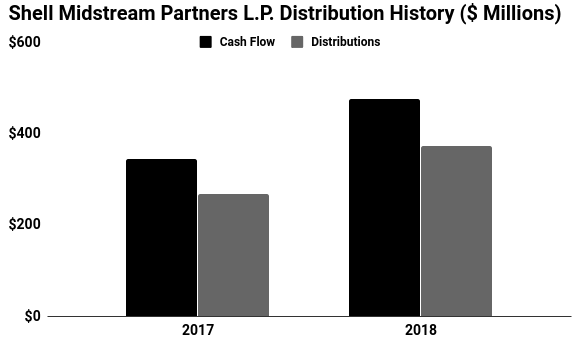

Last year, the company paid out $373.2 million in distributions. Over that same period, the business generated $477.2 million in cash flow. That’s a payout ratio of 78%—within my preference of 90% or less.

I suspect that payout will continue to increase. Pipeline volumes grow slowly, but steadily over time. Each year, management can raise the toll fee on each barrel shipped.

Executives can boost this growth rate further by buying additional assets from its general partner, Royal Dutch Shell PLC (NYSE:RDS.A, NYSE:RDS.B).

In total, analysts project the partnership’s cash flows will grow at a mid-single-digit annual clip over the next five years. Investors can expect the distribution to grow more or less in line with profitability.

Source: “Unitholder Information,” Shell Midstream Partners LP, last accessed February 4, 2019.

In fact, interest rates present the only challenge in the near future. Shell Midstream Partners LP competes directly with fixed-income securities for capital. If rates rise, traders will likely dump their units for safer returns in the bond market.

But considering its respectable payment history, low payout ratio, and growing cash flows, SHLX stock’s 8.2% distribution yield looks safe.