Seven Hills Realty Stock: 10.4%-Yield mREIT’s Shares up 30%+ Since November

SEVN Stock Bullish on Upcoming Interest Rate Cuts

Beaten-down real estate investment trusts (REITs) got a big boost in early November 2023 after the Federal Reserve announced that it was leaving its key interest rate unchanged and hinted that rate cuts were coming.

REITs like Seven Hills Realty Trust (NASDAQ:SEVN) got an even bigger jolt in mid-December when the Fed not only held its key lending rate again, but also signaled that multiple rate cuts were on the table for 2024. (Source: “December Fed Meeting: Officials Anticipate 3 Rate Cuts in 2024,” Forbes, December 13, 2023.)

Back then, the first interest rate cut was expected in March, but now, better-than-expected economic data, including strong U.S. retail sales—plus higher-than-expected inflation—suggest that the Fed might not announce its first rate cut until May.

The actual timing is unknown at this point, but we do know that rate cuts are coming in 2024. That’s been helping REITs trend significantly higher.

Why? As we’ve noted numerous times here at Income Investors, higher interest rates make it more expensive to borrow money and pay down debt. For some REITs, high rates can really cut into their profit margins.

There are different kinds of REITs, though.

Most people think of equity REITs, which are companies with portfolios of physical real estate. This can include anything from residential real estate to industrial properties, hotels, casinos, offices, health-care facilities, retail properties, data centers, or communication towers.

Then there are mortgage REITs (mREITs), which invest in mortgages instead of real estate. They provide financing for income-generating real estate by purchasing or originating mortgages and mortgage-backed securities, earning income from the interest on these investments.

When interest rates are near zero, it can mean less money comes into mREITs, which translates to lower profits. Higher interest rates are terrific for mREITs in general, and they’re a big bonus for mREITs that have a lot of floating-rate loans.

Even with interest rate cuts coming this year, the outlook for mREITs is excellent, as the rates are expected to still be above the pre-pandemic levels for years.

That’s great news for Seven Hills Realty stockholders.

About Seven Hills Realty Trust

Seven Hills Realty focuses on originating and investing in first mortgage loans that are secured by middle-market and transitional commercial real estate in the U.S. (Source: “Investor Presentation: November 2023,” Seven Hills Realty Trust, last accessed January 25, 2024.)

The company’s management describes middle-market commercial real estate as commercial properties with values up to $100.0 million. Transitional commercial real estate comprises commercial properties that are subject to redevelopment or repositioning activities that are expected to increase the value of those properties.

Seven Hills Realty Trust has $720.0 million in loan commitments, 100% of which are invested in floating-rate first mortgage loans. That means the interest rate changes throughout the life of the loan.

By property type, offices account for the majority of the mREIT’s portfolio, at 34%, followed by multifamily residences (33%), retail properties (17%), industrial facilities (14%), and hotels (two percent).

Q3 Net Income Up 44% YOY; Quarterly Dividend of $0.35

For the third quarter ended September 30, 2023, Seven Hills Realty announced that its net income increased by 44% year-over-year to $7.5 million, or $0.51 per share. (Source: “Seven Hills Realty Trust Third Quarter 2023 Financial Results,” Seven Hills Realty Trust, October 31, 2023.)

Its distributable earnings inched up to $5.6 million, or $0.38 per share, while its adjusted distributable earnings came in at $5.3 million, or $0.36 per share.

The company also announced a quarterly distribution of $0.35 per share, for a yield of 10.43% (as of this writing).

Commenting on the results, Tom Lorenzini, Seven Hills Realty Trust’s president and chief investment officer, said, “Our third quarter results once again underscore the quality of our loan portfolio in the current lending environment.” (Source: Ibid.)

He continued,” Distributable earnings increased, more than fully covering our quarterly dividend, and the credit quality of our portfolio remained strong with all loans current on debt service and a weighted average risk rating below three.” (Source: Ibid.)

Seven Hills Realty Stock Rips Higher

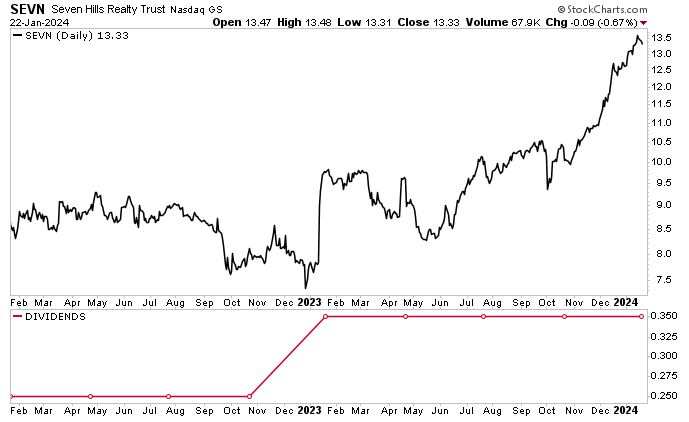

Although Seven Hills Realty reported solid third-quarter results on October 31, 2023, its stock price has been ripping higher since then because the Federal Reserve announced on November 1 that it was holding its key interest rate steady and hinted that rate cuts were coming.

As you can see in the chart below, the price of SEVN stock has been climbing since then.

As noted above, higher interest rates make it more difficult for individuals and businesses to borrow money, but with inflation cooling and the odds of the U.S. avoiding a recession growing, the Fed is expected to announce its first interest rate cut in the first half of 2024.

Lower rates should bring in more borrowers from the sidelines, which should help juice the profits of leading mREITs like Seven Hills Realty Trust.

Investors seem to agree. Seven Hills Realty stock climbed by 24.18% in November and December 2023. Trading at its highest levels in almost four years, SEVN stock has also gone up (as of this writing) by:

- 5.7% year-to-date

- 32.7% over the last three months

- 34.2% over the last six months

- 36.6% over the last 12 months

Chart courtesy of StockCharts.com

Even after those big gains, Wall Street analysts remain bullish on Seven Hills Realty stock. They’ve provided a 12-month median share-price target of $15.00, which points to gains of 12.5%.

The Lowdown on Seven Hills Realty Trust

Seven Hills Realty Trust is a fantastic mREIT that saw its share price take a hit during the Federal Reserve’s aggressive interest rate hike cycle in 2022 and 2023. But with the rate hike cycle likely over, and rate cuts expected to begin this year, the macroeconomic and microeconomic outlook for SEVN stock and other mREIT stocks is solid.

Seven Hills Realty continues to actively invest its capital, closing two new loans during the third quarter of 2023. According to management, the company is “well positioned to capitalize on new investment opportunities and continue to deliver attractive risk adjusted returns for [its] shareholders.”

That includes long-term share-price gains and reliable, high-yield distributions.