10.35%-Yield Service Properties Stock on 30-Year Dividend Streak

SVC Stock an Underperforming REIT Play With High Prospects

During periods of rising interest rates, shares of real estate investment trusts (REITs) tend to encounter major price deterioration. That’s because REITs generally have significant capital expenditures that are vulnerable to high interest rates.

But with the expected decline in interest rates beginning as early as March, REIT stocks have been rallying lately—and there’s likely more to come.

That’s the case with Service Properties Trust (NASDAQ:SVC). The small-cap REIT has more than $11.0 billion invested across two major asset classes: hotels and service-focused retail net lease properties. (Source: “About Us,” Service Properties Trust, last accessed February 1, 2024.)

At the end of September 2023, Service Properties owned more than 221 hotels (totaling more than 37,000 hotel rooms) in the U.S., Puerto Rico, and Canada. As of that date, the company also owned 761 retail service-focused net lease properties (comprising more than 13 million square feet) in the U.S.

Service Properties stock has been hurt by weakness in the hotel and retail space, but things have been improving. My view is that it might be an opportune time to look at Service Properties Trust.

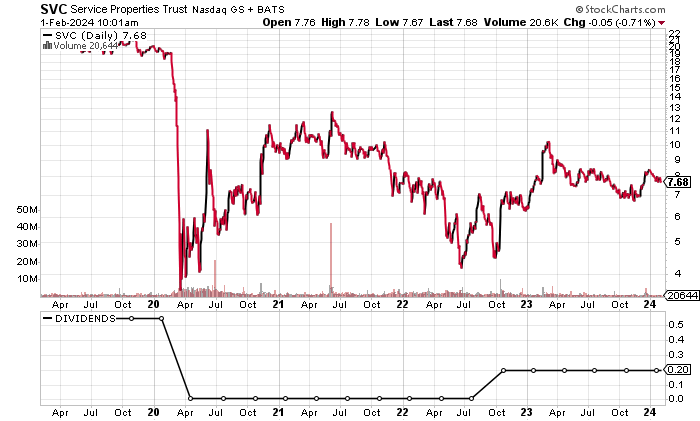

As of this writing, SVC stock’s price is just north of its 52-week low of $6.84 and well below its range high of $11.57 and its five-year high of $28.00 from February 2019. At its current price level, I view Service Properties stock as a compelling opportunity.

Chart courtesy of StockCharts.com

Why I’m Bullish on Service Properties Trust

Service Properties has generated revenue growth in four of its last five reported years. The exception was 2020, which was during the COVID-19 pandemic.

The company’s revenues have been steadily recovering, but the potential for an economic slowdown in 2024 could cause some stalling in its revenue growth.

Analysts estimate that Service Properties will report flat revenues of $1.86 billion for 2023 and $1.9 billion for 2024. (Source: “Service Properties Trust (SVC),” Yahoo! Finance, last accessed February 1, 2024.)

| Fiscal Year | Revenues (Billions) | Growth |

| 2018 | $2.29 | N/A |

| 2019 | $2.32 | 0.9% |

| 2020 | $1.27 | -45.4% |

| 2021 | $1.50 | 18.2% |

| 2022 | $1.86 | 24.6% |

(Source: “Service Properties Trust,” MarketWatch, last accessed February 1, 2024.)

Service Properties’ gross margin picture saw contractions in 2022 and 2023, but its high reading of 44.8% in 2021 may have been an aberration.

| Fiscal Year | Gross Margin |

| 2019 | 39.5% |

| 2020 | 39.0% |

| 2021 | 44.8% |

| 2022 | 28.1% |

| 2023 | 34.0% |

Moving to the bottom line, Service Properties Trust has yet to return to the level of generally accepted accounting principles (GAAP) profitability it had prior to the pandemic.

An encouraging sign was the significant narrowing of its GAAP-diluted earnings-per-share (EPS) loss in 2022, compared to in 2021 and 2020.

Analysts expect Service Properties Trust to continue losing money. They estimate that the REIT’s loss narrowed to $0.14 per diluted share in 2023 and that its loss will increase to $0.24 per diluted share in 2024. (Source: Yahoo! Finance, op. cit.)

The company will need to continue streamlining its cost side and move back toward GAAP profitability.

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2018 | $1.13 | N/A |

| 2019 | $1.58 | 39.8% |

| 2020 | -$1.89 | -219.8% |

| 2021 | -$3.31 | -74.7% |

| 2022 | -$0.80 | 75.7% |

(Source: MarketWatch, op. cit.)

Service Properties Trust’s funds statement shows consistent positive free cash flow (FCF) in each of its five last reported years, including a strong rebound in 2022.

The company uses its FCF to pay dividends to SVC stockholders.

| Fiscal Year | FCF (Millions) | Growth |

| 2018 | $596.95 | N/A |

| 2019 | $624.3 | 4.6% |

| 2020 | $37.9 | -93.9% |

| 2021 | $49.9 | 31.7% |

| 2022 | $243.1 | 387.1% |

(Source: MarketWatch, op. cit.)

A major risk for Service Properties Trust is the $5.7-billion debt on its balance sheet. Its debt is partly offset by $418.2 million in cash. (Source: Yahoo! Finance, op. cit.)

The REIT’s interest coverage ratio of only 0.7 times in 2022 indicates fragility.

Service Properties Trust’s Piotroski score—an indicator of a company’s balance sheet, profitability, and operational efficiency—is a high reading of 7.0, which is only two notches below the Piotroski score’s top reading of 9.0. This suggests that the REIT’s complete financial situation is manageable for now.

Expect Service Properties Stock’s Dividends to Continue

Service Properties Inc has paid dividends for 30 consecutive years, including a total of $38.0 million in 2022.

The company was hurt by the COVID-19 pandemic in 2020, and that led management to make a significant cut to SVC stock’s quarterly dividend—from $0.54 per share in the first quarter of 2020 to $0.01 per share in the second quarter of that year. (Source: “SVC Dividend History,” Nasdaq, last accessed February 1, 2024.)

In a positive development, Service Properties Trust increased its dividend to $0.20 per share in the third quarter of 2022 and has kept it at that level since then. As of this writing, Service Properties stock’s dividend translates to a forward yield of 10.35%.

As long as the REIT’s FCF continues to be positive, I expect its dividend streak to remain intact. The company’s dividend coverage ratio is a healthy 3.8 times. (Source: Yahoo! Finance, op. cit.)

Moreover, based on what Service Properties Trust paid out in 2022, the REIT has the financial room to make a slight increase to its dividends.

| Metric | Value |

| Dividend Growth Streak | 1 Year |

| Dividend Streak | 30 Years |

| 10-Year Average Dividend Yield | 6.5% |

| Dividend Coverage Ratio | 3.8 |

The Lowdown on Service Properties Trust

In my view, SVC stock is worth a look for income investors who have the patience to wait for a turnaround in its share price. In the meantime, investors can benefit from Service Properties Trust’s high-yield dividends.

Note that Service Properties stock has strong institutional support, with 352 institutions holding 79.3% of the outstanding shares (as of this writing). BlackRock Inc (NYSE:BLK) has an 18.4% stake in Service Properties Trust and The Vanguard Group, Inc. has a 16.1% stake. (Source: Yahoo! Finance, op. cit.)