Inflation-Trouncing, 9.7%-Yielding San Juan Basin Royalty Trust Up 129% in 2022

San Juan Basin Royalty Trust Stock Pays Frothy Dividends Monthly

Right now, energy companies are flush with cash, so much so that many of the biggest oil companies have been paying out one year’s worth of regular dividends as special dividends. Everyone loves to be on the receiving end of a special dividend, especially if the regular dividend is so paltry.

What’s better than a big oil company that hogs the spotlight because of its special dividends? A smaller energy company that provides regular ultra-high-yield dividends. Better yet, one that pays them monthly. That’s what you get with San Juan Basin Royalty Trust (NYSE:SJT).

The Houston, TX-based royalty trust is an oil and gas exploration and production (midstream) company that has been providing investors with reliable, high-yield dividends for years and—depending on where energy prices are at any given time—high capital appreciation.

These days, energy stocks like SJT stock are like ATMs, and smart investors jump in to pick up the overflowing cash. And thanks to strong industry tailwinds, energy companies’ share prices have been soaring, too.

San Juan Basin Royalty has a 75% net overriding royalty interest in the San Juan Basin of New Mexico. Virtually every penny that comes from the company’s oil and gas leaseholds goes directly to its unitholders as monthly dividends. (Source: “About Us,” San Juan Basin Royalty Trust, last accessed August 9, 2022.)

And right now, San Juan Basin Royalty Trust stock’s dividend yield stands at 9.7%.

Unlike an actively managed trust, in which the management team can grow the company’s assets, San Juan Basin Royalty Trust doesn’t engage in any new business or commercial activity, nor can it use any portion of the trust to acquire additional properties.

What this means is that the company’s assets (wells) will eventually run dry, but that won’t happen for quite some time. The trust has enough energy reserves to run for at least another 10 to 15 years—probably more. The number of years could increase as drilling technology improves. This means San Juan Basin Royalty Trust can safely provide its stockholders with reliable, ultra-high-yield payouts for years to come.

SJT Stock’s Year-to-Date Distribution Almost Equals its 2021 Total

As might be expected, San Juan Basin Royalty Trust stock’s payout fluctuates month to month based on changing energy prices (more than 90% of the company’s holdings are in natural gas). Most recently, in July, the trust declared a monthly cash distribution of $6.8 million, or $0.145185 per unit. (Source: “News Release,” San Juan Basin Royalty Trust, July 19, 2022.)

These days, San Juan Royalty Trust has been making a lot of money—and there’s every reason to believe the company will hike its dividend over the coming quarters. In 2021, the company’s total net cash distribution was $35.7 million, with a distribution per unit of $0.771744. (Source: “Distributions,” San Juan Basin Royalty Trust, last accessed August 9, 2022.)

San Juan Royalty Trust will top those annual numbers in August. At the end of July, SJT stock’s year-to-date net cash distribution was $34.5 million, with a distribution per unit of $0.739756.

Again, the trust’s distribution fluctuates based on where we are in the economic cycle. In 2020, its net cash distribution was $7.5 million, with a distribution per unit of $0.159164. In 2005, its net cash distribution was $151.5 million, with a distribution per unit of $3.25.

Share-Price Performance

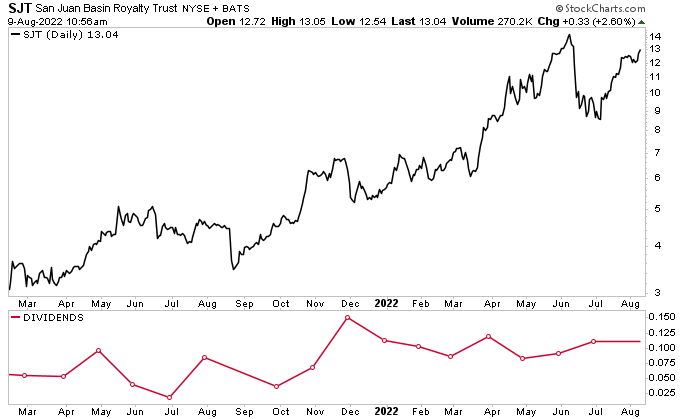

Not only has San Juan Basin Royalty Trust stock been rewarding buy-and-hold investors with big monthly paychecks, but it has also been crushing the market in terms of share price. As of this writing, SJT stock is up by:

- 33% over the last month

- 117% over the last six months

- 126% year-to-date

- 185% year-over-year

Chart courtesy of StockCharts.com

The Lowdown on San Juan Basin Royalty Trust

San Juan Basin Royalty Trust stock is an excellent U.S. oil and gas play that has been rallying due to high energy prices. High oil and natural gas prices also help the company juice its frothy monthly dividends, which investors should be able to bank on for years to come.

The good times will not last forever; SJT stock’s price will ebb and flow. But investing is all about taking advantage of opportunities. Currently, the economic tailwinds suggest it’s an excellent time to look at a midstream energy play like San Juan Basin Royalty Trust.