San Juan Basin Royalty Stock: Investors Come for the Share-Price Gains, Stay for the 14.4% Yield

SJT Stock Pays Ultra-High-Yield Dividends Monthly

Everyone knows the energy sector is one of the best places to be right now (unless you’re Al Gore or Robert Kennedy Jr.). And when it comes to outsized stock market gains and ultra-high-yield dividends, it would be tough to beat San Juan Basin Royalty Trust (NYSE:SJT).

The oil and natural gas company is a royalty trust with a 75% net overriding royalty interest in the San Juan Basin of New Mexico. More than 90% of the company’s holdings are in natural gas. Virtually every penny that comes from the company’s oil and gas leaseholds goes to unitholders as monthly dividends. (Source: “About Us,” San Juan Basin Royalty Trust, last accessed November 18, 2022.)

Unlike an actively managed trust, in which a management team can grow its assets, San Juan Basin Royalty doesn’t engage in any new business or commercial activity, including acquiring additional properties. This means the company’s assets (oil and gas wells) will eventually run dry, but that won’t happen for quite some time. The trust has enough energy reserves to run for at least another 10 to 15 years—probably more. The number of years could increase as drilling technology improves.

This means San Juan Basin Royalty Trust can safely provide investors with reliable, ultra-high-yield payouts for years to come.

Since the amount of San Juan Basin Royalty’s monthly distribution is based on production, which is fueled by supply and demand, San Juan Basin Royalty stock’s dividend fluctuates. Moreover, the company’s dividends will decline as its wells run dry. This means investors need to pay attention to what’s going on in the energy sector. SJT stock isn’t the kind of stock you can just buy and forget about.

At the moment, the energy industry tailwinds are favoring San Juan Basin Royalty stock, so much so that its year-to-date distribution of $1.57 per unit has already trounced the $0.77 per unit it paid out in all of 2021. (Source: “Cash Distributions,” San Juan Basin Royalty Trust, last accessed November 18, 2022.)

The company’s year-to-date payout is its highest since 2011, when it was $1.44 per unit. Chances are high San Juan Basin Royalty will trounce that number; it only has $0.06 to go in order to achieve that. The company might have a little difficulty matching the $3.06 per unit it paid out in 2008, but it’s tough to argue with a dividend yield that’s currently sitting at 14.4%.

On November 15, the company paid out $16.3 million, or $0.349121 per unit. On November 18, San Juan Basin Royalty declared a monthly cash distribution of $8.0 million, or $0.171971 per unit. It’s payable on December 14 to unitholders of record as of November 30. (Sources: “News Release,” San Juan Basin Royalty Trust, October 21, 2022 and “News Release,” San Juan Basin Royalty Trust, November 18, 2022.)

San Juan Basin Royalty Trust’s Share-Price Performance

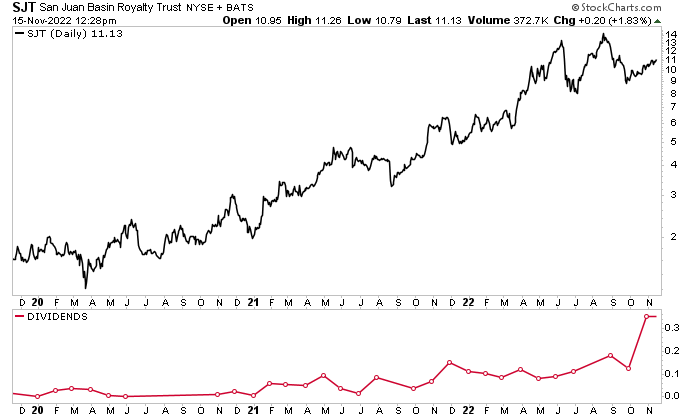

SJT stock’s yield would be even higher, but its share price has been rising lately. As of this writing, the stock is up by:

- 15% over the last month

- 12% over the last six months

- 107% year-to-date

- 86% year-over-year

Chart courtesy of StockCharts.com

The Lowdown on San Juan Basin Royalty Stock

Investing in ultra-high-yield dividend stocks is all about opportunity. San Juan Basin Royalty Trust is currently offering investors a compelling opportunity to take advantage of energy industry tailwinds. Those tailwinds have been sending SJT stock significantly higher and allowing management to reward shareholders with inflation-crushing, high-yield dividends.

As I noted earlier, the company’s good times won’t last forever. San Juan Basin Royalty stock’s value will ebb and flow in step with energy prices. That means the company will likely skip the odd month of paying dividends. But these days, San Juan Basin Royalty is running on all cylinders.

Imagine how well San Juan Basin Royalty Trust will do when it’s not facing macroeconomic headwinds and a potential recession.