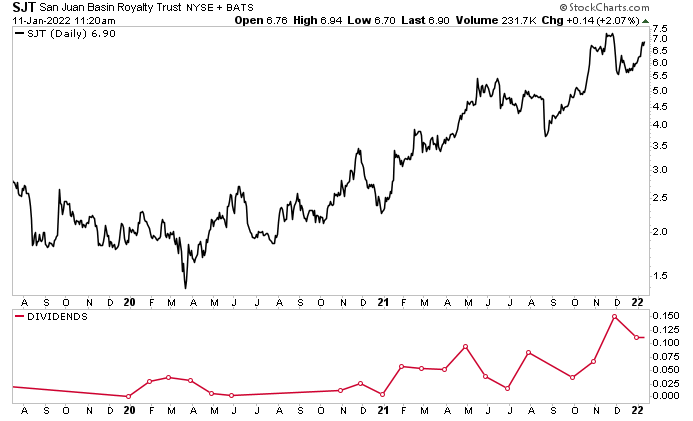

San Juan Basin Royalty Stock Up 175% YOY & Still Provides 11.3% Dividend

SJT Stock an Overlooked, Bullish Oil & Gas Play

With no Wall Street analysts providing an outlook on San Juan Basin Royalty Trust (NYSE:SJT), it’s fair to say this oil and gas exploration and production company is overlooked. That doesn’t mean it should be, though.

The company, which has been around since 1980, provides investors with reliable, high-yield dividends and, depending on where energy prices are, strong capital appreciation. Fortunately for investors, San Juan Basin Royalty stock is in a sweet spot right now.

San Juan Basin Royalty Trust is a royalty trust with a 75% net overriding royalty interest in the San Juan Basin of New Mexico. Virtually every penny that comes from the company’s oil and gas leaseholds goes directly to unitholders as monthly dividends. And right now, SJT stock’s dividend yield stands at 11.3%. (Source: “About Us,” San Juan Basin Royalty Trust, last accessed January 11, 2022.)

Unlike actively managed trusts, in which a management team can grow its assets, San Juan Basin Royalty doesn’t engage in any new business or commercial activity, nor can it use any portion of the trust to acquire additional properties.

What this means is that the company’s assets (wells) will eventually run dry, but that won’t happen for quite some time. The trust has enough energy reserves to run for at least another 10 to 15 years—probably more. The number of years could increase as drilling technology improves.

As a result, investors can take solace in the knowledge that this dividend stock will likely provide them with reliable, ultra-high payouts for years to come. Most recently, in December 2021, the trust declared a monthly distribution of $5.2 million, or $0.112441 per unit. (Source: “Press Release,” San Juan Basin Royalty Trust, December 20, 2021.)

SJT stock’s payout will fluctuate month-to-month on changing energy prices. More than 90% of the company’s holdings are in natural gas. Moreover, the dividends will decline as the wells run dry.

There can be other hiccups, too. Back in August 2021, the trust skipped its monthly dividend as a result of a previous accounting error. The company’s profits for the month were used to rectify the error. It’s the only time that’s happened, so it shouldn’t be seen as a big red flag. (Source: “News Release,” San Juan Basin Royalty Trust, August 20, 2021.)

It’s unfortunate and maddening that investors had to bear the brunt of someone else’s error, but it’s survivable. Moreover, Hilcorp Energy Company, the oil and gas company operating San Juan Basin Royalty’s natural gas wells, has taken the late but wise step of implementing a new accounting system. The new system allows the company to report its actual—instead of estimated—production.

Not surprisingly, investors didn’t take the skipped dividend in stride. They sent San Juan Basin Royalty stock down by more than 20%. The stock has since recovered, however.

As of this writing, SJT stock is up by:

- 13% month-over-month

- 51% over the last six months

- 175% year-over-year

Chart courtesy of StockCharts.com

The Lowdown on San Juan Basin Royalty Trust

San Juan Basin Royalty Trust is an excellent U.S. oil and gas play that has been taking advantage of rising energy prices.

This helps San Juan Basin Royalty stock provide investors with steady, frothy monthly dividends that they should be able to rely on for years to come.