Sabra Healthcare REIT Inc: A Safe 10.1% Yield

Stock Pays 10.1%, and Growing

Today’s chart highlights another winner from a graying America.

Longtime readers have heard our bull case for healthcare stocks before. As the population gets older, we’ll need more tests, drugs, and doctors.

That’s great news for investors, because more demand for healthcare services has resulted in a bonanza of dividend increases. You can also see the trend reflected in the soaring price of healthcare stocks like Johnson & Johnson (NYSE:JNJ), Abbott Laboratories (NYSE:ABT), and Bristol-Myers Squibb Co (NYSE:BMY).

Another case in point is senior and medical property owner Sabra Healthcare REIT Inc (NASDAQ:SBRA). With more than 10,000 boomers turning 65 each day, this landlord can now fund a 10.1% annual dividend yield. But is this high distribution sustainable? Let’s dig into the financial statements.

Sabra generated $2.31 per share in adjusted funds from operations (AFFO) last year, a common measure of cash flow for REITs.

Over the same period, management paid out $1.73 per share in distributions. This comes out to a safe payout ratio of 75%. As a rule of thumb, this figure represents the absolute maximum amount of cash flow I like to see businesses pay out. But, given the recession-proof nature of senior housing, Sabra investors shouldn’t lose much sleep.

That distribution will likely keep growing.

Sabra has situated most of its property portfolio inside dense urban centers. Given the high cost of land and strict zoning regulations, these markets benefit from constraints on new construction. While bad news for tenants, this is great news for investors. With little in the way of competition, Sabra can raise prices year after year. In combination with an aging population, management expects to grow AFFO at a high-single-digit clip.

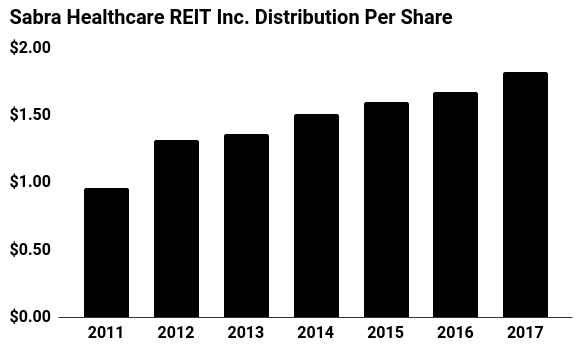

Sabra has passed most of its profits to shareholders in the form of higher distributions. Since going public in 2011, management has boosted the payout six times. Looking forward, we can expect the dividend to grow more or less in line with cash flows.

(Source: “Dividend,” Sabra Healthcare REIT Inc, last accessed July 18, 2018.)

Of course, you can’t call the Sabra story a 100% sure bet. Higher interest rates will increase borrowing costs, which will reduce the number of new properties that management can finance and reduce the pace of distribution increases.

But for now, Sabra Healthcare REIT Inc looks like one of the few safe double-digit yields around. And with a growing number of retirees, that payout will most likely continue to grow. Dividend investors should give this 10.1% yield a second look.