Sabra Health Care REIT: Little-Known Stock Pays Out 10.2%

Quiet Stock Yields 10.2%

I hope readers understand this basic tenet of our investment approach. We seek out wonderful but often overlooked businesses with long track records of rewarding their shareholders. Ecolab Inc. (NYSE:ECL) water filters, Paychex, Inc. (NASDAQ:PAYX) payroll processing, and Crown Castle International Corp. (NYSE:CCI) cell phone towers don’t get a lot of coverage on TV, but they make for tidy investment returns.

Today, I want to bring you another example in Sabra Health Care REIT Inc (NASDAQ:SBRA). The partnership owns dozens of specialty hospitals, skilled nursing facilities, and senior housing properties across the country.

It’s important to note one thing here: Sabra doesn’t make money by providing healthcare, but rather by collecting rent from operators that lease its facilities. This represents a far more dependable business—and a far more lucrative income stream.

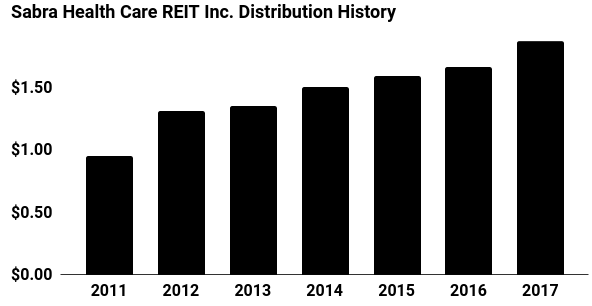

The trust pays a $0.45 per unit quarterly dividend, which comes out to an annual yield of 10.2%. Since it began paying a distribution in 2011, Sabra has boosted its payout to unitholders every year.

Last year, Sabra paid $1.73 in dividends while generating $2.31 billion in adjusted funds from operations (AFFO), which is a measure of cash flow for real estate businesses.

With dividend stocks, I like to see management pay out only 75% or less of cash flow as dividends. This gives me confidence that the distribution will keep rolling in, even if the business suffers from a bad year or two. So, in the case of Sabra, the partnership’s 74% payout ratio leaves quite a bit of wiggle room.

Moreover, that AFFO figure will likely continue to grow. Each day, 10,000 baby boomers turn 65. That has pushed up rents and lowered vacancy rates at senior care facilities. That should translate into higher earnings for Sabra—and by extension, higher distributions for unitholders. Analysts project AFFO to grow at a mid-single clip, driven by rent hikes and cost cuts. This figure could be boosted by additional acquisitions, assuming Sabra doesn’t overpay.

Source: “SABRA HEALTH CA/SH,” Google Finance, last accessed April 6, 2018.

The big risk here? Interest rates. If borrowing costs rise, Sabra will have to fork over more money to bondholders.

That said, management has kept the debt load light and maintained ample liquidity. Of the real estate businesses out there, this firm can weather higher interest rates better than most.

In other words, Sabra Health Care REIT’s 10.2% yield looks reasonably safe.