Sabra Health Care REIT Inc: Is This 8.6% Yield Safe?

Can You Trust Sabra Health Care REIT Inc’s Dividend?

It’s an ongoing problem.

Each time I write my Income Investors column, I often have to make the tough choice between two deserving candidates. Invariably, the first stock will have a lower upfront yield (say four percent), but offers a high degree of safety. The other one might offer a bigger payout today (say eight percent), but faces the higher possibility of a dividend cut later.

I know that some investors want to read more about stock “A,” but others want to hear more about stock “B.” As they say, you can’t make everyone happy.

Or can you?

Today I’m going to introduce you to what could be stock “C”: Sabra Health Care REIT Inc (NASDAQ:SBRA). The partnership has assembled an impressive portfolio of nursing homes, specialty hospitals, and senior living communities. Management also invests in mortgage loans on new developments, which throws off steady interest income.

These investments have funded a respectable dividend yield (8.6% at the time of this writing). But can you really trust such an oversized payout? Let’s dive into the financials.

The first thing you need to check when evaluating a company’s dividend safety is cash flow.

Generally, you want to see a business pay out 90% or less of their profits as dividends. That leaves executives with a little bit of wiggle room in the event of a downturn.

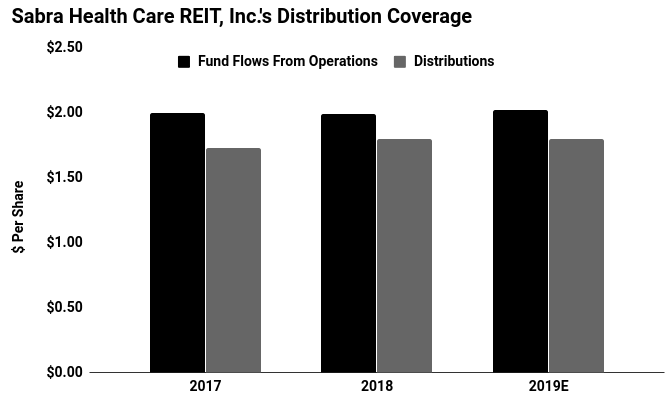

In the case of Sabra Health Care REIT Inc, management estimates that the company’s fund flows from operations (FFO) topped $2.10 per share in 2019. Over that period, the business has paid out $1.80 per share in dividends. That comes out to a payout ratio of 86%, well within my comfort zone.

Sabra’s executives seem to be cleaning up the balance sheet too.

At the end of 2018, the company had $6.12 in net debt (including Sabra’s unconsolidated joint venture) for every dollar generated in adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA). (Source: “4Q 2018 Supplemental Information,” Sabra Health Care REIT Inc, last accessed January 7, 2020)

That sits a little above the average among industry peers.

Management, however, has chipped away at this debt load. They aimed to get their net debt to EBITDA ratio (including Sabra’s unconsolidated joint venture) below 5.5× by the end of 2019. That would leave the partnership in its strongest financial position since its inception. (Source: “Sabra Reports Third Quarter 2019 Results,” Sabra Health Care REIT Inc, October 30, 2019.)

(Source: “Investors,” Sabra Health Care REIT Inc, last accessed January 7, 2019.)

So what could go wrong here? Tenants.

Sabra Health Care’s top five renters account for more than a third of its rental income. That concentration could backfire in the event that any of those tenants run into financial problems.

That said, management has spotted this problem. Over the past few quarters, they have started to diversify the company’s renter concentration. That should, in time, leave the business less vulnerable to any disruptions.

Bottom line: Sabra Health Care REIT Inc might be one of those rare stock “C’s.” This is a business that offers both a high upfront yield and a reasonable degree of dividend safety.

Income hunters might want to give this name a closer look.