Sabra Health Care REIT, Inc.: Is This 10.2% Yield Safe?

This 10.2% Yield Looks Tempting

It’s an income desert out there.

Bonds yield next to nothing. The stock market trades near record highs.

So, if you do see a decent yield out there, it raises suspicion. After all, if the dividend was safe, investors would have bid up the price by now. It’s enough to make you swear off of any double-digit payouts.

So, can you find reasonably safe, high-yield stocks out there? Actually, yes. You just need to dig a little deeper than before.

Case in point: Sabra Health Care REIT, Inc. (NASDAQ:SBRA). This landlord owns a collection of specialty hospitals, transitional care facilities, and senior housing properties across the country.

And with a dividend yield topping 10.2%, the trust has started to pique the interest of income investors. But can such a high payout possibly be safe? Let’s take a look.

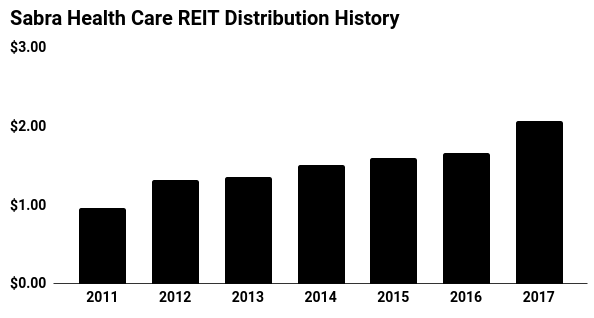

Sabra has a short but impressive dividend track record, to begin with.

Since the partnership began paying distributions in 2011, management has raised the payout every single year. That signals a certain degree of commitment to unitholders from the executive team.

And today, Sabra stands in fine financial shape. Last year, the partnership generated $2.31 per unit in adjusted funds from operations (a measure of cash flow) and paid out $1.73 in distributions. This 75% payout ratio leaves the firm with plenty of wiggle room to keep making payments, even in the event of a bad year or two.

Moreover, that distribution should continue to grow.

Each day, 10,000 American baby boomers turn 65. As this generation grows older, they’ll need more medicine, more tests, and more healthcare in general.

Sabra has positioned itself right in the middle of this boom. Over the next five years, analysts project that the partnership’s cash flow will grow at a high single-digit clip. Most of these profits should be passed on to unitholders in the form of higher distributions.

(Source: Yahoo! Finance, last accessed May 28, 2018.)

Of course, you can’t call Sabra a sure thing. Higher interest rates could slow the pace of future acquisitions, and—by extension—the pace of future distribution hikes.

That seems to be what traders have started to price in. That said, management will likely continue generating respectable growth through rent hikes and other cost-cutting measures. In any event, this looks like one of the few double-digit payouts you can hang your hat on.