Royal Bank of Canada: This “Forever Asset” Has Paid Dividends Since 1870

1 Stock to Own Forever

Today, I want to once again highlight a group of companies I like to call my “Forever Assets.” Put simply, Forever Assets constitute a group of stocks you can buy today and own for the rest of your life. These businesses have created wealth, not just over weeks or years, but for generations.

When you own names like these, you don’t have to fret over recessions, interest rates, or trade wars. Many of these firms have paid dividends to investors for decades. For this reason, you often find these names in the portfolios of some of the world’s wealthiest investors.

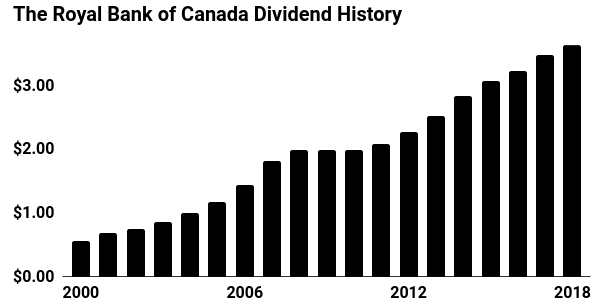

Case in point: Royal Bank of Canada (NYSE:RY). This business has mailed checks to shareholders since 1870 (exactly the type of steady, rising income we look for at Income Investors).

While the firm has sat on my watchlist for years, shares have usually traded for an outrageous premium. But because international stocks have fallen out of favor on Wall Street, investors have a rare chance to scoop up this elite stock at a bargain.

The Business

The company can trace its roots back to 1864, when the founders created the Merchants Bank of Halifax in the province of Nova Scotia. From its first office along the harbor waterfront, the commercial bank got its start financing fishing, timber, and retail businesses.

By the end of the 19th century, management had opened satellite offices in Cuba, Bermuda, New York City, and most of eastern Canada. In 1901, the executives changed the company’s name to the Royal Bank of Canada (RBC) to reflect its growth and new ambitions. (Source: McDowall, Duncan, Quick to the Frontier: Canada’s Royal Bank, Toronto: McClelland & Stewart, 1993.)

Today, RBC is a $120.0-billion company operating across Canada, the United States, and 40 other countries.

The core business of banking hasn’t changed all that much. In the old days, bankers talked about the “3-6-3” rule: Take deposits in at three percent, lend money out at six percent, and hit the golf course by three o’clock. Sure, interest rates have changed over the years. The concept of earning a profit on the spread between bank loan rates and deposit rates, though, really hasn’t.

That said, RBC has evolved over time. Management has gotten into a number of new businesses, including insurance, wealth management, investor services, and capital markets. The bank also generates more fee-income; the practice of charging customers for routine services like transactions, checking accounts, and overdrafts. While the specific operations have changed, owning a Canadian bank has always represented a lucrative proposition.

RBC’s status as a Forever Asset comes from a few key points.

The company’s raw size provides a competitive advantage, first off. With over CA$1.2 trillion in assets under management, RBC represents Canada’s largest financial institution. Such a large base of operations allows management to spread fixed costs over more sales, increasing operating efficiency.

Scale also grants big banks a large amount of bargaining clout with creditors, allowing the company to lock in a lower cost of funding. For banks, we can measure this advantage through the “efficiency ratio.” Analysts calculate this number by dividing the bank’s non-interest expenses by its net income.

In the case of RBC, management spends about $0.41 in non-interest expenses on every dollar generated in profit. Rivals, by comparison, fork over around $0.48. This huge gap means RBC can offer prices that competitors have a difficult time matching—one of the reasons why you don’t see too many small banks in Canada. (Source: “Royal Bank of Canada Investor Presentation Q1/2018,” Royal Bank of Canada, last accessed April 17, 2018.)

Furthermore, banks also enjoy a high degree of switching costs. Moving accounts to another firm represents a big hassle. Clients, therefore, need a big incentive to switch banks. Because the institutions have locked in their customer base, they can easily raise prices and reduce benefits each year without the fear of losing business. This comes in the form of fewer services, lower interest rates on deposits, and higher fees for financial products.

RBC benefits from a particularly “sticky” customer base. By cross-selling a variety of products (loans, mortgages, insurance, credit cards, checking accounts, financial planning, etc.), clients get tied to doing business with just one bank.

Over 23% of RBC households have a transaction account, investments, and borrowing products with the bank, versus an average of only 17% for customers of other banks. For shareholders, that means lower customer turnover, lower interest payments on deposits, and higher interest revenue from loans. And by extension, of course, bigger dividend checks. (Source: Ibid.)

Earnings by Business Segment: Latest 12 Months Ended January 31, 2018

| Business Segment |

Percentage of Earnings |

| Personal & Commercial Banking |

48% |

| Capital Markets |

22% |

| Wealth Management |

17% |

| Investor & Treasury Services |

7% |

| Insurance |

6% |

(Source: Ibid.)

So you might be wondering: “Won’t new rivals eventually eat into this business?” Canada’s tightly regulated banking system prevents foreign firms from entering the country unless approved by the government. International banks can only operate in Canada under certain restrictions, which prevents any real competition.

Regulators also squash any domestic competition from cropping up. Historically, Canada’s banking system developed to favor a few large firms holding vast control of the marketplace. The federal government must grant charters to new entrants, and most of these applications get rejected.

For institutions, this has resulted in an outrageously profitable oligopoly. Canadians pay some of the highest banking fees in the world.

The average customer coughs up around $200.00 in non-interest charges each year, paying steep monthly subscription prices for financial products that most Americans enjoy for free. Canadians also pay higher prices for insurance, mutual funds, and foreign exchange services. (Source: “Canadians pay $185 a year in banking fees, among world’s highest,” Yahoo! Finance, March 20, 2012.)

Good news for shareholders. Over the past decade, the Canadian banking industry has earned returns on common equity (a common measure of profitability in the financial industry) north of 20%. By comparison, U.S. banks earned returns only around the high single digits. European banks barely squeezed out any profits over this same period. Moreover, Canadian banks managed to earn these returns with less risk, lower leverage, and fewer defaults than their international peers.

The Dividend

If the attributes mentioned above didn’t recommend RBC highly enough, the most recent dividend history should. The company has paid out distributions for over a century, and has more than doubled its payout since the Great Recession. North of the border, the firm has developed a reputation as a “widow and orphan” stock.

And for good reason. Since 1790, the United States has suffered through 16 financial crises. Over that same period, Canada has had exactly zero.

Analysts have several theories as to why that’s the case. Research shows that Canada’s more centralized banking system better insulates the industry from political influence. The country maintains stricter lending standards than most other countries. Canadian banks also enjoy a more stable source of depository funding, which leaves them less exposed to the whims of the global capital market.

Anecdotally, I can comment on Canada’s more conservative banking culture firsthand. As a risk analyst for a rival Canadian bank, I worked with a risk-averse management team that had all the excitement of stale toast. We would pass on overly leveraged, poorly thought-out deals and we looked on in horror as international rivals rushed in to chase the high returns. It’s no wonder that subprime mortgage lending took off in the United States but never really caught on in Canada.

Although you can debate the factors behind Canada’s safer banking system, you can’t debate the results. In almost every survey, Canadian banks rank among the soundest in the world.

According to a recent Bloomberg report about the world’s strongest financial institutions, four of Canada’s top banks cracked the top-10 list. By comparison, only one U.S. firm made the cut.

And last year, the World Economic Forum ranked Canada as having the world’s soundest banking system globally—for the ninth year in a row. (Source: “These are the 17 countries with the safest banks in the world,” Business Insider, October 24, 2017.)

In the case of RBC, this makes for a terribly boring business. I don’t even think the CEO gets all that excited about Canadian banking. But the company makes a boatload of money ($11.4 billion in 2017) and has paid out a dividend every year since 1870.

Think about that for a minute. Every year. Since 1870. Through world wars, the Great Depression, asset bubbles, government scandals, wage and price controls, the space age, the Red Scare, the rise of Japan, the dotcom bust, 9/11, the rise of China, and the Great Recession, RBC went about its business, borrowing and lending money and paying out dividends to shareholders.

The first time RBC sent out a check to investors, Ulysses S. Grant sat in the White House, Nebraska had just joined the Union, and the invention of the light bulb was still 10 years away.

Which may have you asking: How do things look today? The bank is arguably underleveraged, with below-average lending risk. The company’s dividend payout ratio (only 45%) is low compared to its peers, reflecting management’s risk-averse approach to business. This position, however, leaves executives with lots of wiggle room to survive a downturn. In other words, this distribution is one of the safest around.

That dividend will likely keep growing, too. RBC’s huge customer base is ripe for cross-selling.

The company’s strategy is to use its retail banking business as a distribution platform to sell additional products. As an already established partner for everyday banking, RBC is a natural choice for consolidating other financial needs (i.e. insurance, investments, retirement planning, etc.). Besides boosting revenues, these extra services enhance customer retention. The more services that customers use, the more sticky they become. This allows management to raise fees on routine services like clockwork year after year.

You can also expect steady returns from RBC’s commercial banking and capital market operations (sales, trading, and investment banking). Last year, the company ranked No. 2 in Canada for merger and acquisition deal volume.

RBC has recently emerged as a real player on the global stage, finally cracking the top 10 worldwide offerings based on deal credit. This institutional business should continue to be a strong contributor to net income.

The company has also recently embarked on a growth campaign in the United States.

In 2015, RBC acquired City National Bank in a $5.4 billion deal. In one shot, the transaction gained RBC a foothold in several key U.S. cities, with a focus on valuable commercial and high net worth clients. Recent financial results look promising, and we’re still in the early innings of the bank’s American expansion. (Source: “RBC to acquire City National Corporation, a premier U.S. private and commercial bank,” Royal Bank of Canada, January 22, 2015.)

So let me sum this up. Over the past five years, RBC has grown its earnings per share by about 7.5% per year. That growth rate looks sustainable, thanks to acquisitions, organic growth, and higher interest rates.

And with one of the best track records of dividend growth around, I have little doubt that RBC will pass on most of that higher income to shareholders. Investors can expect RBC’s distribution growth rate to come in at a mid-single-digit annual clip.

(Source: “Investor Relations,” Royal Bank of Canada, last accessed April 17, 2018.)

The best part? Canadian banks present a rare bargain at the moment. The Great White North has fallen out of favor with investors as the country struggles under the weight of low commodity prices and a left-of-center government. None of these represent permanent problems. But when a group of stocks are on the outs with the financial community, traders will dump great assets just to get them off their books.

In the case of RBC, we get a lucrative combination of an above-average yield, growing distribution, and entrenched market position. With a payout of 3.8% and the prospect of an eight- to nine-percent dividend growth rate, we estimate that the stock’s total return potential comes in at around the low teens. With U.S. stock prices at record highs, Canadian banks constitute one of the few bargains around.

The Risks

Despite operating such a wonderful business, I see three big risks for RBC: the economy, regulators, and exchange rates.

Investors need to keep a close eye on the Canadian economy. The country has high housing prices and the most indebted consumers in the world. Canada also has more exposure to cyclical industries like mining and energy, which account for nearly one in 10 jobs nationwide.

Interest rates rising or commodity prices plunging could clip bank profits. At best, this presents a serious headwind for RBC. At worst, a nationwide downturn could trigger a wave of defaults.

That said, CEO David McKay has positioned the bank well for any recession. Over the past few years, RBC has tightened lending standards, built up capital reserves, and diversified into new businesses. Its exposure to the riskiest industries—like oil, gas, and mining—account for less than two percent of outstanding loans. In other words, the bank will likely soldier though any downturn without so much as a hiccup to dividend payments.

The other two risks seem more mundane. Shareholders should keep an eye on the political climate. Regulators could push new measures on the industry, such as increasing competition, tightening capital requirements, or cracking down on questionable sales practices. There doesn’t seem to be a political push to review bank profits, but this relationship could change in the future.

Finally, exchange rates can cause a headache for U.S.-based investors. RBC pays dividends in Canadian dollars, which fluctuate in value relative to the greenback. If the Canadian dollar goes up, U.S. investors will see their income increase. If the Canadian dollar goes down, U.S. investors will see their payments decline.

I have no insight into where the exchange rate will go next. Economists seem pretty dour on the Canadian economy right now, which doesn’t bode well for the country’s currency. But there tends to be an ebb and flow to these things, with each country falling in and out of favor. Over time, the fluctuations in exchange rates tend to even out.

The Bottom Line

RBC constitutes a sleepy Canadian bank quarterbacked by a conservative management team.

With a 3.8% (and growing) dividend yield, entrenched market position, and bargain share price, this Forever Asset presents a tempting proposition. Investors could scoop up some shares, stash the certificates away, and collect the dividends for decades to come.