REFI Stock: U.S. Pot Stock With 11.8% Yield Might Pay Special Dividend

Why Chicago Real Estate Finance Stock Is Attractive

Stocks in the marijuana sector are having a tough go of it. It’s not all their fault, though. Slow-moving U.S. politicians holding up federal legalization are the biggest roadblock. Still, there are a lot of pot companies that are doing quite well. Then there are companies like Chicago Atlantic Real Estate Finance Inc (NASDAQ:REFI) that play to the current weak economic and political environment for the cannabis industry.

The company is a commercial real estate investment trust (REIT) that originates, structures, and invests in first-mortgage loans and alternative structured financing secured by commercial real estate properties. (Source: “Form 10-Q,” U.S. Securities And Exchange Commission, November 9, 2022.)

Chicago Atlantic Real Estate Finance Inc’s loan portfolio primarily comprises senior loans to state-licensed operators and property owners in the marijuana industry. The loans are secured by real estate, equipment, receivables, licenses, and/or other assets.

As of September 30, the company had total loan commitments of approximately $348.9 million ($330.4 million funded and $18.5 million unfunded) across 22 portfolio companies.

Since Chicago Atlantic Real Estate Finance Inc is a REIT, it’s not subject to federal corporate income taxes if it distributes at least 90% of its taxable income to its shareholders—which it does.

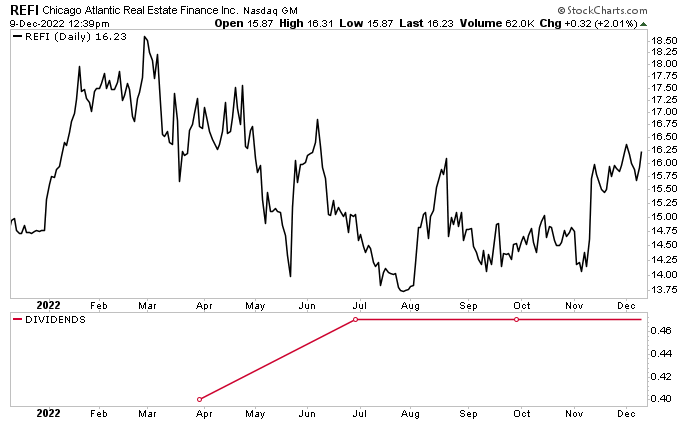

The REIT only went public on December 8, 2021, so REFI stock doesn’t have a long history of paying dividends. In September, the company’s board declared a cash dividend of $0.47 per share, for an inflation-crushing current yield of 11.8%. (Source: “Chicago Atlantic Real Estate Finance Declares Common Stock Dividend for the Third Quarter of 2022,” Chicago Real Estate Finance Inc, September 14, 2022.)

Management has raised Chicago Atlantic Real Estate Finance stock’s dividend once over the last three quarters. And there’s every reason to believe the company will raise its dividend again over the coming quarters.

Chart courtesy of StockCharts.com

Chicago Real Estate Finance Inc Tops Q3 Guidance & Raises Full-Year Outlook

Chicago Atlantic Real Estate Finance Inc can afford to pay frothy dividends (and increase them) because it makes lots of money.

For the third quarter ended September 30, the company announced that its net interest income increased by 13.4% sequentially to $12.9 million. Its net income in the quarter increased by 31.0% sequentially to $9.8 million, or $0.55 per share. (Source: “Chicago Atlantic Real Estate Finance Announces Third Quarter 2022 Financial Results,” Chicago Atlantic Real Estate Finance Inc, November 9, 2022.)

The REIT reported adjusted distributable earnings of $10.3 million, or $0.58 per share, up by 17% from $8.8 million, or $0.50 per share, in the previous quarter.

The company ended the third quarter having borrowed $53.0 million on its $65.0-million secured credit facility, resulting in a leverage ratio (debt-to-book equity) of approximately 20.0%.

John Mazarakis, Chicago Atlantic Real Estate Finance Inc’s executive chairman, noted, “Having previously made the strategic decision to limit growth in the REIT portfolio until we had sourced more accretive sources of capital, we exceeded our expectations for the third quarter, improved book value and raised our full year outlook on the strength of improved portfolio yields and a sequential reduction in expenses.” (Source: Ibid.)

He added, “The loan pipeline remains very robust, and we have been able to selectively fulfill demand through the broader Chicago Atlantic platform. With the recent increase in the REIT’s credit facility, we expect to put the additional capital to work accretively by executing on attractive pipeline opportunities that we are originating in limited-license states.”

REFI Stock Could Pay Special Dividend in December

For fiscal 2022, Chicago Atlantic Real Estate Finance Inc expects to report adjusted distributable earnings in the range of $2.01 to $2.05 per share (up from previous guidance of $1.95 to $2.00) and a leverage ratio in the range of 25% to 35%.

Management expects the fourth-quarter dividend to be $0.47 per share. Moreover, the company says it might have to declare a special dividend by the end of December to meet its 2022 taxable income requirements.

Chicago Atlantic Real Estate Finance Inc’s stronger-than-expected third-quarter results, improved guidance, and potential for a special dividend has helped juice the price of Chicago Atlantic Real Estate Finance stock. Since reporting its third-quarter results on November 9, REFI stock has rallied by an impressive 14.6%.

Over the past year, Chicago Atlantic Real Estate Finance stock has been trumping the broader market, up by:

- 11% over the last month

- 14% over the last three months

- 75% year-to-date

- 10% year-over-year

The outlook for this ultra-high yield dividend stock is bullish, with analysts providing an average 12-month share-price target of $20.00, which points to upside of 23%.

The Lowdown on Chicago Atlantic Real Estate Inc

Chicago Atlantic Real Estate Finance Inc is an excellent REIT operating in the U.S. cannabis sector. Because of the marijuana industry’s macroeconomic headwinds, slower-than-hoped regulatory reform at the federal level, and price compression in many states, the company’s direct lending experience is increasingly becoming a competitive advantage.

Moreover, with weighted average yields to maturity of roughly 18% to 60% of its loans structured as variable-rate loans, the REIT’s portfolio has performed well in 2022 amid rising interest rates.

All that is why REFI stock is worth watching.