Why Realty Income Corp Is a Top Stock: An Appealing 4.4% Dividend Yield

Realty Income Corp (NYSE:O) has been a longtime favorite stock among income seekers. After all, when you go out of your way to call yourself “The Monthly Dividend Company,” and then back it up with remarkably consistent payments, it’s easy to attract dividend-starved investors.

But over the past several months, Realty Income stock has slumped on concerns over softness in the retail industry and rising interest rates, prompting me to place the retail real estate investment trust (REIT) very high up on my watchlist. As regular readers know, there’s nothing I love more than when a rock-solid dividend stock sinks in price. Why? Well, by consistently buying high-quality companies at low valuations, you can minimize the downside of your portfolio while maximizing its upside.

Over time, that kind of risk/reward profile tends to make you rich.

So with Realty Income reporting results recently, I thought it might be a good time to investigate the opportunity. Luckily for investors, we’re staring at a great one.

Shopping Spree Continues

In Q4, adjusted funds from operations (AFFO) per share, the key earnings metric for REITs, increased 10.3% to $0.75, while revenue grew 9.2% to $287.8 million. So despite what its stock price says, Realty Income continues to perform quite well operationally.

In fact, the strong results were driven primarily by a record level of acquisitions, which was a big surprise to many investors who believed that the prospect of creeping interest rates, coupled with a depressed company valuation (i.e. lower price when selling shares), would slow activity down.

Well, management definitely didn’t slow down, as the company invested a whopping $785.6 million in 279 new properties during the quarter alone. In total, Realty Income completed $1.86 billion in property acquisitions for 2016, also a record for the company. But more importantly, those purchases were completed at investment spreads that far exceed its historical average, suggesting that management is also remaining disciplined.

Despite record-level activity, Realty Income still acquired less than seven percent of the $28.5 billion in opportunities that it sourced in 2016, consistent with its average over the past several years.

“We are pleased with another year of solid results as our company continues to execute across all areas of the business,” said John Case, Realty Income’s chief executive officer . “In 2016, we surpassed $1 billion in rental revenue by completing a record-high volume of property acquisitions and actively managing our portfolio to maximize value.” (Source: “Realty Income Announces Operating Results For Fourth Quarter And 2016,” Realty Income Corp, February 22, 2017.)

Portfolio Power

Outside of acquisitions, strong performance from the company’s portfolio also helped boost results.

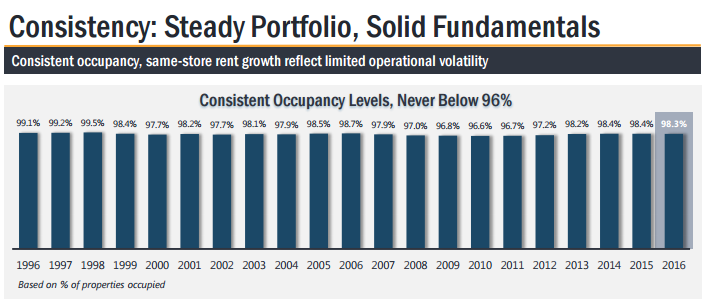

Occupancy rate for Q4 remained at a solid 98.3%, unchanged from the previous quarter, reinforcing the relatively high quality of the company’s real estate. In fact, Realty Income’s occupancy rate has never dropped below 96% in all of its history. Looking ahead, management expects occupancy to stay at roughly 98% for 2017, which should ease some worries about how its retail tenants are performing.

Source: “Investor Presentation 4Q 2016,” Realty Income Corp

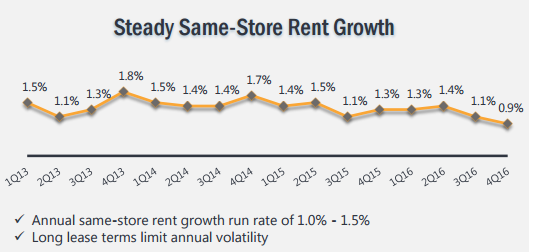

Furthermore, Realty Income’s same-store rent increased 0.9% during the quarter and 1.2% for the full-year 2016; that’s consistent with the run rate management expects for 2017. About 90% of the company’s long-term leases continue to have contractual rent increases averaging about 1.3% per year, which does well to generate extremely consistent growth while minimizing volatility.

Source: “Investor Presentation 4Q 2016,” Realty Income Corp

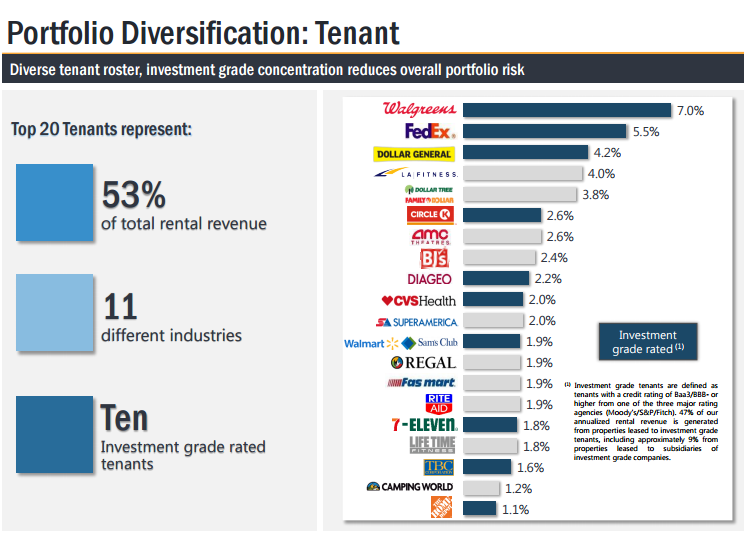

It’s worth noting that Realty Income’s portfolio remains largely diversified by tenant, industry, and geography, which also contributes significantly to the stability of results. In fact, the company now leases about 4,900 properties across the U.S. to 248 different tenants from 47 different industries.

Now, of course, with Walgreens Boots Alliance Inc (NASDAQ:WBA), Dollar General Corp. (NYSE:DG), and Dollar Tree, Inc. (NASDAQ:DLTR) as a few of its biggest tenants, Realty Income is most heavily levered to low-price-point, non-discretionary retail. But considering that its top 20 tenants account for only about half of revenue, while no single industry represents more than 11% of rent, the company simply isn’t exposed to any type of significant concentration risk.

Source: “Investor Presentation 4Q 2016,” Realty Income Corp

“Our portfolio remains healthy and we continue to see an ample volume of acquisition opportunities that allows us to consistently grow earnings,” Case said in a conference call. “The net lease acquisition environment remains a very efficient marketplace and we believe we are best positioned to capitalize on the highest quality opportunities.” (Source: “Realty Income Corporation’s (O) CEO John Case on Q4 2016 Results – Earnings Call Transcript,” Seeking Alpha, February 23, 2017.)

Dividend Legend

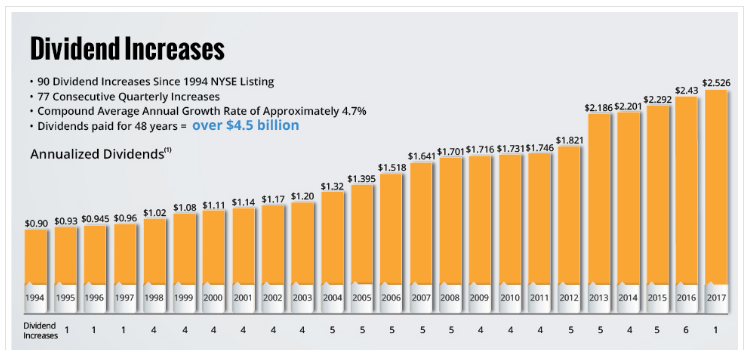

Of course, what really makes Realty Income unique is the company’s commitment to monthly dividend distributions, on top of consistent dividend growth. And Q4 was certainly no exception.

In January, management increased the dividend about six percent, representing the 90th increase in the company’s history. Realty Income has now raised the dividend every year since going public in 1994, growing it at a compound annual rate of nearly five percent. Furthermore, the company’s streak of consecutive dividends paid stands at an incredible 559 months.

All told, the company has returned more than $4.5 billion to shareholders since 1969.

Source: “Investor Presentation 4Q 2016,” Realty Income Corp

But how sustainable is that amazing monthly streak?

Well, considering that the company’s AFFO payout ratio still stands at a comforting 83.5%, I wouldn’t expect it to end anytime soon. Moreover, with management forecasting full-year AFFO of $3.00 to $3.06, a year-over-year increase of 4.2% to 6.3% respectively, it would be pretty safe to expect another year of dividend growth as well.

Yielding Results

That brings us back to Realty Income’s struggling stock price, which is now down an ugly 20% from its 52-week highs set in August.

Now, the threat of rising interest rates is definitely a concern, as it makes the company’s dividend yield less attractive, increases borrowing costs, and also decreases the value of its fixed long-term leases. But given how well Realty Income’s portfolio continues to perform, I think that punishment is largely overdone.

Currently, Realty Income sports a dividend yield of 4.4%. That’s higher than other retail REIT plays like Simon Property Group Inc (NYSE:SPG) (3.9%) and GGP Inc (NYSE:GGP) (3.7%), as well as the S&P 500 (2.1%). Considering how well-covered and consistent Realty Income’s dividend is, I think that spread should narrow over time.

The Bottom Line on Realty Income

Realty Income looks like a particularly attractive dividend play. While rising interest rates will certainly put pressure on results, the company’s high-quality, well-diversified portfolio should continue to perform solidly in most rate environments.

More importantly, with its depressed stock already baking in much of the downside, Realty Income’s famous monthly dividends might be to good to pass up.