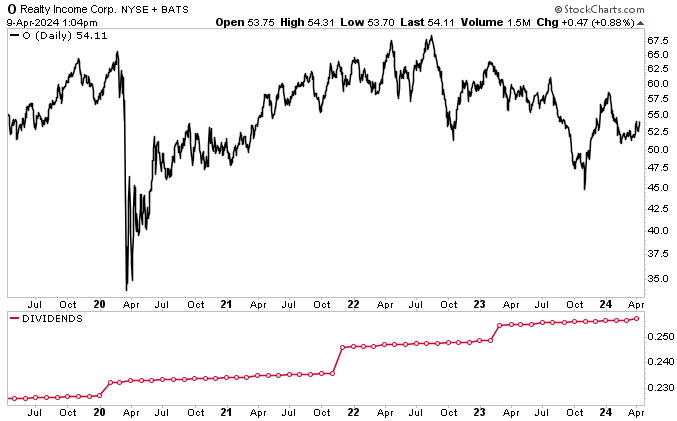

Realty Income Corp Stock Paid 645th Consecutive Monthly Dividend

Why O Stock Is Compelling

When it comes to dividend stocks, there are those that pay monthly and those that pay quarterly. Companies’ dividend amounts can be variable, stay the same, get cut, or—ideally—grow.

S&P 500 companies that have raised their dividends for at least 25 years are called dividend aristocrats. There are more than 65 dividend aristocrats to choose from, but one that stands out at the moment is Realty Income Corp (NYSE:O).

The gold standard for dividend investing, Realty Income Corp stock has paid 645 consecutive monthly dividends since it was listed on the New York Stock Exchange (NYSE) in 1994. Moreover, it has raised its monthly distribution 124 times, including for 106 straight quarters).

Realty Income, which has a 55-year operating history, is the fifth-largest REIT in the world. It owns more than 15,450 commercial properties. (Source: “Investor Presentation: Calculated Consolidation: February 2024,” Realty Income Corp, last accessed April 9, 2024.)

Covering 272 million square feet (equal to about 4,722 NFL fields), the REIT’s properties are leased under long-term agreements to 1,326 tenants in 86 industries. At the end of 2023, the properties’ occupancy rate was 96.6%.

The top 10 industries in the company’s tenant base—in terms of percentage of contractual rent—are as follows:

- Grocery Stores: 11.4%

- Convenience Stores: 10.2%

- Dollar Stores: 7.1%

- Home Improvement Stores: 5.9%

- Drug Stores: 5.5%

- Quick-Service Restaurants: 5.2%

- Casual Dining Restaurants: 4.4%

- Automotive Service Centers: 4.3%

- Health and Fitness Centers: 3.9%

- Gaming (aka Gambling) Facilities: 3.3%

Some of Realty Income Corp’s top clients are 7-Eleven Inc., Dollar General Corp (NYSE:DG), FedEx Corp (NYSE:FDX), Walmart Inc (NYSE:WMT), Wynn Resorts, Limited (NASDAQ:WYNN), Kroger Co (NYSE:KR), and Walgreens Boots Alliance Inc (NASDAQ:WBA).

The vast majority (89%) of its tenants have business models that are resistant to recessions and the onslaught of e-commerce, with some of them even thriving during economic downturns.

In January 2024, Realty Income got a lot bigger when it closed its previously announced $9.3-billion merger with Spirit Realty Capital, Inc. (Source: “Realty Income Closes Merger with Spirit Realty Capital,” Realty Income Corp, January 23, 2024.)

Spirit Realty was a net-lease REIT with a portfolio of more than 2,000 retail, industrial, and other properties in 49 states. (Source: “Spirit Realty Capital Shareholders Approve Realty Income Merger,” Realty Income Corp, January 19, 2024.)

Realty Income Corp Deployed Record-High Investments in 2023

For the fourth quarter of 2023, Realty Income announced that its revenues increased by 21% year-over-year to $1.07 billion. (Source: “Realty Income Announces Operating Results for the Three Months and Year Ended December 31, 2023,” Realty Income Corp, February 20, 2024.)

Its fourth-quarter net income came in at $218.4 million, or $0.30 per share. Its adjusted funds from operations (AFFO) climbed by 15% year-over-year to $731.0 million, or $1.01 per share.

In full-year 2023, the REIT’s revenues went up by 22% to $4.07 billion, while its net income inched up by less than one percent to $872.3 million, or $1.26 per share. Its AFFO advanced in the year by 15.6% to $2.77 billion, or $4.00 per share.

124th Monthly Dividend Increase

If you’re going to trademark the tagline “The Monthly Dividend Company,” you better live up to it.—and Realty Income does.

In March, the company increased its common stock monthly cash dividend to $0.257 per share. (Source: “124th Common Stock Monthly Dividend Increase Declared by Realty Income,” Realty Income Corp, March 13, 2024.)

As of this writing, that works out to a dividend yield of 5.75%.

As mentioned earlier, this represents O stock’s 645th consecutive monthly dividend since it was listed on the NYSE in 1994. It also represents the stock’s 124th monthly dividend increase and its 106th consecutive quarterly dividend increase.

Realty Income Corp Stock Has 36% Upside Potential

As a REIT, Realty Income needs to borrow a lot of money to help expand its property portfolio. With interest rates still at decade highs, that eats away at its profitability and margins. However, interest rates are expected to start coming down in the coming months, which should help juice the company’s bottom line.

Not that Realty Income Corp’s bottom line has been hurting; its net income went up by 141% in 2022 and 0.33% in 2023. Despite that, in the high interest rate environment, investors have been shunning REITs, which has hurt O stock’s price.

But investors should be taking a second look at Realty Income. The company has a high occupancy rate, it has reported median AFFO-per-share growth of five percent since 1996, and it has raised its dividend at a compound annual growth rate (CAGR) of 4.3% since 1994.

The company’s stable earnings and low dividend volatility have resulted in low share-price volatility. As of this writing, Realty Income Corp stock’s total shareholder return volatility since 1994 is 3.6%, the fifth-lowest of all S&P 500 constituents. When it comes to low volatility of total shareholder returns, Realty Income Corp is in the same league as Johnson & Johnson (NYSE:JNJ) and Southern Co (NYSE:SO).

Low volatility means O stock isn’t going to experience massive spikes in price. Trading near $54.30 as of this writing, the stock is down by 8.7% year-over-year and 4.6% year-to-date. To get to its pre-pandemic price level, Realty Income Corp stock needs to climb by more than 20%.

Despite O stock trading in the red lately Wall Street analysts think it could reach fresh highs over the coming quarters. They’ve provided a 12-month share-price high target of $74.00 per share. This points to potential upside of 36.5% and a 6.1% premium over its August 2022 record high of $69.71.

Chart courtesy of StockCharts.com

The Lowdown on Realty Income Corp

When it comes to reliable, growing dividends, it’s tough to beat Realty Income Corp stock.

Calling itself “The Monthly Dividend Company,” Realty Income is a member of the S&P 500 dividend aristocrats index. The REIT has reported positive earnings per share (EPS) in 27 of 28 years, median AFFO-per-share growth of five percent since 1996, and a dividend CAGR of 4.3% since 1994. Moreover, it has provided total annual returns of 13.9% since its 1994 NYSE listing.

This has helped the company increase O stock’s dividend for the last 106 straight quarters and pay 645 consecutive monthly dividends—and counting.