Realty Income Corp: A Monthly Real Estate Stock

Become a “Remote Landlord” Through Real Estate Stocks

“I might have to call the sheriff to get them out of there,” my friend Dan sulked over lunch.

“They just stopped paying rent. It’s going to take months until the rental board reviews my case.”

Dan hates the eviction process. He bought a rental property a while back to earn some extra income. But when his tenant stopped paying, he found out nobody was in his corner.

Meanwhile, the mortgage still needs to be paid. His tax bill just came in the mail. Never mind the mounting list of repairs.

Of course, Dan is hardly the only landlord horror story out there. Even at the best of times, managing a rental property can be a big hassle. While owning real estate can be a great way to build wealth, how many of us really want to deal with deadbeat tenants?

There is a way, however, to collect monthly rental income without buying real estate. No tenants, no security deposits, and best of all, no big mortgage hanging over your head.

Plainly put, I’m talking about becoming a “remote landlord” through one of my favorite real estate stocks: Realty Income Corp (NYSE:O) stock.

Realty Income is not that difficult to wrap your head around. Management has built a sprawling business empire, totaling some 4,700 properties across the United States. The company buys real estate, collects the rent from tenants, and passes the income on to shareholders. (Source: “Investor Presentation 3Q 2016,” Real Income Investor Relations, September 30, 2016.)

This has a couple of big advantages over investing in properties yourself.

First, a professional management team handles all of the day-to-day operations. Getting started is as simple as buying an ordinary dividend stock. All you have to do is wait for the dividend checks to arrive in your bank account each month.

Unlike do-it-yourselfers, Realty benefits from raw scale. Typically, landlords will spend about 10% of their revenue on administration expenses (advertising, repairs, etc.). Small-time investors also have to pay higher interest rates from banks.

Thanks to economies of scale, however, Realty Income has enough clout to cut these costs down considerably. The company spends less than five percent of its revenue on general and administrative expenses. It saves on interest, too. And because the firm is one of the largest landlords in the country, suppliers can be pushed for deals.

Secondly, Realty Income has access to a market usually off limits to small investors: commercial real estate. The company doesn’t invest in apartment buildings or single-family homes. Instead, Realty focuses on malls, gas stations, shopping centers, and other commercial outlets.

NikolayFrolochkin/Pixabay

As you can imagine, these deals can be quite lucrative. Most of Realty’s tenants include top-tier businesses like Walgreens Boots (NASDAQ:WBA), Circle K, and Rite Aid Corporation (NYSE:RAD). These firms tend to have a lot more “rent money”‘ and are far more reliable than most people answering an ad in the newspaper.

Management structures these deals as something called a “triple-net” lease. Most landlords are responsible for taxes and renovations. Realty Income, however, passes on all of these costs to their renters. Tenants have to pay for all of the utilities, property taxes, and any needed repairs.

As a result, this company absolutely gushes cash flow. Nearly $0.67 of every dollar the business collects in rent is converted to operating cash flow. Realty’s net margins are upwards of 30%. I can’t think of too many landlords that are generating profits like this.

Most of this money flows straight to shareholders.

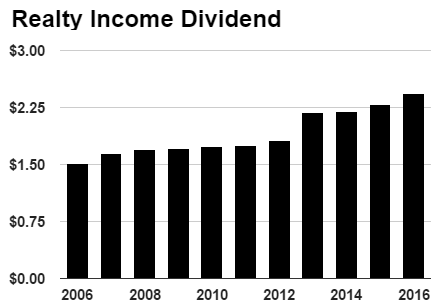

Since the company was incorporated in 1969, executives have never missed a dividend payment to investors. Management has approved 77 consecutive distribution hikes, growing the payout by 4.2% per year since 1994. Today, Realty Income pays out a monthly dividend of $0.2025 per share, which comes out to a yield of 4.1%.

Source: Realty Income Corp

That tradition will likely continue. Management expects profits to grow by about five percent per year through a combination of acquisitions, rent increases, and cost savings. As we’ve seen over the past 20 years, investors can expect their dividends to grow roughly in-line with earnings.

Bottom line: becoming a “remote landlord” through real estate stocks is a great gig. Dozens of different companies are publicly traded. My colleague Jing prepared a great resource for new investors, featuring some names that pay out yields upwards of nine percent.

Realty Income, though, is one of my favorite real estate stocks. The executive team is a proven steward of shareholder capital. Their long dividend track record is the gold standard of the business. Not to mention that cashing dividend checks sure beats chasing down tenants any day.

Also Read:

10 Best Real Estate Stocks to Own in 2017

REIT ETF List: Earn Regular Income from These Real Estate ETFs