Preferred Apartment Communities Inc.: High-Dividend REIT Up 144% YOY

APTS Stock Poised for a Dividend Raise?

After a disastrous 2020, in which real estate investment trusts (REITs) were hammered by COVID-19, 2021 saw many REITs come charging back.

One of the top-performing REITs has been, without question, Preferred Apartment Communities Inc. (NYSE:APTS). Preferred Apartment Communities stock has been on fire, and by all accounts, the company is poised to increase its quarterly dividend again. There are no guarantees, of course, but everything is pointing in that direction.

Preferred Apartment Communities Inc. owns and operates Class A multifamily residential properties, with select investments in grocery-anchored shopping centers and Class A office buildings. The REIT’s $3.7-billion real estate portfolio consists of 107 properties in 13 states, predominantly in the southeast U.S. (Source: “Corporate Overview,” Preferred Apartment Communities Inc., last accessed December 28, 2021.)

The average physical occupancy of the company’s same-store multifamily communities increased to 97.1% during the three-month period ended September 30, up from 95.6% in the three-month period ended September 30, 2020 and 96.8% in the three-month period ended June 30, 2021.

Over the last few quarters, Preferred Apartment Communities has sold off office properties to concentrate on multifamily residential properties. The REIT has sold eight office assets for total gross proceeds of $780.0 million. It now owns just two office buildings: one in Atlanta, GA and one in San Antonio, TX. (Source: “Preferred Apartment Communities, Inc Completes Disposition of Brookwood Center Office Building for $55.0 Million,” Preferred Apartment Communities Inc., November 15, 2021.)

The huge influx in cash from selling properties has helped Preferred Apartment Communities Inc. build out its multifamily residential portfolio. In September, the REIT announced that it had acquired a 301-unit multifamily community in Nashville, TN; a 240-multifamily unit in Washington, D.C.; and a 256-unit multifamily community in Charlotte, NC.

The company has also announced a number of real estate loan investments over the last few months, including a $16.6-million investment in a Jacksonville, FL multifamily development and a $9.1-million investment in an Atlanta multifamily development.

In mid-December, Preferred Apartment Communities Inc. announced that it had signed a new 15-year lease for approximately five floors and 127,000 square feet (the size of about 2.2 NFL fields) in an office building in Atlanta. The company leased the space to Hapag-Lloyd AG (ETR:HLAG, OTCMKTS:HLAGF), one of the world’s leading shipping companies. With this lease, the office building is approximately 94% leased, with an average weighted lease term of just over nine years.

Third-Quarter Results & Full-Year Guidance

In the third quarter of 2021, Preferred Apartment Communities announced that its total revenue went down by 12.2% year-over-year to $111.0 million. (Source: “Preferred Apartment Communities, Inc. Reports Results for Third Quarter 2021,” Preferred Apartment Communities Inc., November 8, 2021.)

The company’s net loss expanded to $0.92 per share, from a loss of $0.79 per share in the same period of the previous year.

On the plus side, its core funds from operations (FFO) went up by 7.7% year-over-year from $0.26 to $0.28. Moreover, Preferred Apartment Communities Inc.’s adjusted FFO, which is where dividends come from, soared by 471% year-over-year from $0.07 to $0.40. This is more than enough to cover APTS stock’s quarterly payout of $0.175 per share.

During the third quarter, the company reported that its:

- Multifamily communities’ same-store rental and other property revenue increased by 7.5%

- Same-store property net operating income increased by 8.8%

- Rental rates for its multifamily same-store properties for new and renewal leases increased by 24.1% and 8.8%, respectively

- Recurring rental revenue collections were approximately 99.2% for multifamily communities and 99.2% for grocery-anchored retail properties

Also during the quarter, Preferred Apartment Communities Inc. closed on four multifamily communities and sold one multifamily community.

As of September 30, the average age of the company’s multifamily communities was approximately 6.1 years, which it believes is the youngest in the public multifamily REIT industry.

For full-year 2021, Preferred Apartment Communities Inc. revised its guidance to reflect the positive impact of the company’s third-quarter performance. It now expects to report:

- Core FFO in the range of $1.00 to $1.07 per share, up from the previous guidance of $0.90 to $1.00 per share

- Same-store multifamily net operating income growth of 5.5% to seven percent, compared to its prior guidance range of five to seven percent

- $300.0 to $400.0 million in acquisitions of multifamily properties, which is unchanged from its previous guidance

- New real estate loan investment originations of $50.0 to $100.0 million, which is unchanged from its previous guidance

Preferred Apartment Communities Stock Thumping Broader Market

With history as our guide, it’s not surprising that investors kicked APTS stock off a cliff in March 2020 and the stock struggled throughout much of the past year.

Preferred Apartment Communities Inc.’s fortunes changed in November 2020, when the company reported better-than-expected third-quarter results. Investors sent Preferred Apartment Communities stock up by more than 50% over the ensuing weeks.

Thanks to continued strong results and investor enthusiasm, the stock has gone on to rack up fresh record highs and market-thrashing gains:

- 18% month-over-month

- 41% over the last three months

- 65% over the last six months

- 138% year-to-date

- 144% year-over-year

Preferred Apartment Community Inc. Maintains 4.2% Dividend

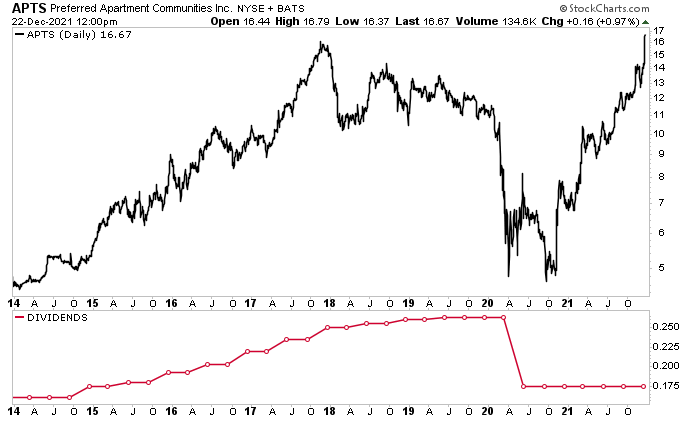

Before the COVID-19 pandemic, APTS stock had a solid history of rising quarterly dividends: 11 increases between 2013 and 2019, from $0.15 to $0.262.

Then COVID-19 hit, causing economic uncertainty. In an effort to beef up its bottom line, Preferred Apartment Communities Inc. cut its quarterly dividend from $0.262 in the first quarter of 2020 to $0.175 in the second quarter. Since then, the REIT has held the payout steady at $0.175, for a current yield of 4.2%.

Will the company raise its quarterly dividend again? There are, of course, no guarantees, but it’s hard to imagine it won’t.

Preferred Apartment Communities Inc. has a solid balance sheet and lower capital requirements, it streamlined operations with the divestiture of the vast majority of its office properties, its new leases are up, and it continues to acquire premier multifamily properties.

Chart courtesy of StockCharts.com

The Lowdown on Preferred Apartment Communities Stock

Preferred Apartment Communities Inc. is a top REIT that predominantly operates in the premier multifamily property field. Its rent collections have been at pre-pandemic levels, it continues to acquire and invest in multifamily communities, and it has virtually sold off all of its office portfolio.

Investors have been rewarded by APTS stock rising to record levels. Thanks to the company’s rock-solid balance sheet, this high-yield dividend stock should resume hiking its quarterly payouts in the not-too-distant future.