Preferred Apartment Communities Inc.: Can You Bank on This 7.8% Yield?

Is Preferred Apartment Communities Inc.’s 7.8% Dividend Yield Safe?

In the world of investment real estate, no type of property generates more reliable income than apartment buildings.

Rent, by and large, is one of the last bills that people avoid during an economic downturn. And with a generation of millennials priced out of the home ownership market, rental properties have become cash cows.

One of the largest owners of these buildings is Preferred Apartment Communities Inc. (NYSE:APTS). Over the past few years, management has acquired a sprawling portfolio of residential housing. Executives have padded the bottom line further through student apartments, retail shops, and small office buildings.

For shareholders, this has created a great income stream. APTS now pays an upfront distribution yield of 7.8%.

But can you really trust this payout? Let’s dive into the numbers.

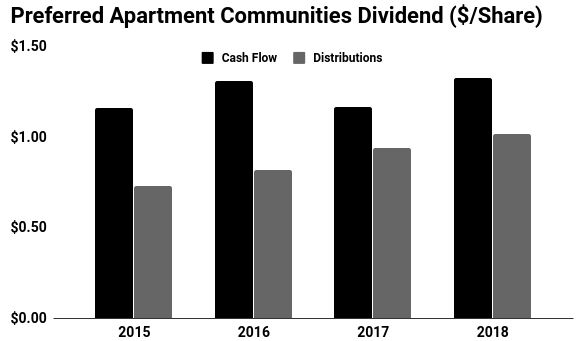

First off, executives have managed Preferred Apartment Communities Inc.’s financials in a conservative manner. Last year, the partnership paid out $0.77 in distributions for every dollar generated in cash flow. Generally, I like to see businesses payout 90% or less of their profits as dividends, just to leave a little financial wiggle room. So this partnership’s payout ratio sits well within my comfort zone.

Second, Preferred Apartment Communities is in fine financial health, with plenty of liquidity and a manageable debt maturity profile. The partnership’s debt-to-equity ratio stands at 8.0. That figure is slightly elevated, at least compared to other real estate firms. But given the partnership’s bond-like cash flows from its apartment properties, shareholders don’t have too much to worry about.

Those cash flows look poised to grow, too.

(Source: “Investors,” Preferred Apartment Communities Inc., last accessed September 3, 2019.)

I like the characteristics of Preferred Apartment Communities Inc.’s core portfolio, which is situated mainly in and around large urban centers. These markets benefit from constraints on the building of new housing supply, allowing landlords to raise rents each year.

The partnership can boost its cash flow further through acquisitions, assuming management doesn’t overpay. Over the next five years, Wall Street expects the trust to increase fund flows from operations per share at a mid-to high single-digit annual clip. That should translate into growing distributions to shareholders.

So what should investors keep an eye on? Counterintuitively, they need to watch a development that normally improves a company’s safety: diversification.

As mentioned above, Preferred Apartment Communities has expanded into new concerns of the real estate market. Over the past few years, management has started buying more office and retail properties in a bid to boost returns. These segments now account for almost 40% of the fund’s rental income. (Source: “Investor Presentation June 2019,” Preferred Apartment Communities Inc., last accessed September 3, 2019.)

APTS shareholders don’t have too much to worry about right now. Executives have maintained a conservative financial profile and the company’s new investments have produced reliable profits. But if management continues to expand into riskier investments, we might have to revisit this partnership’s rating.

In the meantime, this 7.8% yield looks safe.