Why PM Stock Is a Top Dividend Pick: An Attractive Yield of 4%

Philip Morris International Inc. (NYSE:PM) stock is on a tear. After falling sharply over the last couple of months in 2016, Philip Morris stock has already gained 14% in 2017 and is up about 20% from its 52-week lows in November.

Philip Morris’s stock has been struggling to grow in recent years, but its recent bounce suggests that brighter days are ahead. Regular readers know that I’m a value investor at heart, but I usually like to invest in turnaround situations when things are actually starting to turn around. That way, I can eliminate some of the downside risks of the investment thesis, while also having more confidence in the company’s future cash flows and, in turn, dividend payments.

When it comes to Philip Morris stock, I’m pretty sure we have a dividend winner on our hands.

Let me explain this dividend stock by digging into the company’s most recent quarter.

Headwinds Still Blowing

In the fourth quarter (Q4), Philip Morris’ earnings per share of $1.10 missed consensus estimates by $0.02, but that was largely overlooked by the company’s revenue of $6.98 billion, which was a nine-percent improvement over the year-ago period.

Now, that isn’t exactly breakneck growth but, considering that Philip Morris has struggled to generate any meaningful top-line increases over the past several years, it was certainly a welcome surprise for investors. As I touched on earlier, Philip Morris has been grappling with several issues for quite some time now, including severe currency headwinds, declining global tobacco demand, and increased regulatory scrutiny.

So does the recent revenue jump mean that all those challenges are now behind the company? Well, not necessarily.

After all, unfavorable currency shifts smacked Philip Morris’s earnings to the tune of $0.13 per share in Q4, a far bigger foreign exchange hit than what the company saw in the year-ago period. Additionally, cigarette shipment volume continued to decline during the quarter, down 4.4% year-over-year to 200.6-billion units. Thus, it’s pretty clear that Philip Morris is still far from a stress-free situation.

So then where did all the revenue improvement come from? Simple: strong pricing and awesome demand for its e-cigarette products.

Reduced-Risk-Based Rally

While cigarette volumes continue to decline, Philip Morris was able to offset much of the decrease with higher prices.

Specifically, favorable pricing variance added a whopping $565.0 million to revenue during the quarter from across all regions. Additionally, the strong pricing was supported by a favorable volume/mix of $104.0 million, driven largely by strength in Asia. That translated into an impressive 620-basis-point jump in adjusted operating margins, suggesting that Philip Morris’s competitive advantage remains as strong as ever.

And that, my fellow Income Investors, is why I do everything in my power to stick with companies that boast durable economic moats.

See, businesses with strong competitive advantages can use their pricing power to hold up margins even amid sluggish demand. When it comes to brand power, it’s obvious that Philip Morris’s portfolio—which includes names like “L&M,” “Parliament,” and, of course, “Marlboro”—remains one of the most formidable within the consumer staples space.

The other big driver of Philip Morris’s dividend stock and top-line increase relates to the company’s larger transformation from tobacco products to a “Reduced-Risk Products” (RRPs)-focused company. Although traditional cigarettes continue to experience weaker demand and heightened scrutiny from governments, demand for Philip Morris’s RRPs, which include its “heat-not-burn” products, are absolutely booming.

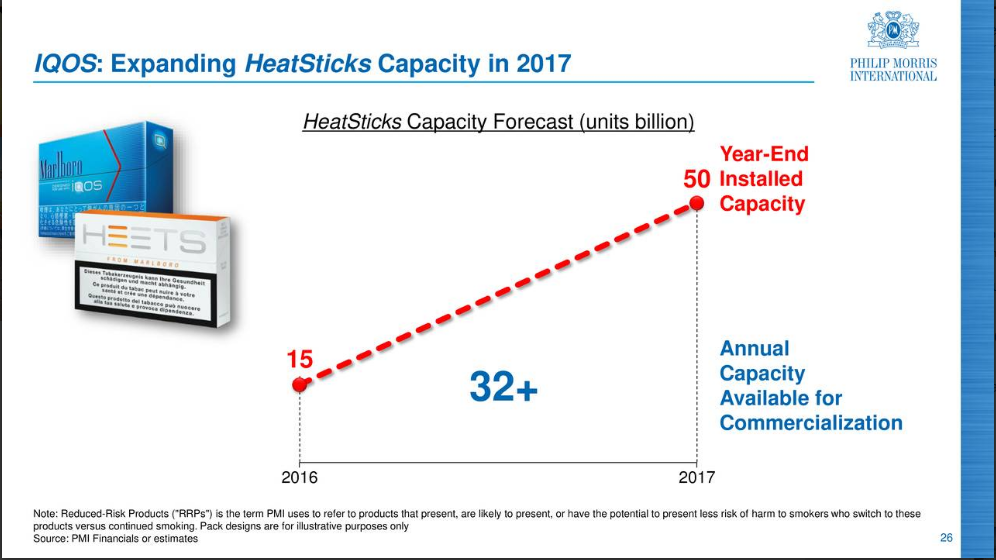

During the quarter, the company shipped a massive 3.7 billion “HeatSticks” units, up 62 million units over the year-ago period. What’s even more impressive is that Philip Morris could have shipped more units if it just had the supply. In 2016, HeatSticks volume reached 7.4 billion units, reflecting the company’s maximum capacity for the year.

Naturally, management is investing far more heavily to support RRP expansion, expecting an installed annual capacity of roughly 50-billion units by year-end. That’s a lot of HeatSticks!

(Source: “2016 Fourth-Quarter and Full-Year Results,” Philip Morris International Inc., February 2, 2017)

“Our results last year underscore the strength of our existing business, driven by our world-class brand portfolio, the enormous promise of our Reduced-Risk Products and the tremendous commitment of our talented employees,” said Philip Morris’s Chief Executive Officer André Calantzopoulos. “We continue to make considerable progress on the development, assessment and commercialization of our Reduced-Risk Products.” (Source: “Philip Morris International Inc. (PMI) Reports 2016 Results; Provides 2017 Earnings Per Share Forecast,” Philip Morris International Inc., February 2, 2017.)

Dividends Still Smoking

But, at the end of the day, we Income Investors know that it is cold, hard cash flow that pays the dividends. Luckily for investors, Philip Morris’s e-cigarette spending isn’t getting in the way of those dividend stock payments.

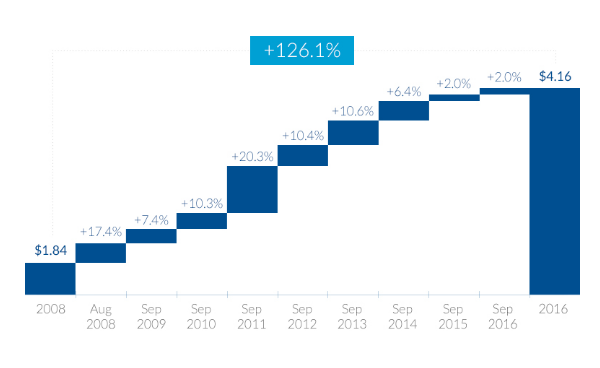

Despite the volume and currency headwinds, Philip Morris’s pricing power helped keep 2016 operating cash flow stable at $8.1 billion, $6.4 billion of which was used to pay out in dividends. In fact, the company has boosted its dividend every year since becoming a public company in 2008, representing a total increase of 126%, or a compound annual growth rate of about 11%.

(Source: “2016 Fourth-Quarter and Full-Year Results,” Philip Morris International Inc., op cit.)

Now, to be sure, Philip Morris’s payout ratio of about 90% is on the high end of what we typically look for as income investors. But with management targeting operating cash flow of roughly $8.5 billion in 2017, and earnings expected to grow at an annual rate of about nine percent over the next five years, I wouldn’t expect Philip Morris’s dividend growth streak to end anytime soon.

“While we expect our combustible tobacco business to remain the primary driver of our financial results in the near term,” said Calantzopoulos in a conference call with analysts. “Our Reduced-Risk Products portfolio provides us with the single-largest opportunity to significantly accelerate the growth of our company and generously reward our shareholders.” (Source: “Philip Morris International (PM) Q4 2016 Results – Earnings Call Transcript,” Philip Morris International Inc., February 2, 2017.)

Inexpensive Draw

And that brings us back to Philip Morris’s rebounding stock price, which now makes a whole lot of sense, given how well the company’s pricing power and e-cigarette success are helping fuel a return to growth.

But even with the recent spike, PM stock still boasts a scrumptious dividend yield of four-percent. That easily bests the S&P 500 (2.2%), as well as close peers like Altria Group Inc (NYSE:MO) (3.2%), British American Tobacco PLC (ADR) (NYSEMKT:BTI) (3.5%), and Reynolds American, Inc. (NYSE:RAI) (2.9%).

In other words, PM stock certainly looks like a relatively attractive income opportunity.

The Bottom Line on Philip Morris Stock

The PM dividend stock deserves the attention of conservative investors. Even amid currency headwinds and declining cigarette volumes, Philip Morris’s pricing power continues to stabilize cash flows, while the transition toward RRPs provides strong growth tailwinds going forward.

So, while the Philip Morris stock dividend’s recent rise isn’t ideal for value hounds, income investors should still find the dividend yield quite safe and satisfying.