7.6%-Yield Plains GP Stock Up 20.8% Year-Over-Year

Plains GP Holdings LP Renewing Its Dividend Growth

The COVID-19 pandemic in 2020 had negative impacts on many companies, especially those that pay dividends.

That was the case with Plains GP Holdings LP (NASDAQ:PAGP), but things have been improving for the company since then.

Plains GP is a major midstream energy player. The master limited partnership transports more than 8.0 million barrels per day of crude oil and natural gas liquids (NGL) in the U.S. and Canada. Its assets include pipelines, terminals, storage facilities, and gathering assets. (Source: “About Us,” Plains GP Holdings LP, last accessed February 15, 2024.)

When the pandemic surfaced, management slashed PAGP stock’s quarterly dividends by 50% from $0.36 per share in February 2020 to $0.18 per share in May 2020. (Source: “PAGP Dividend History,” Nasdaq, last accessed February 15, 2024.)

But after the energy market improved, Plains GP Holdings LP increased its quarterly dividends to $0.2675 per share in February 2023 and followed that with an increase to $0.3175 per share in February 2024.

Based on its current dividend level, Plains GP stock has a forward yield of 7.6% (as of this writing).

Plains GP Holdings LP is on an 11-year dividend streak. PAGP stock’s dividends will likely continue to grow, given the company’s history of positive free cash flow (FCF) and its expected higher profitability.

| Metric | Value |

| Dividend Growth Streak | 2 Years |

| Dividend Streak | 11 Years |

| 7-Year Dividend Compound Annual Growth Rate | -20.1% |

| 10-Year Average Dividend Yield | 10.0% |

| Dividend Coverage Ratio | 10.3 |

Plains GP Stock’s Share-Price Could Keep Rising

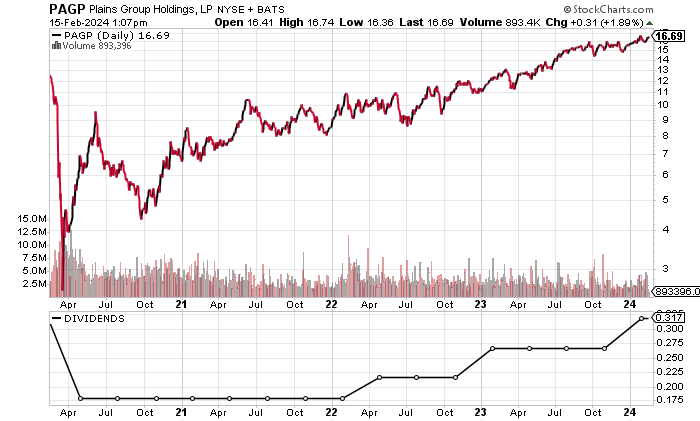

PAGP stock’s current attractive dividend yield is despite its share price appreciating by 20.81% year-over-year (as of February 15).

Plains GP Holdings LP’s shares traded at a 52-week high of $17.05 on January 26, but they remain well below their five-year high of $25.82 in March 2019 and their 10-year high of $86.76 in June 2014. Plains GP stock’s current low price presents a compelling upside opportunity.

The below chart shows PAGP stock recently overtaking its 50-day moving average (MA) of $16.08 after moving above its 200-day MA of $15.45.

Technically, Plains GP stock is in a golden cross pattern, which is a bullish crossover formation that appears when a stock’s 50-day MA breaks above its 200-day MA.

Chart courtesy of StockCharts.com

Higher Profits Bode Well for PAGP Stock

The pandemic led Plains GP Holdings LP’s revenues to plummet in 2020, but this was followed by two consecutive years of high-double-digit revenue growth, up to a 10-year high in 2022.

The company’s revenues contracted in 2023, but they’re expected to grow over the next two years.

| Fiscal Year | Revenues (Billions) | Growth |

| 2019 | $33.35 | N/A |

| 2020 | $23.59 | -25.15% |

| 2021 | $42.79 | 81.4% |

| 2022 | $57.16 | 33.6% |

| 2023 | $48.71 | -14.8% |

(Source: “Plains GP Holdings LP,” MarketWatch, last accessed February 15, 2024 and “Plains All American Reports Fourth-Quarter and Full-Year 2023 Results,” Plains GP Holdings LP, February 9, 2024)

Analysts estimate that Plains GP will grow its revenues by 2.8% to $50.09 billion in 2024 and follow that with revenue growth of 8.0% to $54.12 billion in 2025. (Source: “Plains GP Holdings, L.P. (PAGP),” Yahoo! Finance, last accessed February 15, 2024.)

As far as its valuation goes, Plains GP Holdings LP trades at an extremely low 0.07 times its consensus 2025 revenue estimate.

Analysts expect Plains GP Holdings to grow its adjusted profits to $1.38 per diluted share in 2024, versus $1.01 per diluted share in 2023. The following year looks even better, with a consensus estimate of $1.75 per diluted share for 2025. (Source: Yahoo! Finance, op. cit.)

The midstream energy segment requires a significant amount of capital expenditures in order to build infrastructure. On that note, Plains GP Holdings LP had $8.02 billion of debt and $450.0 million of cash on its balance sheet at the end of 2023. (Source: Yahoo! Finance, op. cit.)

I don’t see any major financial issues at this time, though. The partnership had a relatively strong interest coverage ratio of 3.1 in 2023. Moreover, Plains GP Holdings LP’s Piotroski score—an indicator of a company’s balance sheet, profitability, and operational efficiency—is 7.0, which is near the top of the Piotroski score’s range of 1.0 to 9.0.

The Lowdown on Plains GP Holdings LP

Plains GP stock’s higher dividends in the last two years are encouraging. The company’s expected earnings growth, combined with its low revenue multiple, should allow it to continue raising its dividends.

PAGP stock has strong institutional support, with 305 institutional investors holding 85.2% of the outstanding shares at the time of this writing. (Source: Yahoo! Finance, op. cit.)

Moreover, since Plains GP Holdings LP’s share price is significantly below its highs, its potential for price appreciation is enormous.