7.8%-Yield Plains All American Pipeline Stock Hit Fresh High

Why PAA Stock Is Worth Considering

Energy stocks have been some of the biggest winners over the last few years. And while oil prices took a breather in the fourth quarter of 2023, falling by more than 20% in that period, the price of West Texas Intermediate (WTI) crude oil rebounded in the opening weeks of 2024, rising by 7.5% to about $77.0 per barrel.

The U.S. Energy Information Administration (EIA) expects WTI crude oil to average $82.00 per barrel in 2024.

That’s great news for Plains All American Pipeline, L.P. (NYSE:PAA), one of the largest independent midstream energy companies in North America.

The partnership provides logistics services for the crude oil, natural gas liquid (NGL), and natural gas sectors in the U.S. and Canada. (Source: “Plains All American Reports Fourth-Quarter and Full-Year 2023 Results; Announces 2024 Guidance,” Plains All American Pipeline, L.P., February 9, 2024.)

On average, the company handles more than 8.0 million barrels of crude oil and NGL per day through its extensive North American network, which spans key producing basins, major market hubs, and transportation gateways.

About 80% of Plains All American Pipeline, L.P.’s revenues come from the crude oil segment. Of that, roughly 60% comes from the Permian Basin, an area that has been driving U.S. oil supply growth. (Source: “Investor Presentation: Fourth-Quarter 2023,” Plains All American Pipeline, L.P., last accessed February 21, 2024.)

The remaining 20% or so of the company’s revenues come from the NGL segment.

Better-Than-Expected 2023 Results

For the fourth quarter of 2023, Plains All American Pipeline announced that its net income increased by 19% year-over-year to $312.0 million. Meanwhile, its net income per common unit went up by 17% year-over-year to $0.35. (Source: Plains All American Pipeline, L.P., February 9, 2024, op. cit.)

The company’s net cash provided by operating activities soared in the fourth quarter by 202% year-over-year to $1.01 billion. The partnership also generated fourth-quarter adjusted free cash flow (FCF) of $402.0 million, up by 70% from $236.0 million in the same prior-year period.

Plains All American Pipeline, L.P.’s fourth-quarter adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) were above the top end of its guidance, at $737.0 million.

The company’s full-year 2023 net income went up by 19% year-over-year to $1.23 billion, while its diluted earnings per share (EPS) increased by 18% to $1.40. Its full-year net cash provided by operating activities rallied by 13% year-over-year to $2.72 billion.

The partnership generated full-year adjusted FCF of $1.6 billion and achieved year-end leverage of 3.1 times. Its full-year adjusted EBITDA was above the high end of its guidance, at $2.71 billion.

Commenting on the results, Willie Chiang, Plains All American Pipeline, L.P.’s chairman and CEO, said, “Strong execution in 2023 drove better-than-expected results and allowed us to accelerate progress on our long-term goals and objectives. This included lowering our leverage ratio target range, increasing capital returns to equity holders through increased distributions, and completing multiple win-win strategic transactions in both our Crude Oil and NGL segments.”

For 2024, Plains All American Pipeline expects to report adjusted EBITDA in the range of $2.65 billion to $2.72 billion. It also expects to report adjusted FCF of $1.65 billion and adjusted FCF after distributions of $500.0 million.

Management Hiked Dividend by 19%

Plains All American Pipeline’s high FCF generation allows it to execute its capital allocation framework, which is focused on maintaining capital discipline, enhancing financial flexibility, and increasing returns to its unitholders. (Source: “Investor Presentation: Fourth-Quarter 2023,” Plains All American Pipeline, L.P., op. cit.)

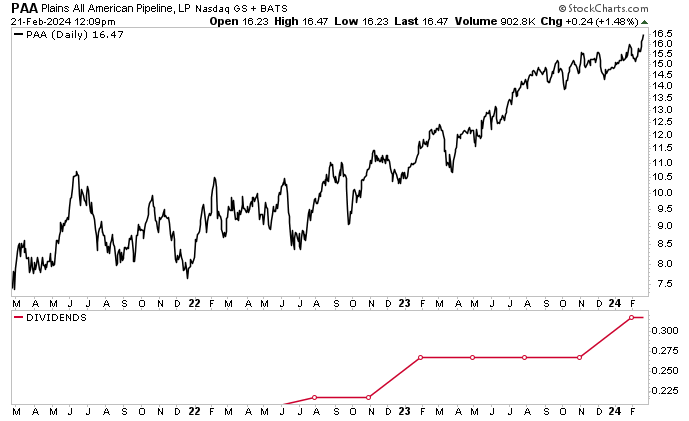

In early January, management declared a fourth-quarter distribution of $0.3175 per unit, up by 18.69% from Plains All American Pipeline stock’s November 2023 distribution of $0.2675 per share. (Source: “Plains All American Pipeline and Plains GP Holdings Announce Quarterly Distributions and Timing of Fourth-Quarter 2023 Earnings,” Plains All American Pipeline, L.P., January 8, 2024.)

PAA stock’s quarterly dividend of $0.3175 translates to a yield of 7.83% (as of this writing).

Plains All American Pipeline Stock Crushing the S&P 500

Strong industry dynamics have helped the price of Plains All American Pipeline units trend steadily higher, easily outperforming the broader market. In fact, on February 21, PAA stock hit a new record intraday high of $16.46.

As of this writing, Plains All American Pipeline stock is up by 10.8% year-to-date and 36.7% over the last 12 months. In comparison, the S&P 500 is up by 4.1% year-to-date and 24.2% over the last 12 months.

Wall Street analysts expect PAA units to hit new highs over the coming quarters. They’ve provided a 12-month average estimate of $17.30 and a high estimate of $21.00. This points to potential gains of approximately 5.5% to 28.0%.

Chart courtesy of StockCharts.com

The Lowdown on Plains All American Pipeline, L.P.

Plains All American Pipeline, L.P. has been firing on all cylinders.

The partnership reported better-than-expected fourth-quarter and full-year 2023 results and provided strong guidance for 2024.

Plains All American Pipeline units have been outpacing the broader market and recently hit an all-time record high. On top of that, management recently increased PAA stock’s quarterly dividend by almost 19%.

Plains All American Pipeline, L.P.’s outlook for 2024 is robust. The company is well positioned to generate high FCF, sustain capital discipline, and increase returns to its unitholders.