Can Investors Count on This High-Yield Stock?

At first glance, Phillips 66 Partners LP (NYSE:PSXP) seems just like another beaten-down energy stock with an oversized yield.

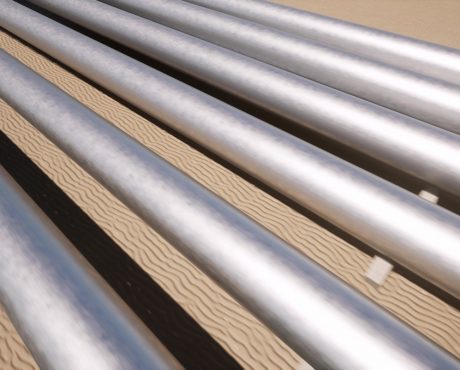

Structured as a master limited partnership (MLP), Phillips 66 Partners LP was created by Phillips 66 (NYSE:PSX) to own, operate, develop, and acquire fee-based crude oil, refined petroleum products, and natural gas liquids pipelines, terminals, and other midstream assets.

We know that the energy industry had a major downturn early last year. And while the commodity price environment has improved since then, many energy stocks are yet to make a full recovery. Also, the downturn has led to plenty of dividend cuts in the sector.

Phillips 66 Partners stock is trading at nearly 20% lower prices than it was a year ago. However, the partnership did not reduce its payout, even during the height of the economic crisis. PSXP stock had a quarterly distribution rate of $0.875 per unit at the beginning of 2020, and it has continued to pay that amount. (Source: “Distribution History,” Phillips 66 Partners LP, last accessed April 19, 2021.)

At a given cash payout, there’s an inverse relationship between a company’s dividend yield and its stock price. Since Phillips 66 Partners stock maintained its payout, the lower share price means it’s offering a higher yield than before. At the time of this writing, PSXP stock yields 10.7%.

Now, you may be wondering whether a double-digit yield in this market is too good to be true. To answer that question, let’s take a look at the company’s financials.

In the fourth quarter of 2020, Phillips 66 Partners generated $240.0 million in distributable cash flow. Meanwhile, its actual cash distributions totaled $200.0 million. That resulted in a distribution coverage ratio of 1.2 times. (Source: “Phillips 66 Partners Reports Fourth-Quarter 2020 Financial Results,” Phillips 66 Partners LP, January 29, 2021.)

In full-year 2020, Phillips 66 Partners earned $970.0 million in distributable cash flow. Its total cash distributions, on the other hand, totaled $799.0 million for the year. Therefore, its distribution coverage ratio came in at 1.2 times.

Considering that 2020 was a year filled with many operational challenges in the energy sector, Phillips 66 Partners’ ability to maintain its cash distribution and outearn its payout is quite commendable.

So why hasn’t Phillips 66 Partners’ stock price recovered?

One thing that has led to some investor concerns was the situation with the Dakota Access Pipeline (DAPL), of which Phillips 66 Partners LP owns 25%. Last year, the U.S. District Court for the District of Columbia ordered the pipeline to shut down. The owners appealed and the pipeline has remained open—for now.

It was recently reported that DAPL wouldn’t be forced to shut down while federal regulators conduct a new environmental analysis. While the fate of the pipeline is still in the hands of the judge, the lack of a forced shutdown was good news for the owners. PSXP stock surged by as much as 10% on the news. (Source: “U.S. Won’t Shut Dakota Access Pipe Amid New Environmental Review,” BNN Bloomberg, April 9, 2021.)

Bottom Line on Phillips 66 Partners LP

Phillips 66 Partners LP will be reporting its first-quarter 2021 financial results on April 30.

Other than paying attention to the usual financial metrics such as distributable cash flow, investors and analysts will want to listen to management’s comment about the DAPL situation. Once the situation with the pipeline is resolved, we could see more investor enthusiasm toward Phillips 66 Partners stock.