Petroleo Brasileiro Stock: 18%-Yielder Has 33% Upside in 2024

Why PBR Stock Was Able to Climb 73.5% Year-Over-Year

The green energy policies of President Joe Biden’s administration and other governments around the world are expected to put a big dent in the demand for oil and natural gas. But the glacial pace of the development of clean energy projects—and even cancellations—means oil and gas are going to be with us for decades.

Near the end of 2023, Brent crude oil prices were expected to stay near $80.00 per barrel in early 2024 but slip to $61.00 per barrel in 2025. West Texas Intermediate (WTI) oil prices were expected to be around $75.00 per barrel in early 2024. (Source: “Oil Analysis and Price Forecast 2024: Volatility Due to Geopolitical Tensions and Economic Uncertainties,” CAPEX, December 21, 2023.)

For the next five years, though, forecasts for Brent crude oil range from $131.53 to $146.00 per barrel and forecasts for WTI oil range from $100.75 to $136.00 per barrel.

The point is, the demand for fossil fuels isn’t going to disappear any time soon. That’s pretty good news for the broader oil and gas sector, and it’s why investors should keep companies like Petroleo Brasileiro (NYSE:PBR), also known as Petrobras, on their radar.

Headquartered in Rio De Janeiro, Brazil, Petroleo Brasileiro is a state-run, multinational company that specializes in the oil and natural gas industry.

The company prospects for, produces, refines, transports, and markets crude oil, natural gas, and natural gas liquids (NGL). It’s particularly known for its oil and gas exploration and production in deep and ultra-deep waters. (Source: “Profile,” Petroleo Brasileiro, last accessed January 5, 2024.)

The company’s assets include 12 refineries, more than 5,000 oil and gas wells, and proven reserves of 8.9 billion barrels of oil equivalent. It produces 2.8 million barrels of oil equivalent per day. Of that amount, 1.9 million barrels are crude oil. (Source: “2024_2028+ Strategic Plan,” Petroleo Brasileiro, last accessed January 5, 2024.)

The company also has 123 owned and chartered vessels in its shipping fleet, 7,719 km (4,796 miles) of oil pipelines, and 9,190 km (5,710 miles) of gas pipelines.

With the decline of the internal combustion engine and the expected pullback in oil demand, the company has been taking steps to decarbonize its operations. It owns 15 thermoelectric plants, three biodiesel plants, and one photovoltaic solar plant.

Why does Petroleo Brasileiro need to diversify?

A growing number of countries (151 out of 198) have made commitments to be net-zero by 2050. These countries are currently responsible for 88% of the world’s emissions and 92% of the world’s gross domestic product (GDP). On top of that, 43 of the world’s leading international banks might limit the capital that they make available to the oil and gas industry.

Management Increased Oil & Gas Production Guidance

For the third quarter ended September 30, 2023, Petroleo Brasileiro reported revenues of $25.55 billion, down from $32.4 billion in the third quarter of 2023 and below Wall Street analysts’ projections of $27.4 billion. (Source: “Production & Sales 3Q23,” Petroleo Brasileiro, November 9, 2023.)

Its net income in the third quarter of 2023 was $5.46 billion, or $0.84 per share ($0.86 on an adjusted basis). That was below its third-quarter 2022 net income of $1.35 per share and below Wall Street analysts’ call for $0.90 per share (on an adjusted basis).

Management blamed the lower earnings on factors such as lower Brent crude oil prices, rising costs, and an unfavorable exchange rate.

Despite the earnings and revenue miss, investors are actually quite bullish on Petroleo Brasileiro. That’s partly because the company reported third-quarter free cash flow (FCF) of $8.3 billion, which represented its 34th consecutive quarter of positive FCF.

Moreover, the company increased its 2023 oil and gas production guidance to 2.8 million barrels of oil equivalent per day (MMboe/d) from its previous guidance of 2.6 MMboe/d. It also hiked its commercial production guidance to 2.4 MMboe/d from its previous guidance of 2.3 MMboe/d. Furthermore, it increased its oil and NGL production guidance to 2.2 MMboe/d from its previous guidance of 2.1 MMboe/d.

The guidance increases were due to the company’s third-quarter performance, its ramp-up of four offshore platforms, and fewer maintenance-related stoppages.

Next Dividend to Be $0.548 Per Share

In July 2023, Petroleo Brasileiro announced a new dividend policy that cuts its payouts to 45% of its FCF but allows for share buybacks. (Source: “Shareholder Remuneration Policy,” Petroleo Brasileiro, July 28, 2023.)

Previously, it distributed as much as 60% of its operational cash flow (when its gross debt was below $65.0 billion).

The company will continue to pay minimum total dividends of $4.0 billion per year as long as Brent crude oil prices are above $40.00 per barrel. Right now, Brent crude is trading around $77.00 per barrel.

The current dividend policy means Petroleo Brasileiro pays dividends that are in line with those of its peers. It also means investors will be able to rely on more predictable payout amounts, as opposed to payout levels that fluctuate drastically from quarter to quarter.

To that end, in November 2023, the company announced a dividend of $0.548 per share, to be paid in February 2024. (Source: “Petróleo Brasileiro S.A. – Petrobras (PBR),” Stock Analysis, last accessed January 5, 2024.)

That translates to a yield of 18.03% (as of this writing).

Petroleo Brasileiro Stock Rallied Despite Earnings Miss

Although Petroleo Brasileiro reported a 2023 third-quarter earnings miss, investors weren’t phased too much.

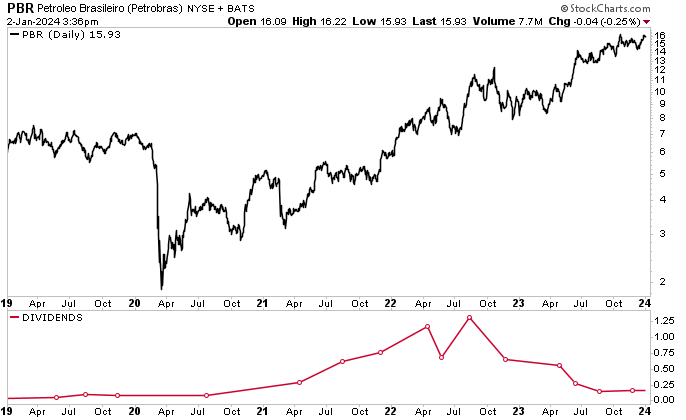

Since the company’s third-quarter results were announced on November 9, PBR stock’s share price has risen by seven percent (as of this writing). Petroleo Brasileiro stock is also up by 21% over the last six months and 73.5% year-over-year.

The strong gains have partly been a result of the company’s increased production guidance.

Chart courtesy of StockCharts.com

Despite its market-crushing gains, PBR stock has more room to run.

Wall Street analysts have provided an average 12-month share-price estimate of $16.10 and a high 12-month share-price estimate of $21.20. That points to gains in the range of one percent to 33%.

The Lowdown on Petroleo Brasileiro

Petroleo Brasileiro, which is the largest oil producer in Latin America, has a solid balance sheet, reliable cash flow, and an improved dividend policy.

Despite the company’s underwhelming third-quarter financial results, shareholders remain upbeat, with management expecting to report increased production results for 2023. The company’s upward revision to its guidance comes from new wells coming online in the fourth quarter, less maintenance-related downtime, and lower capital spending in 2023 than previously projected.

These tailwinds should further energize Petroleo Brasileiro stock’s price and variable dividends in 2024.