PermRock Stock: 10.7%-Yielder Pays Reliable Monthly Dividends

Energy Industry Tailwinds a Plus for PRT Stock

Oil and natural gas prices can be volatile, but the long-term outlook for the energy industry is excellent, which is great for monthly dividend-paying stocks like PermRock Royalty Trust (NYSE:PRT).

The North American oil and natural gas industry raked in record-high profits in 2022, and that momentum is expected to continue.

Some analysts project that West Texas Intermediate (WTI) oil will finish 2024 trading around $74.00 per barrel and average around the same price in 2025. Some energy industry bulls say crude oil could trade as high as $102.00 per barrel at the end of 2025. (Source: “Oil Analysis and Price Forecast 2024: Volatility Due to Geopolitical Tensions and Economic Uncertainties,” CAPEX, December 21, 2023.)

The U.S. Energy Information Administration (EIA) expects natural gas to average $2.79 per million British Thermal Units (MMBtu) in 2024, up by about $0.10 per MMBtu from its price in 2023. (Source: “Natural Gas Forecast & Price Predictions January 2024 and Beyond,” CAPEX, January 3, 2024.

The Henry Hub natural gas spot price is projected to increase in 2025 to an average of more than $2.90 per MMBtu as liquefied natural gas (LNG) exports increase. The long-term outlook for LNG is also robust, as natural gas is set to be a major player in the green energy transition.

That’s where PermRock Royalty Trust comes in. The Fort Worth, Texas-based company owns a perpetual interest in oil and natural gas-producing properties in the Permian Basin area of Texas.

Founded in 2017, PermRock Royalty Trust is entitled to 80% of the net profits from the sale of oil and gas from certain properties owned by Boaz Energy II, LLC (rather than a specific portion of the production). The underlying properties consist of four operating areas in the Permian Basin, totaling approximately 31,783 gross (22,731 net) acres. (Source: “Form 10K,” U.S. Securities and Exchange Commission, November 14, 2023.)

PermRock Royalty Trust has produced more than 30.0 billion barrels of oil and more than 75.0 trillion cubic feet of natural gas.

For the third quarter ended September 30, 2023, the trust reported net profits income of $1.69 million, down from $3.5 million in the same period of 2022. The decrease in net profits income was primarily due to a decrease in oil and gas revenues, which was a result of lower oil and gas prices. (Source: Ibid.)

PermRock Royalty Trust’s distributable income also went down—to $1.46 million, or $0.1205 per unit— from $3.35 million, or $0.2757 per unit, in the third quarter of 2022.

About PermRock Stock’s Dividends

PermRock Royalty Trust paid out its first monthly dividend in May 2018. As might be expected from an energy stock, PRT stock’s monthly payout fluctuates based on the prices and sales volumes of oil and gas.

Some months have been more prosperous than others for the company. During the 2020 COVID-19 crisis, PermRock Royalty Trust actually suspended its payout for five months. That’s hardly a surprise; around that time, the global economy ground to a halt and the demand for oil and gas evaporated.

That suspension of PermRock stock’s monthly dividend is a good example of why it’s imperative that investors who are interested in energy stocks pay close attention to commodity prices, the opinions of the Federal Reserve, and other economic indicators.

The company hasn’t officially announced its fourth-quarter 2023 results yet, but because it announces results monthly, we already know that PRT stock paid out $0.04 per unit in October and November, and $0.03 per unit in December—for a total fourth-quarter payout of $0.11 per unit. (Source: “Cash Distributions,” PermRock Royalty Trust, last accessed December 15, 2024.)

The December payout of $0.03 per unit works out to a yield of 10.71% (as of this writing).

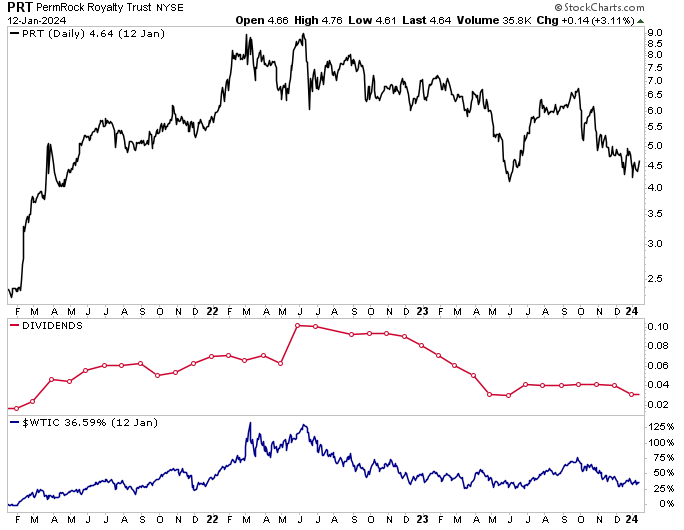

Note that the red line in the chart below represents PermRock stock’s dividend, and the blue line represents the price of WTI oil.

Chart courtesy of StockCharts.com

As of this writing, oil is trading around $73.00 per barrel, down from its March 2022 high of about $130.00 per barrel. The lower oil prices have been putting pressure on oil and gas stocks. PermRock units are no exception; their price is down by 32.7% year-over-year (as of this writing).

On the plus side, crude oil prices have gone up recently as tensions in the Middle East have heated up. Fears that the tensions could spread outside the Middle East and disrupt vulnerable transportation routes have helped PRT stock rally by approximately five percent so far in 2024.

The Lowdown on PermRock Trust

PermRock stock is a terrific way for energy industry bulls to get paid dividends monthly.

PermRock Royalty Trust has a big presence in the Permian Basin, and thanks to the historically high demand for oil and natural gas, the company has been able to provide PRT stockholders with inflation-crushing monthly dividends.