PermRock Stock: Investors Get Paid Monthly From This 14%-Yielder

PRT Stock’s Price & Dividends Poised for Growth

The timing seems to be perfect for reliable, ultra-high-yield, monthly dividend stocks like PermRock Royalty Trust (NYSE:PRT).

U.S. inflation may be cooling, but it’s still driving Americans further into debt. U.S. household debt is at a record $17.0 trillion. That’s $2.9 trillion higher than at the end of 2019, before the COVID-19-related recession. (Source: “Total Household Debt Reaches $17.05 trillion in Q1 2023; Mortgage Loan Growth Slows,” Federal Reserve Bank of New York, May 15, 2023.)

With higher costs and an expected recession, more than half of all Americans (58%) are living paycheck to paycheck. A larger group, about 70%, say they’re stressed out about their finances, citing inflation, rising interest rates, and economic uncertainty as the main causes. (Source: “With Inflation Stubbornly High, 58% of Americans Are Living Paycheck to Paycheck: CNBC survey,” CNBC, April 11, 2023.)

With numbers like 58% and 70%, you know Americans of all stripes are feeling pinched.

While inflation may be down to about four percent, it isn’t going to return to the Federal Reserve’s target range of two percent any time soon, putting additional stress on Americans.

For investors, one of the best ways to fight inflation and combat stock market volatility is with reliable, high-yield dividend stocks like PermRock stock.

Most companies pay their dividends quarterly—some even annually—but a small number of companies pay monthly dividends. More frequent payouts mean cash gets into your bank account more quickly, or you can reinvest the dividends in additional shares at a faster pace.

That’s where PermRock Royalty Trust comes in. It’s an oil and gas exploration and production company that has been reporting strong results and rewarding PRT unitholders with monthly, ultra-high-yield dividends.

About PermRock Royalty Trust

PermRock Royalty owns a perpetual interest in oil- and natural gas-producing properties located in the Permian Basin in Texas. It receives an 80% net profit interest from the sale of production from certain properties owned by Boaz Energy II, LLC, rather than a specific portion of the production. (Source: “Form 10K,” U.S. Securities And Exchange Commission, May 15, 2023.)

The underlying properties consist of about 31,783 gross (22,731 net) acres in the Permian Basin. This basin extends over 75,000 square miles in West Texas and Southeastern New Mexico.

Founded in 2017, PermRock Royalty Trust has produced more than 30 billion barrels of oil and more than 75 trillion cubic feet of natural gas.

For the first quarter ended March 31, the company reported net profit income of $2.4 million, down from $2.8 million in the same period last year. This decline was primarily due to a fall in oil and gas revenue resulting from decreased oil production and lower gas prices in the reporting period.

PermRock Royalty Trust’s distributable income was also down slightly, at $2.2 million, or $0.18 per unit, from $2.5 million, or $0.21 per unit, in the first quarter of 2022.

The company hasn’t officially announced its second-quarter results yet, but because it also announces its monthly results, we already know that it paid dividends of $0.03 per unit in April and May and $0.04 in June, for a second-quarter total payout of $0.1016. (Source: “Cash Distributions,” PermRock Royalty Trust, last accessed July 13, 2023.)

In June, it declared a monthly cash distribution of $496,169.38, or $0.040784 per unit, for a current yield of 14.1%.

PermRock was founded in 2017 but only went public in 2018, and it paid its first monthly dividend in May of that year. As might be expected, PRT stock’s payout fluctuates based on the prices of oil and natural gas, as well as sales volumes.

| Year | Distribution/Share |

| 2022 | $1.011357 |

| 2021 | $0.605881 |

| 2020 | $0.157014 |

| 2019 | $0.726501 |

| 2018 | $1.281452 |

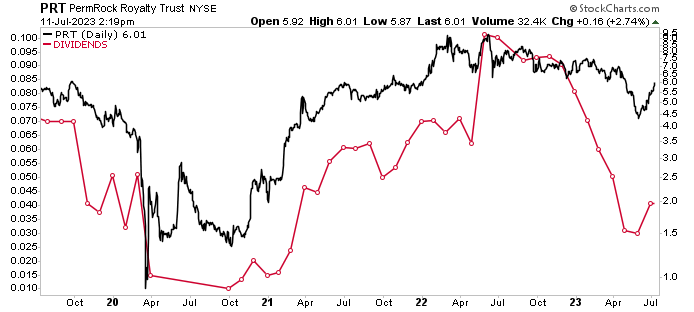

Some months are more prosperous than others. As you can see in the chart below (the red line), PermRock Royalty Trust suspended its payout for five months in 2020. Not a big surprise; the COVID-19 pandemic shut down the global economy, which caused the demand for oil and gas to be virtually non-existent in that period.

The suspension of PermRock stock’s monthly dividend is a good example of why it’s imperative that investors who are interested in the energy sector pay close attention to commodity prices, the opinions of the Federal Reserve, and other economic indicators.

Chart courtesy of StockCharts.com

Oil prices are currently down from their March 2022 high of $130.00 per barrel, trading around $73.00 per barrel.

The lower oil prices have been putting pressure on oil and gas stocks. PRT stock is no exception; its price is down by 18.5% year-to-date (as of this writing). On the plus side, PermRock units are up by 23% over the last month. This coincides with oil prices rallying to their highest level in 10 weeks.

Oil stocks have actually been moving higher since late June, due to a falling U.S. dollar, oil production cuts by Saudi Arabia and Russia, and expectations for higher oil demand in the developing world. This should help boost PermRock Royalty Trust’s July production volumes and average realized prices for oil and natural gas.

The PRT unit price follows pretty closely with its monthly distribution. So, rising oil and gas prices bode well for PermRock units’ near-term price and monthly distributions.

The Lowdown on PermRock Stock

PermRock Royalty Trust is a great oil and natural gas exploration and production company with a commanding foothold in the Permian Basin of West Texas. Thanks to the historically high demand for oil and gas, the company has been able to provide PRT stockholders with inflation-crushing monthly dividends.

While the demand for oil and gas was muted in the first half of 2023, the industry’s outlook is solid, with the demand from China rebounding and the odds growing that an upcoming U.S. recession will be mild.