PepsiCo Stock: Undervalued Industry Giant Hikes Payout for 51 Straight Years

PEP Stock’s Dividends & Share Price Keep Rising: Here’s Why

Consumer defensive stocks tend to do well no matter where we are in the economic cycle. That’s what makes PepsiCo, Inc. (NASDAQ:PEP) such a reliable blue-chip income stock.

Admittedly, some dividend hogs only want to look at stocks with double-digit dividend yields. But there’s something to be said for reliable stocks like PepsiCo stock, which not only pays steady, growing dividends, but also has a history of outperforming the broader market in terms of share price.

PepsiCo, Inc.’s 2.7% dividend yield might not excite every investor, but a company that has raised its dividends for more than half a century and whose share price consistently trounces the S&P 500 is far better than a company with a 15% dividend yield and a share price that underperforms the S&P 500.

Most people probably think of PepsiCo as just a soft drink company, but it’s a lot more than that. The Purchase, New York-based company manufactures, markets, and sells more than 500 food and beverage brands in more than 200 countries and territories around the world. (Source: “The PepsiCo Way: CAGNY 2023,” PepsiCo, Inc., last accessed May 24, 2023.)

Convenience foods account for 58% of PepsiCo, Inc.’s total revenues, with beverages making up the rest. In terms of the beverage market, the company has diverse exposure to carbonated soft drinks, water, sports drinks, and energy drinks.

Aside from “Pepsi,” some of the company’s most popular food and beverage brands are “Aquafina,” “Bubly,” “Cheetos,” “Doritos,” “Gatorade,” “Lay’s,” “Mountain Dew,” “Quaker,” and “SodaStream.” (“Source: About PepsiCo,” PepsiCo, Inc., last accessed May 24, 2023.)

How popular are PepsiCo’s products?

Each day, the company’s products are consumed more than one billion times.

PepsiCo has a nine-percent share of the $626.0-billion global beverage market. The company is the second-largest beverage provider in the world, only behind Coca-Cola Co (NYSE:KO). PepsiCo also controls 22% of the $200.0-billion global savory snack market.

The company’s North American and international sales have been experiencing broad-based growth across all of its geographies and categories. This has been aided by some of its biggest brands. From 2020 to 2022, Gatorade sales increased at a compound annual growth rate (CAGR) of 13%, followed by Doritos (11%), Cheetos (11%), Lay’s (nine percent), Mountain Dew (nine percent), and Pepsi (seven percent).

PepsiCo, Inc.’s sales growth is being juiced by an expanded omnichannel presence and enhanced digital capabilities. In 2022, its e-commerce and away-from-home (delivery, vending machines, etc.) sales each delivered double-digit net revenue growth.

Through cost-cutting initiatives, PepsiCo has delivered at least $1.0 billion in annual productivity savings since 2019. This progress fortuitously started just before the COVID-19 pandemic.

To help the business become more agile, precise, and leaner, management has implemented a number of digital processes, including analytics, artificial intelligence (AI), automation, insights, Internet of Things (IoT), and machine learning.

Together, these actions are expected to help PepsiCo, Inc. take advantage of the ongoing opportunities in the $599.0-billion global convenient food market, of which PepsiCo has an eight-percent share. This market is projected to expand over the next five years at a CAGR of five percent.

PepsiCo also has a nine-percent share of the $626.0-billion global beverage market. Over the next five years, this category is expected to grow at a CAGR of five percent.

PepsiCo, Inc. Reports Q1 Earnings Beat & Raises Guidance

PepsiCo kept bullish investors happy when it recently reported a first-quarter earnings and revenue beat and raised its full-year profit guidance. (Source: “PepsiCo Reports First-Quarter 2023 Results; Raises Full-Year Guidance,” PepsiCo, Inc., April 25, 2023.)

Its first-quarter net revenue increased by 10.2% year-over-year from $16.2 to $17.8 billion. Wall Street analysts had been looking for sales of $17.2 billion.

The company’s first-quarter net income came in at $1.9 billion, or $1.40 per share. Meanwhile, its adjusted earnings came in at $1.50 per share. Analysts were calling for first-quarter adjusted earnings of $1.38 per share.

PepsiCo, Inc., along with most other consumer brands, has raised its prices to offset inflationary headwinds. The company’s average prices rose by 16% year-over-year in the first quarter, while its organic volumes fell by just two percent. Passing costs on to consumers has helped PepsiCo deliver better margin results than expected.

So far, the decision to raise prices hasn’t hurt the company, which has consistently beaten Wall Street’s estimates for earnings and sales. With inflation cooling, PepsiCo doesn’t foresee making any more drastic price increases.

Commenting on the first-quarter results, Ramon Laguarta, PepsiCo, Inc.’s CEO, said, “We are very pleased with our performance and business momentum as our categories and geographies remained resilient during the first quarter.” (Source: Ibid.)

Laguarta said the company has raised its guidance and is now expecting to report full-year earnings of $7.27 per share, up from a previous forecast of $7.20 per share. Management also expects to report organic revenue growth of eight percent, up from a previous forecast of six percent.

PepsiCo Stock Up 14.7% Year-Over-Year & Has 19% Upside

Thanks to PepsiCo, Inc.’s strong, loyal customer base that doesn’t mind ponying up some extra money for its snacks and beverages, PEP stock has been thumping the broader market.

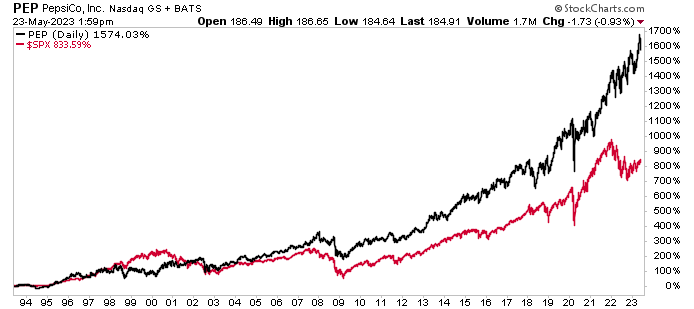

Over the last 30 years, with dividends reinvested, PepsiCo stock has provided total returns of 1,574%. Over the same time frame, the S&P 500 has provided returns of 833%. Over the last 20 years, PEP stock has provided returns of 600%, versus the S&P 500, which has provided returns of 346%. Over the last five years, PepsiCo stock has provided returns of 112%, versus the S&P 500, which has provided returns of 52%.

More recently, PEP stock has gone up by three percent year-to-date and 14.7% year-over-year.

Chart courtesy of StockCharts.com

Those are solid gains, and more gains are expected from PepsiCo stock. Analysts have provided a 12-month share-price target for PepsiCo, Inc. of $201.00 to $220.00 per share, which points to gains in the range of approximately 8.5% to 19%. That’s a far cry from analysts’ call for the S&P 500 to tumble by between 20% and 40%.

PEP Stock’s Dividend Hiked for 51 Consecutive Years

PepsiCo is a rare company, one that ranks as a dividend king. That is, the company has raised its dividends for more than 50 consecutive years.

On May 2, the board declared a quarterly dividend of $1.265 per share, a 10% increase from the $1.15 per share it paid in the same period of last year. (Source: “PepsiCo Declares Quarterly Dividend,” PepsiCo, Inc., May 2, 2023.)

This works out to a current yield of 2.6%.

The dividend is payable on June 30 to shareholders of record at the close of business on June 2.

The Lowdown on PepsiCo, Inc.

PepsiCo is an enormous company with a growing global presence and leading positions in large, fast-growing product categories.

And, as mentioned earlier, PepsiCo stock is a consumer defensive play. That’s because the demand for the company’s beverages and snacks remains resilient no matter what stage of the economic cycle we’re in.

PepsiCo, Inc. recently reported a first-quarter earnings beat, increased its full-year profit guidance, and raised its dividend for the 51st consecutive year. In a stubbornly high inflationary environment, in which fears of a recession are hampering investor sentiment, you can’t ask much more from a company than that.