PennantPark Stock: 7.2%-Yielder Up 48% YOY & Hikes Dividend

Shares of PennantPark Investment Corp. Trading at Record Levels

If you’re looking for an ultra-high-yield dividend stock that also provides massive price appreciation, PennantPark Investment Corp. (NASDAQ:PNNT) might be up your alley.

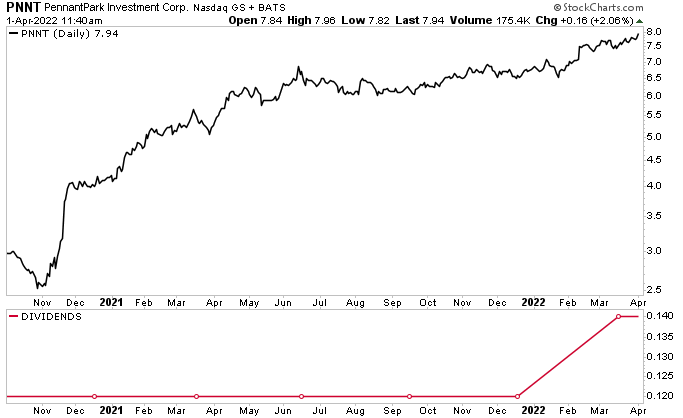

PNNT stock has been on fire lately, up by 17% year-to-date and 48% year-over-year. In comparison, the S&P 500 is down by 5.3% year-to-date and only up by 12% year-over-year. The Nasdaq, meanwhile, is down by 9.5% year-to-date and up by five percent year-over-year.

PennantPark stock’s dividend is also on the move. The company recently announced that it increased its second-quarter dividend to $0.14 per share, from $0.12 per share. This works out to a yield of 7.2%. (Source: “PennantPark Investment Corporation Announces an Increase of Its Quarterly Distribution to $0.14 per Share, Its Financial Results for the Quarter Ended December 31, 2021 and Initiates a Stock Repurchase Program,” PennantPark Investment Corp., February 9, 2022.)

As one would hope for an asset management company, its dividend is safe, with a payout ratio of just 26.5%. That gives the company more than enough financial wiggle room to continue paying a high-yield dividend and increase it (if it so chooses).

The company also has enough cash to return value to shareholders through a recently announced $25.0-million share repurchase program. The program expires on March 31, 2023.

Chart courtesy of StockCharts.com

About PNNT Stock

What’s the big deal about PennantPark stock? Many businesses need capital, and PennantPark Investment Corp.’s management is good at picking winners.

PennantPark is a closed-end, externally managed, and non-diversified business development company (BDC). As a BDC, its objective is to generate current income and capital appreciation while seeking to preserve capital through debt and equity investments. (Source: “Investor Presentation,” PennantPark Investment Corp., December 31, 2021.)

The company primarily invests in U.S. middle-market companies in the form of first-lien secured debt, second-lien secured debt, subordinated debt (to a lesser extent), and equity investments.

Why middle-market companies? The U.S. middle market is made up of approximately 200,000 companies, generating $10.0 trillion of revenue annually. That’s equivalent to one-third of the U.S. economy. On its own, the U.S. middle market is the world’s fifth-largest economy.

PennantPark Investment Corp.’s debt investments range in maturity from three to 10 years and are made to businesses that operate in various industries and geographical regions. The BDC’s portfolio is currently made up of 107 companies with an average investment of $13.5 million and a weighted average yield on interest-bearing debt investments of 8.8%.

The company has invested 47% in first-lien secured debt, 15% in second-lien secured debt, eight percent in subordinated debt, and 30% in preferred and common equity. As of December 31, 2021, PennantPark Investment Corp.’s portfolio totaled $1.4 billion, which consisted of $672.7 million of first-lien secured debt, $213.9 million of second-lien secured debt, $118.7 million of subordinated debt, and $440.1 million of preferred and common equity.

The diverse portfolio includes businesses in the health-care, education, childcare, consumer product, business service, aerospace, defense, media, hotel, motel, gaming, and auto sectors.

Even during the depths of the COVID-19 pandemic, PennantPark Investment Corp. was able to report significant net asset value (NAV) growth.

In December 2019, right before the pandemic hit, the company’s NAV per share was $8.79. By March 2020, it had dropped to $7.78 per share, but by December 2020, it had essentially erased all of those losses. Throughout 2021, PennantPark Investment Corp.’s NAV continued to climb. By December 2021, its NAV had increased by 15% over its December 2019 level to $10.11 per share.

PennantPark Investment Corp.’s Investments & Income Surpass Pre-Pandemic Levels

For the fourth quarter of 2019, PennantPark Investment Corp. invested $173.7 million in 13 new and 15 existing portfolio companies with a weighted average yield on debt investments of 8.8%. The BDC’s sales and repayments of investments for the three months ended December 31, 2019 totaled $31.2 million.

For the fourth quarter of 2020, PennantPark invested $68.2 million in four new and 15 existing portfolio companies with a weighted average yield on debt investments of 9.9%. The company’s sales and repayments of investments for the three months ended December 31, 2020 totaled $102.6 million.

For the fourth quarter of 2021, PennantPark Investment Corp. invested $295.1 million in 15 new and 30 existing portfolio companies with a weighted average yield on debt investments of 8.1%. Its sales and repayments of investments during the period totaled $132.2 million.

The BDC’s net investment income during the fourth quarter of 2021 came in at $12.5 million, or $0.19 per share. That was up by 50% from its fourth-quarter 2020 net investment income of $8.3 million, or $0.12 per share.

The Lowdown on PennantPark Stock

PennantPark Investment Corp. is a solid BDC with a seasoned management team that can generate income no matter what’s going on with the broader economy.

Recently, PNNT stock’s price has been on a tear. Moreover, the company increased its ultra-high-yield dividend and announced a large share repurchase program.

All this bodes well for dividend and income hogs in 2022 and beyond.