PAA Stock: 8%-Yielder Up 19% Since April…More to Come?

Plains All American Units to Rise 34%?

Oil prices can be volatile, rising and falling due to where we are in the economic cycle, Black Swan events, geopolitical challenges, or even the weather. But there’s one area of the energy sector that doesn’t care about where oil prices are: oil and gas midstream companies…limited partnerships (LPs) in particular.

As midstream companies, energy LPs manage the storage and transportation of oil and/or natural gas. They don’t have to worry about the price of crude oil because they don’t need to drill new wells.

Moreover, these companies don’t have to pay corporate taxes as long as they earn at least 90% of their income from activities involving the transportation of commodities in the U.S. This extra money allows energy LPs to pay some of the best dividends on Wall Street.

One excellent energy midstream LP that provides unitholders with long-term growth is Houston-Texas-based Plains All American Pipeline LP (NASDAQ:PAA). The partnership has been reporting reliable revenue growth and generating high profits. It also churns out positive free cash flow (FCF), which allows it to dish out robust distributions.

Plains GP Holdings LP (NASDAQ:PAGP), which acts as the general partner, is responsible for managing the day-to-day operations of the partnership.

Plains All American Pipeline operates a network of pipelines that transporting crude oil, natural gas liquids (NGLs), and natural gas across the U.S. and Canada. This provides stable, fee-based revenue to the company in a volatile energy industry. (Source: “What We Do,” Plains All American Pipeline LP, last accessed July 27, 2025.)

Plains All American’s infrastructure includes approximately:

- 20,000 miles of active crude oil and NGL pipelines and gather systems

- 170 million barrels of storage capacity

- 2,300 trucks and trailers

- 5,400 crude oil and NGL railcars

Another Solid Quarter

Plains All American Pipeline’s revenues have grown in three of the last five years, including gains of 80.7% in 2021 and 36.3% in 2022, reaching a record-high of $57.3 billion, prior to slipping to $48.7 billion in 2023.

In 2024, the limited partnership’s revenue grew to $50.07 billion, up 2.7% from 2023. Wall Street analysts are projecting that its revenue will climb to around $51.3 billion and $53.5 billion in 2025 and 2026, respectively. (Source: “Plains All American Reports Fourth-Quarter and Full-Year 2024 Results,” Plains All American Pipeline LP, February 7, 2025.)

In 2024, Plains All American Pipeline reported net income of $772.0 million, or $0.73 per diluted common unit. It also generated $2.77 billion in adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA), up from $2.71 billion in 2023, and churned out $1.24 billion in adjusted FCF.

That momentum carried into 2025 with first-quarter revenue increasing to $12.01 billion, net income jumping 67% to $443.0 million, or $0.49 per unit, and net cash provided by operating activities climbing 53% to $639.0 million. Plains All American reported adjusted EBITDA of $754.0 million. (Source: “Plains All American Reports First-Quarter 2025 Results,” Plains All American Pipeline LP, May 9, 2025.)

Commenting on the results, Willie Chiang, the company’s chairman and chief executive officer, said, “Plains delivered another quarter of solid operational and financial performance. Substantial cash flow generation from our integrated Crude Oil and NGL footprints coupled with a strong balance sheet positions us well through a time of market volatility and uncertainty.”

Third-Quarter Distribution of $0.38/Share

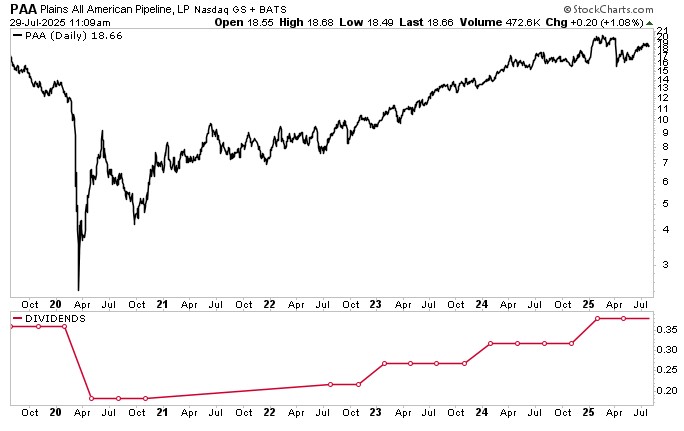

Thanks to reliable FCF, Plains All American Pipeline has a history of raising its quarterly payout—five years and counting. PAA stock paid a quarterly distribution of $0.18 per unit in 2020, raising that to $0.2175 per unit in 2022, $0.2675 in 2023, $0.3175 per unit in 2024, and $0.38 per unit in 2025. This works out to an annual distribution of $1.52 per unit for a forward distribution rate of 8.23%.

The payout doesn’t always go up, of course. Plains All American suspended its payout in the aftermath of the 2020 health crisis, reinstating it in 2023. Again, it’s been rising every year since then.

34% Upside Potential with PAA Stock?

PAA stock may experience short-term bumps, but longer term, it has been providing unitholders with excellent long-term capital appreciation. Over the last five years PAA stock has advanced 220%, far outpacing the S&P 500, which is up 98% over the same time period.

That 220% gain represents the total returns with PAA stock, including reinvested distributions. Had a unitholder elected to take the money and run, the return would slip to 141%.

More recently, PAA stock is up 19% since April, 13.6% year to date, and 10% on an annual basis. More gains are expected, with Wall Street analysts providing a 12-month share price target range of $21.16 to $25.00 per unit. This points to potential upside of approximately 13% to 34%.

Chart courtesy of StockCharts.com

The Lowdown on PAA Stock

Plains All American Pipeline LP is a great midstream energy play. The company has been reporting strong annual results, PAA stock is outpacing the broader market, and it recently raised its quarterly distribution to $0.38 per unit.

The outlook remains solid for Plains All American in 2025, with the partnership nicely positioned to generate strong FCF and increase returns to unitholders.

On the institutional front, 429 major holders account for 63.32% of all outstanding PAA stock. Three of the biggest holders include ALPS Advisors, Inc., Invesco Ltd., and The Goldman Sachs Group, Inc. (Source: “Plains All American Pipeline, L.P. (PAA),” Yahoo! Finance, last accessed July 27, 2025.)