This Dividend Stock’s 10% Yield Is Growing

A Growing 10% Yielder

Today’s chart highlights another winner in the healthcare business, senior housing.

Regular readers have heard our bullish argument on senior housing before. As the population gets older, we’re going to need more nursing homes, retirement communities, and long-term care facilities.

This trend has represented one of the market’s biggest tailwinds over the past few years. Senior housing providers have delivered double-digit returns over the past decade. And we’ve seen it driving dividends higher for many partnerships, like HCP, Inc. (NYSE:HCP), Ventas, Inc. (NYSE:VTR), and Welltower Inc (NYSE:WELL).

Today, we can see this trend’s success with Omega Healthcare Investors Inc (NYSE:OHI). This real estate investment trust (REIT) owns the facilities or mortgages of 477 nursing homes and specialty hospitals. And with a yield approaching 10%, income investors have taken notice.

Omega Healthcare Investors is a lucrative business. It doesn’t actually run any senior care facilities itself; instead, management leases out properties to operators in exchange for ongoing rent checks.

And business, it seems, has been going quite well. America’s 65-and-older population has topped 49.2 million people, larger than the entire population of Canada. Each day, more than 10,000 baby boomers enter their senior years. That’s good news for Omega. (Source: “The Nation’s Older Population Is Still Growing, Census Bureau Reports,” United States Census Bureau, June 22, 2017.)

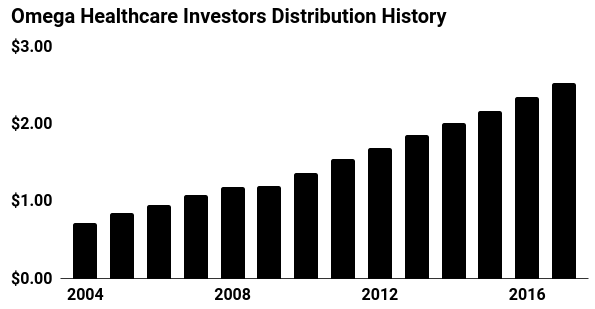

As you can see in the chart below, this demographic tailwind has paid off for unitholders. Analysts see cash flow—and by rough extension, the distribution—growing at a mid-to-high single-digit annual clip, driven by higher rents and lower vacancies.

(Source: “Dividends,” Omega Healthcare Investors Inc, last accessed March 19, 2018.)

To be clear, you can’t call this investment a sure thing. Tenants can (and do) default on their leases from time to time. The stock prices have dropped in recent months due to higher interest rates, because an increase in borrowing costs will force management to dial back their growth plans.

That said, the executives have made a lot of smart moves to minimize their risk here. Management has diversified the company’s tenant base, given that no one operator accounts for more than 10% of rental income. So, even if a renter runs into trouble, it shouldn’t result in catastrophic losses for Omega. (Source: “Investor Presentation March 2018,” Omega Healthcare Investors Inc, last accessed March 19, 2018.)

Furthermore, the executives have maintained a light debt load. Management has locked in most of the company’s debt at low interest rates, so, even if we see a big rise in borrowing costs, Omega Healthcare Investors Inc should keep mailing out distributions.