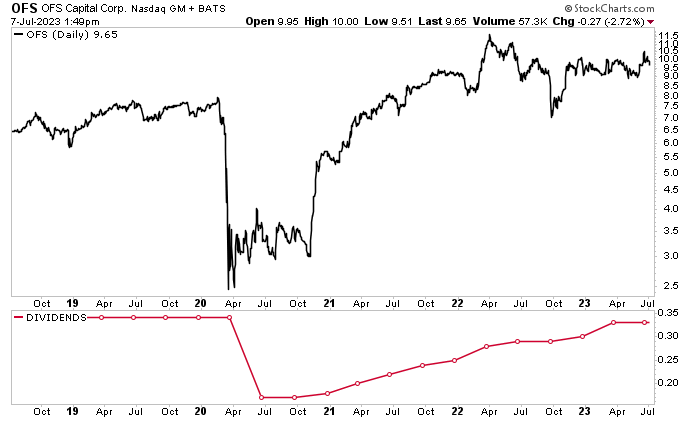

OFS Capital Stock: Market-Crushing 13.2%-Yielder Has Raised Payout 94% Since June 2020

OFS Stock Should Be on Investors’ Radar

There aren’t a lot of people or businesses that like rising interest rates. After all, higher rates make it more expensive to borrow. One industry that’s been having a great time with rising interest rates, though, is asset management—in particular, business development companies (BDCs) like OFS Capital Corp (NASDAQ:OFS).

BDCs operate in much the same way as traditional financial institutions. They borrow money at low interest rates and then lend out that money at higher interest rates. The profit, called the spread, comes from the difference between the interest they pay to creditors and what they receive from borrowers.

Like traditional banks, BDCs often build sprawling, nationwide operations and provide loans to clients in various industries.

However, the similarities end there. Unlike regular banks, BDCs don’t serve the general public. They have no branches and no ATMs. Moreover, they don’t provide checking accounts, credit cards, or mortgages. That explains why most people aren’t familiar with the vast majority of BDCs.

BDCs have carved out a lucrative niche in the financing marketplace. They generally lend capital to small and midsized companies that aren’t large enough to go public. These businesses need bigger loans than those typically provided by traditional banks. So, BDCs fit right into the “sweet spot” of the U.S. economy, within the huge gap between commercial banks and investment banks.

That said, “small and midsized companies” might be a bit of a misnomer; we’re not talking about local diners or beauty salons. BDCs typically lend capital to companies that generate between $20.0 and $100.0 million yearly in sales. Those companies use loans to fund acquisitions and growth projects, or simply to pay dividends.

Not all loans are created equal, and lenders need to know how likely they are to get paid in the event a borrower defaults.

For instance, a BDC with a lot of “senior” debt stands first in line to get its money back. “Mezzanine” lenders get paid second. Meanwhile, “preferred” and “equity” investors usually receive only a fraction of their original investment back (if anything at all) in the event of a bankruptcy.

BDCs don’t just benefit their clients; they come with an advantage for income investors. Standard financial outfits have to pay the government between $0.25 and $0.35 in taxes on each dollar they make in profit. But to encourage lending to entrepreneurs, BDCs pay little or no corporate tax on their earnings.

There is a caveat, of course. In exchange for this benefit, BDCs must distribute at least 90% of their ordinary taxable income to their shareholders. As a result, they pay out some of the biggest dividend yields around.

It’s not uncommon to see BDC stocks with yields as high as 15%, which is about five times higher than what traditional bank stocks pay.

About OFS Capital Corp

OFS Capital is an externally managed BDC that specializes in direct and fund investments, as well as add-on acquisitions.

The company provides its shareholders with current income and capital appreciation, primarily through debt investments and, to a lesser extent, equity investments. (Source: “Investor Presentation: May 2023,” OFS Capital Corp, last accessed July 11, 2023.)

OFS Capital primarily invests in privately held middle-market companies in the U.S., particularly those with annual earnings before interest, taxes, depreciation, and amortization (EBITDA) between $5.0 and $50.0 million. It doesn’t invest in operational turnarounds or start-up businesses.

OFS Capital Corp offers senior secured loans, which include first-lien, second-lien, and unitranche loans—as well as subordinated loans and, to a lesser extent, warrants and other minority equity securities.

The BDC has $4.1 billion of assets under management.

As of March 31, based on fair value, 94% of its loan portfolio consisted of floating-rate loans and approximately 99% consisted of senior secured loans.

OFS Capital Corp’s lending portfolio is diversified across 15 business sectors and 47 distinct loan obligations, with no material exposure to cyclical sectors. Manufacturing accounts for the biggest part of its portfolio (27.5%), followed by health care and social assistance (16.5%); wholesale trade (13.1%); and professional, scientific, and technical services (11.7%).

OFS Capital Corp’s experienced management team believes in what the company is doing, with 22.5% insider ownership of the company’s shares, compared to the BDC sector’s median of just two percent.

Net Income Jumped by 55.5% in First Quarter

For the first quarter ended March 31, OFS Capital reported net investment income of $0.37 per share, up from $0.22 in the same period last year and $0.35 in the fourth quarter of 2022. (Source: “OFS Capital Corporation Announces First Quarter 2023 Financial Results,” OFS Capital Corp, May 4, 2023.)

Its total investment income increased in the first quarter to $14.3 million, from $14.0 million in the prior quarter. The company also reported net income of $0.28 per share, up by 55.5% from $0.18 in the fourth quarter of 2022.

Commenting on OFS Capital Corp’s future results, Bilal Rashid, the company’s chairman and CEO, said, “We expect to continue to see the benefits of our positioning in this rising interest rate environment[,] with the vast majority of our loan portfolio being floating rate and the majority of our debt being fixed-rate.” (Source: Ibid.)

OFS Capital Stock’s Quarterly Dividends Are on the Rise

In February, OFS Capital Corp declared a quarterly distribution of $0.33 per share, up from $0.30 in the previous quarter. In May, the company announced that it would be maintaining that payout in June, for an inflation-thumping current yield of 13.2%. (Source: “Distribution History,” OFS Capital Corp, last accessed July 7, 2023.)

For context, the U.S. inflation rate is currently about four percent.

OFS has a history of raising its distribution. It has raised its payout in nine of the last 12 quarters, for a total increase of 94% since June 30, 2020.

To be fair, the company’s dividend took a hit during the COVID-19 pandemic, but it’s not a total surprise to see a banking stock reduce its dividend during the toughest economic climate in 100 years.

OFS Capital Corp’s quarterly payout is almost back to its pre-pandemic level. In March 2020, the company paid out $0.34 per share, which is only one cent higher than its current quarterly distribution.

OFS Stock’s Price Is on the Rise, Too

In terms of share price, OFS Capital Corp has more than erased all of its losses associated with the COVID-19 pandemic, even though OFS Capital stock was trading at record levels before the pandemic.

Not surprisingly, the shuttering of the global economy, a recession, and uncertainty took the wind out of OFS Capital Corp’s sails. OFS stock cratered by almost 70% in the opening days of the pandemic.

All things considered, it didn’t take that long for OFS Capital stock to recover. By June 2021, it was trading at record levels again. On April 1, 2022, the stock hit a new record high of $11.66. That represents a 413% gain over its March 2020 low of $2.27 per share.

In 2023, OFS stock has traded in a fairly tight range, but it’s still up by 3.1% over the last six months, 1.3% year-to-date, and 8.3% year-over-year (as of this writing). It’s also up by 20% from its pre-pandemic record high.

Chart courtesy of StockCharts.com

Rising interest rates and a growing lending portfolio have positioned OFS Capital Corp for additional share-price gains in the coming quarters.

The Lowdown on OFS Capital Corp

OFS Capital stock is a great way for investors to dip their toes in the world of BDCs, or what we at Income Investors call “alternative banks.”

The company’s diverse client base consists of high-quality, recession-resistant businesses, and its loan portfolio is made up almost entirely of senior secured loans.

This helps OFS Capital Corp provide its shareholders with significant capital gains and ultra-high-yield dividends. At a time when Americans are worried about growing personal debt and a recession, it’s tough to beat a BDC play like OFS stock.