Office Properties Income Trust Stock: 16.4% Payout From Uncle Sam

OPI Stock’s Outlook Solid on Fundamentals

Office Properties Income Trust (NASDAQ:OPI) is a real estate investment trust (REIT) we’ve been following for a while (even back when it used to be called Government Properties Income Trust)—and for good reason.

A REIT is only as strong as its tenants, and few—if any—REITs have the kind of rock-solid tenants that Office Properties Income Trust does.

The company’s previous name should give you an idea of who some of its clients are. The U.S. government is still its biggest tenant, paying 19.1% of the REIT’s annualized rent. Combined, the federal government, state governments, and government contractors account for 36% of the company’s annualized rent. (Source: “Investor Presentation: Q3 2022,” Office Properties Income Trust, last accessed January 16, 2023.)

The majority of the company’s rent (63%) comes from investment-grade tenants.

The REIT’s $4.5-billion real estate portfolio consists of 162 properties comprising 21.2 million square feet in 31 states and Washington, D.C. Office Properties Income Trust’s 90.7% occupancy rate outperforms the occupancy rate of the broader market.

The company focuses on areas with strong economic outlooks, particularly those with favorable long-term demand outlooks. Its top three markets are Washington, D.C. (22% of its annualized rental income), Chicago (11%), and Silicon Valley/Sacramento (10%).

| Office Properties Income Trust’s Top 10 Tenants | Portion of Annualized Rental Income |

| U.S. Government | 19.1% |

| Alphabet Inc | 4.3% |

| Shook, Hardy & Bacon L.L.P. | 3.5% |

| IG Investments Holdings LLC | 3.0% |

| Bank of America Corp | 2.9% |

| State of California | 2.9% |

| Commonwealth of Massachusetts | 2.2% |

| CareFirst, Inc. | 2.1% |

| Northrop Grumman Corp | 2.1% |

| Tyson Foods, Inc. | 2.0% |

(Source: Ibid.)

Office Properties Income Trust’s metrics are always changing.

In 2021, the company:

- Executed 2.5 million square feet of new and renewal leasing activity

- Sold six non-core properties (2.6 million square feet) for more than $225.0 million

- Acquired two core properties in Chicago and Atlanta for $550.0 million (adding Alphabet Inc as a top tenant)

- Launched the redevelopment of two properties in Washington, D.C. and Seattle, WA

- Issued $1.1 billion worth of senior notes, which reduced its debt costs and increased its average debt maturity

In the first nine months of 2022, Office Properties Income Trust:

- Executed 1.9 million square feet of leasing activity

- Completed a new 84,000-square-foot lease to anchor its Seattle Life Science development

- Sold 16 properties (2.1 million square feet) for more than $195.0 million

Office Properties Income Trust Reports Another Strong Quarter & Maintains Dividend

For the third quarter ended September 30, 2022, Office Properties announced that its net income was $17.0 million, or $0.35 per share, an improvement from $3.7 million, or $0.08 per share, in the same period of 2021. (Source: “Office Properties Income Trust Announces Third Quarter 2022 Results,” Office Properties Income Trust, October 27, 2022.)

The REIT’s normalized funds from operations (FFO) in the third quarter of 2022 were $53.8 million, or $1.11 per share, compared to $59.6 million, or $1.24 per diluted share, in the same period of 2021. Meanwhile, its cash available for distribution was $28.1 million, or $0.58 per share, versus $30.9 million, or $0.64 per share, in the third quarter of 2021.

Office Properties Income Trust ended the third quarter of 2022 with cash and cash equivalents of $14.0 million. It also had $615.0 million available to borrow under a revolving credit facility.

For the third quarter, the company’s board declared a quarterly cash distribution of $0.55 per share, for a yield of 16.4%. Its cash available for distribution safely covers that dividend. Office Properties Income Trust stock’s reliable payout can provide dividend hogs with a safety net to help them ride out the ongoing market volatility.

Moreover, in terms of share price, OPI stock has been doing a lot better than much of the broader market. Office Properties Income Trust stock is trading up by seven percent over the last month and 28% over the last three months. It’s down by 38% year-over-year, though.

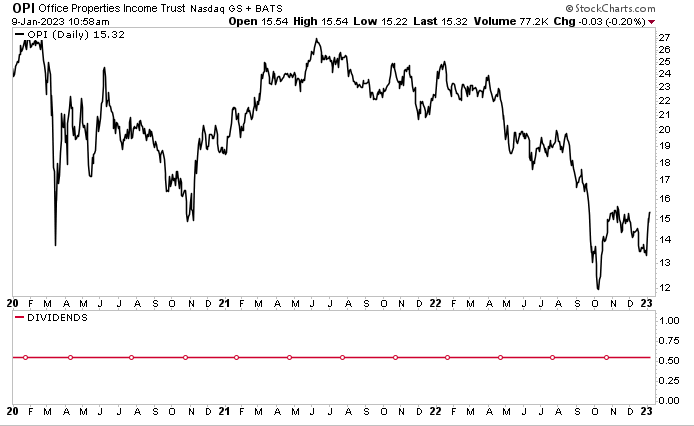

Chart courtesy of StockCharts.com

The outlook for OPI stock in 2023 is solid. Analysts estimate that the stock will advance between 22% and 90% over the coming 12 months.

The Lowdown on Office Properties Income Trust Stock

Investors have punished REITs lately because they believe that rising interest rates and a possible increase in the failure of tenants being able to pay their rents will hammer their bottom lines. This hasn’t been the case, though, especially with Office Properties Income Trust.

As mentioned earlier, governments and government contractors account for 36% of the REIT’s total annualized rent, and investment-grade tenants account for 63% of its total annualized rent. Second, despite fears that REITs underperform when interest rates are high, they’ve actually done well in times of high interest rates and inflation. One reason is that REITs can pass on their additional costs to their tenants through increased rents.

This allows Office Properties Income Trust to maintain a reliable cash flow, which it returns to OPI stockholders in the form of reliable, ultra-high-yield dividends.