Oaktree Specialty Lending Corp Up 87% Year-Over-Year; Pays Safe 7.2% Dividend

OCSL Stock’s Dividend Rose in Last 3 Quarters

The financial services sector took a hit during the coronavirus pandemic. With much of the global economy shut down last year, there weren’t tons of businesses looking for financing. If they were looking, there weren’t many lenders willing to throw good money at a horrible economic situation.

That was 2020. Now we’re knee-deep into 2021 and the credit market is rallying, fueled by improving economic conditions, improving consumer sentiment, the rollout of COVID-19 vaccines, and the likelihood of continued government stimulus measures.

Oaktree Specialty Lending Corp (NASDAQ:OCSL) is already capitalizing on the upgraded economic conditions. In addition to reporting another quarter of strong financial results, it raised its quarterly dividend by 26% year-over-year and nine percent sequentially. This represents the third consecutive quarter that Oaktree Specialty Lending has raised its payout.

The company was able to do this as middle-market loan volumes, which were dampened for much of 2020, rebounded in the fourth quarter of the year as pent-up demand drove new issuance.

And middle-market loans are exactly what Oaktree Specialty Lending specializes in.

A business development company (BDC), Oaktree Specialty Lending provides loans and credit to the mid-market segment and smaller firms that would otherwise have difficulty accessing public or private capital. (Source: “Investor Presentation: First Quarter 2021,” Oaktree Specialty Lending Corp, last accessed April 21, 2021.)

The company generates income and capital appreciation by providing companies with diverse financing solutions, including first- and second-lien loans, unsecured loans, mezzanine loans, and preferred equity.

Oaktree Specialty Lending’s portfolio is made up of $1.7 billion in total investments in 115 companies. The company serves various industries, including advertising; construction and engineering; health-care equipment and services; industrial machinery; Internet software and services; multi-sector holdings; pharmaceuticals; and research and consulting services.

The BDC’s investment allocation is made up of first lien (60%); second lien (25%); unsecured and equity (seven percent); and joint venture (seven percent).

In March, Oaktree Specialty Lending Corp completed its previously announced merger with Oaktree Strategic Income Corporation. The combined company has more than $2.2 billion of assets on a pro forma basis.

For the first quarter of fiscal 2021, ended December 31, 2020, Oaktree Specialty Lending announced that its total investment income was $38.2 million ($0.27 per share), versus $43.6 million ($0.31 per share) in the fourth quarter of fiscal 2020. (Source: “Oaktree Specialty Lending Corporation Announces First Fiscal Quarter 2021 Financial Results and Declares Increased Distribution of $0.12 Per Share,” Oaktree Specialty Lending Corp, February 4, 2021.)

The drop in investment income for Q1 2021 was primarily driven by lower one-time make-whole interest income from investments that were prepaid in the fourth quarter of fiscal 2020.

Oaktree Specialty Lending reported first-quarter 2021 net investment income of $10.0 million ($0.07 per share), compared to $24.5 million ($0.17 per share) for the fourth quarter of fiscal 2020.

On an adjusted basis, first-quarter 2021 net investment income was $19.6 million ($0.14 per share), compared to $24.5 million ($0.17 per share) in the fourth quarter of fiscal 2020.

Its net asset value (NAV) per share was $6.85, up five percent from $6.49 as of September 30, 2020. That exceeded the pre-pandemic NAV of $6.61 per share.

During the first quarter of fiscal 2021, Oaktree Specialty Lending Corp originated $286.3 million of new investment commitments and received $160.7 million of proceeds from prepayments, exits, other paydowns, and sales. Of these new investment commitments, 68.6% were first-lien loans and 31.4% were second-lien loans. The weighted average yield on new debt investments was 8.7%.

“OCSL reported another quarter of strong financial results and portfolio performance,” said Armen Panossian, CEO and chief investment officer. (Source: “Oaktree Specialty Lending Corporation Announces First Fiscal Quarter 2021 Financial Results and Declares Increased Distribution of $0.12 Per Share,” Oaktree Specialty Lending Corp, February 4, 2021.)

“Earnings were solid at $0.14 per share, as our opportunistic investment activity in the wake of the pandemic and progress in rotating the portfolio into higher yielding, proprietary investments continue to favorably impact results.”

Because of this strong performance, and a nod to stronger days to come, the company’s board of directors announced that it was hiking Oaktree Specialty Lending stock’s quarterly dividend 26% year-over-year to $0.12 per share, marking the third consecutive quarter with a dividend increase.

That’s an important milestone. During the worst economic crisis since the Great Depression, Oaktree Specialty Lending actually raised OCSL stock’s dividend three times.

| Quarter | Dividend |

| Q1 2021 | $0.12 |

| Q4 2020 | $0.11 |

| Q3 2020 | $0.105 |

| Q2 2020 | $0.095 |

| Q1 2020 | $0.095 |

| Q4 2019 | $0.095 |

| Q3 2019 | $0.095 |

| Q2 2019 | $0.095 |

| Q1 2019 | $0.095 |

| Q4 2018 | $0.095 |

| Q3 2018 | $0.095 |

| Q2 2018 | $0.095 |

| Q1 2018 | $0.095 |

(Source: “Dividends,” Oaktree Specialty Lending Corp, last accessed April 21, 2021.)

Oaktree Specialty Lending stock provides an annual dividend of $0.48 per share, which, at its current level, represents a yield of 7.2%.

OCSL stock’s high dividend yield is safe; the payout ratio is just 63.3%. The maximum payout ratio I like to see is 90%. With that much financial wiggle room, chances are good that Oaktree Specialty Lending Corp will raise its quarterly distribution again this year.

Not only does Oaktree Specialty Lending stock have a history of providing investors with a stable quarterly payout, but management is making an effort to keep it at elevated levels. The trailing annual dividend yield is six percent and the five-year average dividend yield is 9.3%.

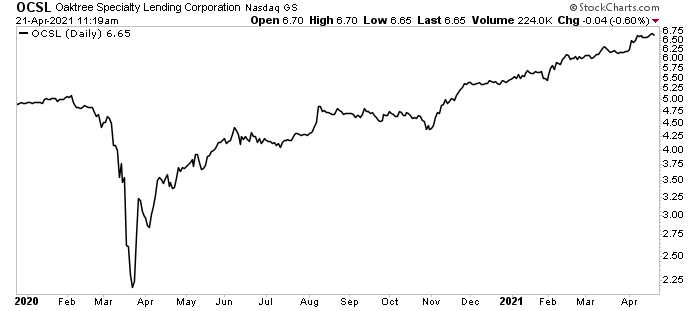

Strong financial results and encouraging economic signs have not only helped juice Oaktree Specialty Lending’s dividend payout, but they’ve also helped OCSL stock climb to record levels.

Currently trading at $6.65, Oaktree Specialty Lending stock is up 82.3% year-over-year and 20% year-to-date. Trading at record levels, OCSL stock is also up 209% since hitting its March 2020 low of $2.15 per share.

Chart courtesy of StockCharts.com

The Lowdown on Oaktree Specialty Lending Corp

Oaktree Specialty Lending Corp is a bullish financial services firm that could be perfect for investors who love to see their underlying investment and dividend payout rise.

As detailed earlier, the company reported strong financial results, with its NAV per share climbing more than five percent sequentially and exceeding its pre-pandemic level.

Looking ahead, the company’s high-quality investment portfolio with an improved yield profile is well positioned to deliver attractive risk-adjusted returns to Oaktree Specialty Lending stock holders.