Oaktree Specialty Lending Corp Hikes Dividend for 6th Straight Quarter

Bullish 8.3%-Yielding OCSL Stock Rose 46% in 2021

You can’t judge a book by its cover, but you can certainly judge a stock by its history of high dividends.

In the early days of the COVID-19 pandemic, many business development companies (BDCs) slashed their dividends. That’s not a surprise. With much of the economy shuttered and millions of people laid off, many companies put their growth projects on hold. During that time, many BDCs came out on the losing end.

One BDC that won big, however, was Oaktree Specialty Lending Corp (NASDAQ:OCSL)—and Oaktree Specialty Lending stock investors were the better for it.

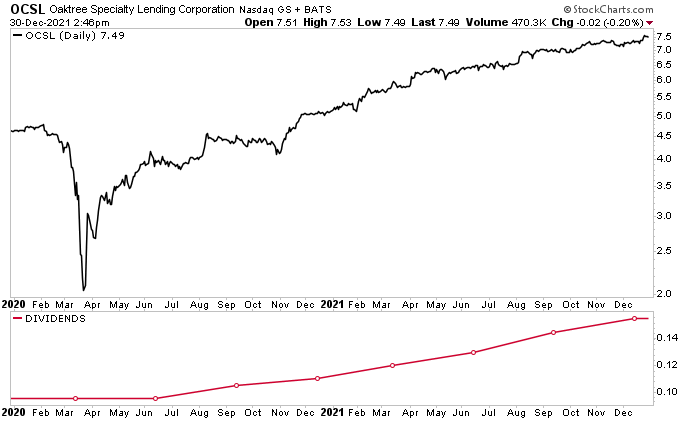

OCSL stock’s share price and dividend have both increased since the start of 2020. In fact, the company has raised its dividend for each of the last six quarters, from $0.095 per share in June 2020 to $0.155 in December 2021. That represents an overall increase of 63%. (Source: “Dividends,” Oaktree Specialty Lending Corp, last accessed January 4, 2022.)

When the company declared a quarterly dividend of $0.155 per share in November 2021, that was an increase of seven percent from the prior quarter and 41% year-over-year.

|

Record Date |

OCSL Stock Dividend |

|

December 15, 2021 |

$0.155 |

|

September 15, 2021 |

$0.145 |

|

June 15, 2021 |

$0.13 |

|

March 15, 2021 |

$0.12 |

|

December 15, 2020 |

$0.11 |

|

September 15, 2020 |

$0.105 |

|

June 15, 2020 |

$0.095 |

|

March 13, 2020 |

$0.095 |

(Source: Ibid.)

Over the last two years, this ultra-high-yield dividend stock has rewarded buy-and-hold investors. As of this writing, Oaktree Specialty Lending stock is up by:

- Five percent over the last three months

- Six percent over the last six months

- 46% year-over-year

If a BDC like Oaktree Specialty Lending Corp can raise its frothy dividend for six consecutive quarters and have its shares trade consistently higher during the worst economic crisis in 100 years, imagine what the company will do when everything returns to “normal.”

Chart courtesy of StockCharts.com

About Oaktree Specialty Lending Corp

What’s the big deal about Oaktree Specialty Lending? After all, there are many BDCs out there. The difference is who the company lends to.

The company provides loans and credit to under-served midsized and smaller firms that would otherwise have difficulty accessing public or private capital. It does this through senior secured debt, asset-backed loans, unsecured/mezzanine loans, bonds, and preferred and/or common equity. (Source: “Fact Sheet,” Oaktree Specialty Lending Corp, September 30, 2021)

The vast majority of the BDC’s portfolio is made up of first liens (68%), followed by second liens (19%), joint ventures (eight percent), equity (four percent), and unsecured loans (one percent).

The company’s $2.3-billion debt portfolio is invested in 135 companies, with an 8.4% weighted average yield on debt investments and 91.4% of the portfolio made up of floating-rate investments.

The top 10 industries in Oaktree Specialty Lending Corp’s portfolio are:

- Application Software (14.6%)

- Pharmaceuticals (5.6%)

- Data Processing and Outsourced Services (4.5%)

- Biotech (4.4%)

- Personal Products (4.1%)

- Industrial Machinery (3.5%)

- Health-Care Services (3.3%)

- Aerospace and Defense (2.7%)

- Specialized Finance (2.7%)

- Internet and Direct Marketing (2.7%)

In March 2021, Oaktree Specialty Lending announced that it had closed on its previously announced merger with Oaktree Strategic Income Corporation. (Source: “Oaktree Specialty Lending Corporation Completes Merger with Oaktree Strategic Income Corporation,” Oaktree Specialty Lending Corp, March 19, 2021.)

Due to the merger, Oaktree Specialty Lending’s portfolio increased from $1.6 to $2.2 billion, and the number of companies in its portfolio increased by 29 to 148. The merger improves the BDC’s portfolio diversification and exposure to first-lien investments.

Fourth Quarter Capped a Great Fiscal 2021

For the fourth quarter of fiscal 2021 ended September 30, 2021, Oaktree Specialty Lending reported total investment income of $63.8 million, or $0.35 per share, compared to $43.9 million, or $0.31 per share, in the same prior-year period. (Source: “Oaktree Specialty Lending Corporation Announces Fourth Fiscal Quarter and Full Year 2021 Financial Results and Declares Increased Distribution of $0.155 Per Share,” Oaktree Lending Corp, November 16, 2021.)

The company’s investment income in the fourth quarter of 2021 was $33.0 million, or $0.18 per share, compared to $24.5 million, or $0.17 per share, in the fourth quarter of fiscal 2020. Its net asset value was $7.28 per share, up by 12% from $6.49 in the same period of the previous year and up by 0.8% from $7.22 per share in the third fiscal quarter of 2021.

During the fourth quarter of 2021, Oaktree Specialty Lending Corp originated $385.0 million of new investment commitments and received $201.8 million of proceeds from prepayments, exits, or other paydowns and sales.

Of the new investment commitments, 91% were first-lien loans, three percent were second-lien loans, five percent were subordinated debt investments, and one percent were equity investments. The weighted average yield on new debt investments was 8.6%.

The BDC ended the quarter with $29.0 million in cash and $470.0 million of undrawn capacity on its credit facility.

The Lowdown on Oaktree Specialty Lending Stock

Oaktree Specialty Lending Corp is an excellent financial services company with a conservative balance sheet, strong liquidity, and diverse portfolio.

The fourth quarter of fiscal 2021 capped a wonderful fiscal year with a solid investment performance, underscored by the BDC’s highest annual level of adjusted net investment income per share. As a result, the company was able to increase its dividend by 41% and grow its net asset value by more than 12% in fiscal year 2021.

While 2021 was good for OCSL stock investors, 2022 looks even better.