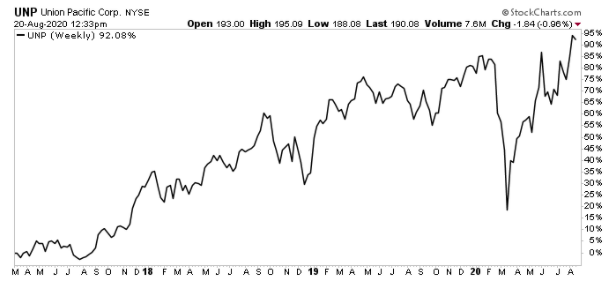

Union Pacific Corporation: Up 93%…with More Upside Ahead

The Initiative Quietly Making Union Pacific Shareholders a Fortune

Union Pacific Corporation (NYSE:UNP) has fretted this year over layoffs, plunging shipments, and a COVID-19 recession. But Wall Street, it appears, hasn’t noticed.

Earlier this summer, the railroad giant put out an absolutely terrible quarterly earnings report. Yet, in spite of the disappointing numbers, Union Pacific shares recently closed at fresh all-time highs.

And, since I first featured the stock to my Retirement Riches subscribers in early-2017, the stock has posted a total gain, including dividends, of 93%.

So, what the heck is going on?

Well, Union Pacific Corporation’s second-quarter top-line numbers turned out just as badly as you’d expect. Total carloads plunged 20%. Average revenue per carload declined six percent. Overall, revenues dropped 24% from the same period in 2019, and management issued pessimistic guidance for the upcoming year. (Source: “Union Pacific Reports Second Quarter 2020 Results,” Union Pacific Corporation Investor Relations, July 23, 2020.)

“The second quarter proved very challenging as we faced a volume decline of 20% due to the economic impact of the COVID-19 pandemic.” Lance Fritz, Union Pacific’s chairman and chief executive officer, wrote in a note to shareholders. “Our dedicated employees are feeling a very real impact from this pandemic, making tangible sacrifices.” (Source: “Union Pacific Reports Second Quarter 2020 Results,” Union Pacific Corporation, July 23, 2020.)

The answer to the mystery comes from a growing trend in the industry called precision schedule railroading, or PSR. For those not up on the industry lingo, PSR advocates for the idea of running freight on fixed scheduled trains on a point-to-point basis, in contrast to the traditional hub-and-spoke model. As a result, railroads can run faster trains with less idle time. By ensuring grass never grows beneath the wheels, companies can squeeze more income out of their business with less money tied up in locomotives, railcars, and other equipment.

PSR, in effect, has turned the industry into a money machine.

The Impact of PSR on Union Pacific Corporation

In 2018, the four biggest railroad companies spent $0.63 in operating expenses on every dollar generated in revenue. But, by the end of 2019, this figure had dropped to just over $0.61. Multiply those savings across hundreds of billions in revenues, and you’re talking about a large chunk of money freed up that can now be paid to shareholders. (Source: “Here’s Why Railroad Stocks Are Soaring in 2020,” The Motley Fool, February 6, 2020.)

PSR has had a similar impact at Union Pacific. In September 2018, executives announced their “Unified Plan 2020,” which called for an almost total overhaul of the company’s operations.

Management planned to dramatically reduce car dwell time, slash locomotive power requirements, and speed up average train speeds. The result, in theory, should allow Union Pacific to dramatically cut costs without impacting customer service or employee safety. (Source: “Union Pacific Announces Unified Plan 2020,” Union Pacific Corporation, September 17, 2020.)

And, for the most part, that’s exactly how things have played out.

In 2018, Union Pacific spent $0.67 in operating expenses on each dollar generated in revenue, one of the worst operating ratios in the industry. But, by the end of 2019, executives had reduced this number to approximately $0.60. And, based on the original “Unified Plan,” management believes they can get this number down to $0.55 on the dollar at some undetermined point in the future. (Source: “Union Pacific Announces Unified Plan 2020,” Union Pacific Corporation, September 17, 2020.)

These cost-cutting measures in large part explain how Union Pacific Corporation has held up so well through COVID-19.

The railroad’s net income has come in at $2.6 billion year-to-date, down only 12% from the same period in 2019. That won’t have readers jumping for joy, but it’s hardly the disaster most analysts expected this spring. (Source: “Union Pacific Reports Second Quarter 2020 Results,” Union Pacific Corporation Investor Relations, July 23, 2020.)

Chart courtesy of StockCharts.com

Furthermore, investors have good reason to expect a quick recovery.

Union Pacific has opted to only furlough idle workers rather than lay them off. This indicates that management expects a quick rebound in railcar traffic as the economy opens back up. Early numbers from the Association of American Railroads (AAR) also show that container shipments bottomed out this spring, and have actually started to rebound slightly. (Source: “Rail Traffic for the Week Ending August 15, 2020,” AAR, August 19, 2020.)

All of which bodes well for Union Pacific Corporation’s long-term prospects.