ENB Stock: Can Enbridge Inc Investors Trust This 7% Yield?

Enbridge Inc Gushing Dividends

This might sound odd, but I avoid most high-yield stocks.

Their payouts look great—at least at first. But after digging into the financials, I realize it’s just a matter of time until these dividends get slashed.

For that reason, I generally treat high-yield stocks the same way I’d treat a mama bear with cubs: I steer clear.

That said, I do find exceptions to this rule. Over the years, I’ve found good payouts buried among the trash. And recently, I found one of these pockets in the pipeline industry.

Enbridge Inc (NYSE:ENB) fell out of favor on Wall Street following the downturn in oil prices. Income hunters, though, have long prized this company for its reliable cash flows and dividends. And with a yield that’s almost seven percent, I get many e-mails about the stock.

Can such a high payout possibly be safe? Savvy investors will dig into the numbers before pulling the trigger on any big decision. So let’s do that.

Enbridge Inc has tidied up its balance sheet, first off.

In 2018, the company acquired rival Specta Energy Corp in a $4.3-billion deal. The transaction created one of the largest pipeline companies in North America, but management borrowed out the nose to fund the purchase. (Source: “Enbridge to buy Spectra Energy Partners for $4.3 billion,” Financial Post, August 24, 2018.)

At the end of 2018, Enbridge had almost $6.00 in debt for every dollar generated in earnings before interest, taxes, depreciation, and amortization (EBITDA). That left management with little wiggle room in the event of an industry downturn or higher interest rates.

But Enbridge seems to have digested this acquisition. Through repayments, higher cash flow, and debt refinancing, the company’s debt to EBITDA ratio has dropped to 4.5, well within the industry’s average. Assuming management makes no more big purchases, analysts project that this ratio will drop to 4.2 by the end of 2021. (Source: “Investment Community Presentation July 2019,” Enbridge Inc, last accessed July 29, 2019.)

Great news for investors hoping to cash reliable dividend payments. This lower debt load puts the distribution on a much firmer foundation.

Enbridge Inc can fund these liabilities because the business gushes profits.

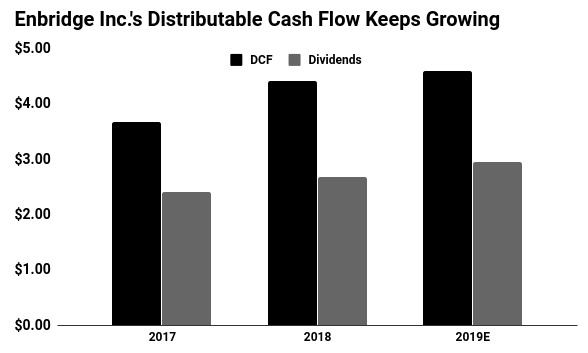

In the pipeline business, we measure performance through a metric called distributable cash flow (DCF). This metric provides a better indicator than traditional earnings as to how much cash the company can return to investors.

Last year, Enbridge’s DCF was $4.42 per share. And today, the company’s per-share annual dividend comes out to $2.18. That comes out to a payout ratio of 49%, well within my comfort zone.

(Source: Ibid.)

This income stream will likely continue to grow.

New technologies, such as oil sands mining and hydraulic fracturing, have unlocked vast supplies of oil and gas across the continent. The problem is, we don’t have enough infrastructure to actually ship, store, and process all of this energy.

Bad news if you work in the business of pulling crude out of the ground. But for Enbridge Inc, this crisis has been a boon. Aside from raising tolls on existing pipelines, management has also boosted profits by building new lines and expanding shipment capacity.

Overall, management projects that the company’s DCF could grow at a seven percent compounded annual clip over the next 10 years. (Source: Ibid.)

Given the company’s conservative payout ratio, executives will likely boost the dividend at an even faster clip. In other words, Enbridge stock looks like one of the few seven percent yields you can trust.