Northwest Natural Stock: 52-Year Dividend Growth Streak

Why 4.8%-Yielding NWN Stock Looks Compelling

The top dividend-paying stocks are known as “dividend kings.” These are companies that have paid dividends for at least 50 consecutive years. Some dividend kings have even raised their payouts annually for long periods of time. That’s impressive, considering that companies and whole industries move through economic cycles.

One dividend king worth watching is Northwest Natural Holding Co (NYSE:NWN), a natural gas and water company. With a small market cap of $1.45 billion, this is not a major company. However, the fact that Northwest Natural is on a 53-year dividend streak—and the company has raised its dividends in 52 straight years—is an accomplishment that’s welcome by income investors.

Northwest Natural has been operating for more than 160 years in the Pacific Northwest. The company owns NW Natural Gas Company, NW Natural Renewables Holdings, NW Natural Water Company, and some other smaller business interests. (Source: “About NW Natural Holdings,” Northwest Natural Holding Co, last accessed September 14, 2023.)

NW Natural Gas provides gas to about 2.5 million people in Oregon and Southwest Washington. NW Natural Water distributes water and provides wastewater services to about 158,000 people throughout the Pacific Northwest, Texas, and Arizona.

Northwest Natural Stock Struggling to Find Support

To say that NWN stock’s price has been underperforming would be an understatement. In February 2020, shares of Northwest Natural Holding Co hit a record-high $77.26. On September 5, 2022, they fell to a 52-week low of $37.79. So far in 2023, they’ve gone down by about 1,620%.

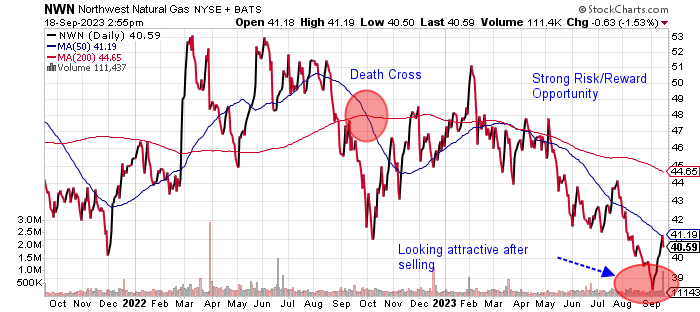

The below chart shows NWN stock in a bearish death cross pattern, trading below its 50-day moving average (MA) of $41.42 and its 200-day MA of $45.54.

The technical picture for Northwest Natural stock’s share price is bearish, but patient investors can collect quarterly dividends and wait for a potential turnaround in the price.

Chart courtesy of StockCharts.com

Natural Holding Co Pays Steady Dividends

As mentioned earlier, Northwest Natural Holding Co has paid dividends for the past 53 years.

The company’s most recent quarterly dividend of $0.485 translates to a current yield of 4.8%. NWN stock’s five-year average dividend yield is lower than that, though: 3.6%. This is largely due to a higher share price in the past.

Given the company’s expected earnings over the next two years, I expect that Northwest Natural stock’s dividends will continue rising. The company’s payout ratio of 69.2% is manageable. (Source: “Northwest Natural Holding Company (NWN),” Yahoo! Finance, last accessed September 18, 2023.)

| Metric | |

| Dividend Growth Streak | 52 Years |

| Dividend Streak | 53 Years |

| Dividend 7-Year Compound Annual Growth Rate | 0.5% |

| 10-Year Average Dividend Yield | 3.9% |

| Dividend Coverage Ratio | 3.8 |

Over $1 Billion in Revenues in 2022

Northwest Natural Holding Co’s revenues have risen in each of its last four reported years, including by double-digit percentages in 2021 and 2022. The company managed to break the billion-dollar revenue mark in 2022. Its revenue compound annual growth rate (CAGR) for its last five reported years was a reasonable 10.1%.

Analysts predict that Northwest Natural will keep driving its revenues higher. Watch for revenue growth of 12.1% to $1.16 billion in 2023, followed by further growth to $1.19 billion in 2024. (Source: Ibid.)

| Fiscal Year | Revenues | Growth |

| 2018 | $704.5 Million | N/A |

| 2019 | $746.9 Million | 6.0% |

| 2020 | $774.9 Million | 3.7% |

| 2021 | $860.4 Million | 11.0% |

| 2022 | $1.0 Billion | 20.6% |

(Source: “Northwest Natural Holding Co.” MarketWatch, last accessed September 18, 2023.)

On the bottom line, Northwest Natural has been consistently profitable on a generally accepted accounting principles (GAAP)-diluted earnings-per-share (EPS) basis.

Analysts expect that Northwest Natural Holding Co will report earnings of $2.67 per diluted share for full-year 2023 and $2.78 per diluted share for 2024. (Source: Yahoo! Finance, op. cit.)

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2018 | $2.24 | N/A |

| 2019 | $2.07 | -7.5% |

| 2020 | $2.32 | 12.0% |

| 2021 | $2.56 | 10.5% |

| 2022 | $2.54 | -0.7% |

(Source: MarketWatch, op. cit.)

Moving to Northwest Natural Holding Co’s funds statement, the company has reported negative free cash flow (FCF) for the past five years. This is concerning, due to the potential impact on its dividends, but based on what the company has done in the past few years, it should be able to continue paying dividends as long as it’s profitable.

| Fiscal Year | FCF (Millions) | Growth |

| 2018 | -$45.9 | N/A |

| 2019 | -$57.0 | -24.3% |

| 2020 | -$137.9 | -142.0% |

| 2021 | -$134.9 | 2.2% |

| 2022 | -$191.7 | -42.1% |

(Source: MarketWatch, op. cit.)

The major risk with NWN stock is the company’s debt of $1.66 billion, which is slightly offset by $137.8 million in cash on its balance sheet. (Source: Yahoo! Finance, op. cit.)

The company’s debt risk needs to be monitored. Northwest Natural Holding Co’s Piotroski score—an indicator of a company’s balance sheet, profitability, and operational efficiency—is an acceptable 6.0. That’s well above the midpoint of the Piotroski score’s range of 1.0 to 9.0.

Moreover, Northwest Natural had a reasonable interest coverage ratio of 3.1 in 2022. The following table shows that Northwest Natural can easily cover its interest expense via its earnings before interest and taxes (EBIT). So for now, the company’s financial situation is manageable.

| Fiscal Year | EBIT After Unusual Expenses (Millions) | Interest Expense (Millions) |

| 2018 | $139.6 | $37.1 |

| 2019 | $161.4 | $42.7 |

| 2020 | $146.1 | $43.1 |

| 2021 | $112.2 | $44.5 |

| 2022 | $167.4 | $53.3 |

(Source: MarketWatch, op. cit.)

The Lowdown on Northwest Natural Holding Co

The fact that Northwest Natural stock is a dividend king is impressive.

Investors who are patient might want to enjoy the dividends from Northwest Natural Holding Co and wait for a potential turnaround in its share price that could generate capital gains.