6%-Yield NNN REIT Stock on 40-Year Dividend Streak

NNN Stock’s Dividends Have Been Rising for 34 Consecutive Years

There’s a current battle for attention between high-yield bonds and dividend-paying stocks. While interest rates have been holding at the same level for a while, their future direction is clearly downward, which would support high-yield dividend stocks.

My thinking is that investors could continue to accumulate high-yield bonds, but this strategy might limit their total returns by missing out on distribution income and potential share-price appreciation from dividend stocks.

Consider NNN REIT Inc (NYSE:NNN), a mid-cap real estate investment trust (REIT) that has paid dividends for 40 years and raised its dividends for 34 consecutive years. Moreover, as of this writing, its shares trade just south of their 52-week high of $44.96.

NNN REIT, which was formerly called National Retail Properties, Inc., invests in single-tenant net-leased retail properties in the U.S. As of March 31, the company owned 3,546 properties in 49 states, encompassing 36.1 million square feet. Its real estate portfolio has an average remaining lease term of 10 years. (Source: “Fact Sheet,” NNN REIT Inc, last accessed May 2, 2024.)

NNN REIT stock has been part of the S&P 400 MidCap index and the S&P High Yield Dividend Aristocrats index for more than 12 years.

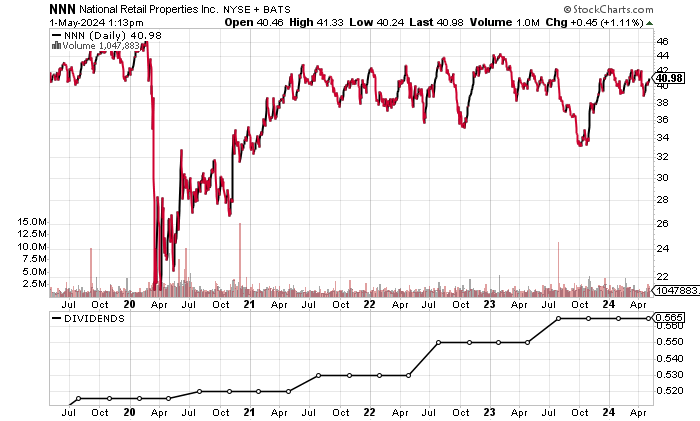

On its price chart, NNN stock has been hovering between a level above its 200-day moving average (MA) of $40.10 and a level just below its 50-day MA of $41.37. NNN REIT Inc’s chart also currently shows a golden cross pattern, which is a bullish technical crossover formation that appears when a stock’s 50-day MA is above its 200-day MA.

Chart courtesy of StockCharts.com

Steady Revenue Growth, Profitability, & Positive FCF

NNN REIT Inc’s revenues have increased in four of the last five years and nine of the last 10 years, to a record-high $828.1 million in 2023.

Its revenue growth is expected to continue. Analysts estimate that the REIT will increase its revenues by 3.8% to $860.0 million in 2024, followed by 4.6% to $899.5 million in 2025. (Source: Yahoo! Finance, op. cit.)

| Fiscal Year | Revenues (Millions) | Growth |

| 2019 | $670.5 | N/A |

| 2020 | $660.7 | -1.5% |

| 2021 | $726.4 | 10.0% |

| 2022 | $773.1 | 6.4% |

| 2023 | $828.1 | 7.1% |

(Source: “NNN REIT, Inc,” MarketWatch, last accessed May 2, 2024.)

NNN REIT Inc has consistently generated gross margins of 80% and above, as the following table shows.

| Fiscal Year | Gross Margin |

| 2019 | 95.9% |

| 2020 | 95.7% |

| 2021 | 96.1% |

| 2022 | 96.6% |

| 2023 | 96.6% |

On the bottom line, NNN REIT Inc has been producing generally accepted accounting principles (GAAP) profitability, highlighted by three straight years of GAAP-diluted earnings-per-share (EPS) growth to a record high in 2023.

Analysts expect that the company will report lower earnings of $1.97 per diluted share for 2024, prior to reporting a slight bump to $2.04 per diluted share for 2025. (Source: Yahoo! Finance, op. cit.)

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2019 | $1.56 | N/A |

| 2020 | $1.22 | -21.8% |

| 2021 | $1.51 | 23.5% |

| 2022 | $1.89 | 25.2% |

| 2023 | $2.16 | 14.3% |

(Source: MarketWatch, op. cit.)

NNN REIT Inc’s funds statement points to consistent positive free cash flow (FCF), with three straight years of FCF growth. In 2023, its FCF came in at a record high that was well above its pre-pandemic FCF levels.

The REIT’s strong FCF enables it to pay (and raise) its dividends, invest in more properties, and cut its debt.

| Fiscal Year | FCF (Millions) | Growth |

| 2019 | $501.7 | N/A |

| 2020 | $450.2 | -10.3% |

| 2021 | $568.4 | 26.3% |

| 2022 | $578.4 | 1.8% |

| 2023 | $612.4 | 5.9% |

(Source: MarketWatch, op. cit.)

NNN REIT Inc’s high capital expenditures are typical of retail REITs. At the end of 2023, the company carried $4.36 billion in total debt. (Source: Yahoo! Finance, op. cit.)

Going forward, lower interest rates should help the REIT reduce its debt.

For the time being, NNN REIT has been easily covering its annual interest expenses with higher earnings before interest and taxes (EBIT). The interest coverage ratio in 2023 was reasonable at 3.4 times.

| Fiscal Year | EBIT (Millions) | Interest Expense (Millions) |

| 2020 | $358.2 | $129.4 |

| 2021 | $428.0 | $137.9 |

| 2022 | $482.7 | $148.1 |

| 2023 | $556.2 | $163.9 |

(Source: Yahoo! Finance, op. cit.)

NNN REIT Inc’s Piotroski score—an indicator of a company’s balance sheet, profitability, and operational efficiency—is 6.0. This is well above the midpoint of the Piotroski score’s range of 1.0 to 9.0.

NNN REIT Stock’s Dividend Outlook Is Good

NNN REIT is a well-managed REIT that strives to return capital to its shareholders. NNN stock currently pays out quarterly dividends of $0.565. (Source: “Dividends,” NNN REIT Inc, last accessed May 2, 2024.)

This represents a forward dividend yield of 5.58%.

Given the company’s strong profitability and FCF, there’s no reason to think that NNN REIT stock’s dividends won’t continue to edge higher.

| Metric | Value |

| Dividend Growth Streak | 34 Years |

| Dividend Streak | 40 Years |

| 7-Year Dividend Compound Annual Growth Rate | 3.1% |

| 10-Year Average Dividend Yield | 5.3% |

| Dividend Coverage Ratio | 1.5 |

The Lowdown on NNN REIT Inc

Income investors who seek steady and rising dividends, along with the potential for share-price appreciation, might want to look at NNN stock.

Note that institutional ownership of NNN REIT Inc has been extremely strong, with 619 institutions holding 93.27% of the company’s outstanding shares (as of this writing). The top two institutional investors are The Vanguard Group, Inc., with a 14.78% stake, and Blackrock Inc (NYSE:BLK), with an 11.62% stake. (Source: Yahoo! Finance, op. cit.)

Company insiders have also been investing in NNN REIT stock. Over the last six months, insiders bought a net 320,933 shares.

Those are good signs.