3.1%-Yield NextEra Energy Stock Has Significant Upside

NEE Stock’s Dividends Hiked for 28 Straight Years

While I generally look for dividend stocks with yields above five percent, I sometimes consider stocks with lower yields but significant potential in terms of share-price gains.

That’s the case with NextEra Energy Inc (NYSE:NEE), a utility company with a $122.8-billion market cap.

NextEra Energy started in 1925 as Florida Power & Light Company. It changed its name to FPL Group, Inc. in 1984, then changed its name again to NextEra Energy Inc in 2010. (Source: “Our History,” NextEra Energy Inc, last accessed December 14, 2023.)

Florida Power & Light Company still exists as a subsidiary of NextEra Energy, and it’s the largest electric utility in North America, serving about 5.8 million customers in Florida. (Source: “About NextEra Energy,” NextEra Energy Inc, last accessed December 14, 2023.)

NextEra Energy also owns the clean-energy business NextEra Energy Resources LLC. This business unit, along with its affiliates, is the world’s largest generator of renewable energy (solar and wind). It’s also a major player in the battery storage sector.

Moreover, NextEra Energy produces electricity from seven commercial nuclear facilities in Florida, New Hampshire, and Wisconsin.

NextEra Energy Inc blossomed during the years of low interest rates, but then it was hurt by 11 straight interest rate increases by the Federal Reserve in its battle against inflation. High interest rates drive up the debt-financing costs associated with utilities’ significant capital expenditures. While I view this as a major risk, the situation will improve in time.

As of this writing, NextEra Energy stock is down by 28.4% in 2023, but my view is that this presents a contrarian opportunity, given that NextEra Energy Inc has paid dividends for 58 straight years and raised its dividends for 28 straight years.

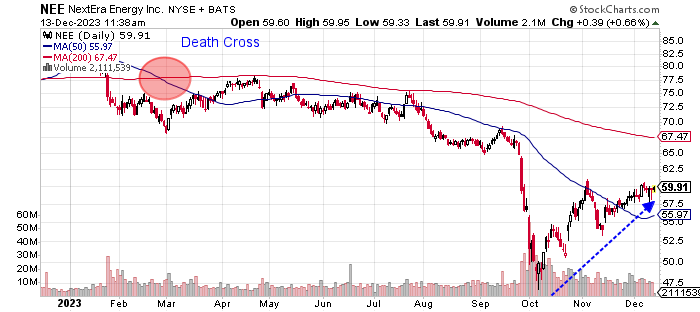

The following chart shows NEE stock’s share price below its 200-day moving average (MA) of $67.47 and caught in a death cross, which is a bearish technical crossover pattern that forms when a stock’s 50-day MA ($55.98) breaks below its 200-day MA.

A plus is that NextEra Energy stock has been rallying since its recent sell-off.

Chart courtesy of StockCharts.com

NextEra Energy Inc Grows Revenues & Profits

NextEra Energy’s revenue picture has been mixed, with growth in only two of its last five reported years. A positive development was a rebound in its revenues of 22.8% to a five-year high in 2022. That performance was far better than those of the previous three years, which included two years of negative growth.

For full-year 2023, analysts expect NextEra Energy Inc to maintain a double-digit revenue growth rate. They estimate that the company will ramp up its revenues by 25.9% to $26.38 billion in full-year 2023, followed by 2.4% to $27.0 billion in 2024. (Source: “NextEra Energy, Inc. (NEE),” Yahoo! Finance, last accessed December 14, 2023.)

| Fiscal Year | Revenues (Billions) | Growth |

| 2018 | $16.73 | N/A |

| 2019 | $19.20 | 14.8% |

| 2020 | $18.00 | -6.3% |

| 2021 | $17.07 | -5.2% |

| 2022 | $20.96 | 22.8% |

(Source: Ibid.)

On the cost side, the company has consistently generated gross margins above 50%, except in 2022, when interest rates were rising.

| Fiscal Year | Gross Margin |

| 2018 | 57.8% |

| 2019 | 58.3% |

| 2020 | 58.5% |

| 2021 | 50.2% |

| 2022 | 48.4% |

On the bottom line, NextEra Energy Inc has consistently delivered generally accepted accounting principles (GAAP) profits. The company has achieved two straight years of GAAP-diluted earnings-per-share (EPS) growth in its past four reported years.

Its GAAP EPS grew by 15.7% to $2.10 per diluted share in 2022, but that was well below its five-year high of $3.47 in 2018.

Analysts expect NextEra Energy to report an adjusted $3.13 per diluted share for full-year 2023, versus $2.90 in 2022. This is expected to rise to $3.40 in 2024. (Source: Ibid.)

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2018 | $3.47 | N/A |

| 2019 | $1.94 | -44.1% |

| 2020 | $1.48 | -23.6% |

| 2021 | $1.81 | 22.2% |

| 2022 | $2.10 | 15.7% |

(Source: “NextEra Energy Inc.” MarketWatch, last accessed December 14, 2023.)

NextEra Energy’s free cash flow (FCF) has also been inconsistent due to the company’s heavy capital expenditures.

Its five-year FCF high was $1.2 billion in 2018 and its five-year FCF low was -$1.48 billion in 2022. Note that the company had $9.74 billion in capital expenditures in 2022.

| Fiscal Year | FCF (Billions) | Growth |

| 2018 | $1.22 | N/A |

| 2019 | -$2.92 | -339.5% |

| 2020 | $0.22 | 107.7% |

| 2021 | -$0.28 | -223.7% |

| 2022 | -$1.48 | -434.3% |

(Source: Ibid.)

While NextEra Energy Inc’s FCF has been inconsistent over its past five reported years, its total dividends on common shares have risen by 69% since 2018.

The company’s five-year distribution high was $3.35 billion in 2022.

| Fiscal Year | Total Dividends (Billions) |

| 2018 | $2.10 |

| 2019 | $2.41 |

| 2020 | $2.74 |

| 2021 | $3.02 |

| 2022 | $3.35 |

(Source: “Dividend Information,” NextEra Energy Inc, last accessed December 14, 2023.)

At the end of September, NextEra Energy Inc had debt of $73.3 billion and cash of $1.57 billion. (Source: Yahoo! Finance, op. cit.)

Again, for capital-intensive utility companies, a high amount of debt isn’t unusual, but it’s risky—especially when interest rates are high. NextEra Energy paid $585.0 million in interest in 2022 but still managed to report profits of $3.25 billion.

Furthermore, the company’s interest expense has been declining, and its interest coverage ratio of 7.6 in 2022 was very good. The following table shows that the company has managed to easily cover its interest expense via high earnings before interest and taxes (EBIT) from 2019 through 2022.

| Fiscal Year | EBIT | Interest Expense |

| 2019 | $6.09 Billion | $2.25 Billion |

| 2020 | $4.36 Billion | $1.95 Billion |

| 2021 | $4.45 Billion | $1.27 Billion |

| 2022 | $4.42 Billion | $585.0 Million |

(Source: Yahoo! Finance, op. cit.)

NextEra Energy Inc’s Piotroski score, which is an indicator of a company’s balance sheet, profitability, and operational efficiency, is a strong reading of 7.0, near the top end of the Piotroski score’s 1.0–9.0 range.

Watch for Dividend Growth Streak to Continue

NEE stock’s quarterly dividend of $0.4675 in December represents a yield of 3.14% (as of this writing). Given the company’s expected higher revenues and profitability, I expect its dividend growth to continue.

NextEra Energy Inc has paid dividends for 53 straight years, which makes NextEra Energy stock a dividend king.

Moreover, the company is one of the top dividend payers among its peer group.

| Metric | Value |

| Dividend Growth Streak | 28 Years |

| Dividend Streak | 53 Years |

| 7-Year Dividend Compound Annual Growth Rate | 12.0% |

| 10-Year Average Dividend Yield | 2.6% |

| Dividend Coverage Ratio | 2.6 |

The Lowdown on NextEra Energy Inc

NextEra Energy is a top-tier utility company and clean energy provider. I expect its financials to improve, considering the ongoing move toward cleaner energy.

Institutional investors love NEE stock. As of this writing, 2,986 institutions hold an 81.3% stake. Company insiders have also been buying the stock, to the tune of a net 37,806 shares over the past six months. (Source: Yahoo! Finance, op. cit.)

While the company’s high carrying costs of debt and large capital expenditures are a concern, NextEra Energy Inc should have no problem paying its interest expense and dividends. The company’s payout ratio of 48.2% is reasonable, and its high expected earnings should allow management to continue increasing NextEra Energy stock’s dividends.