NextEra Energy Stock on Sale: Time to Look at This Dividend King

NEE Stock’s 40% Sell-Off May Be an Opportunity

An opportunity to accumulate shares of a steady dividend payer at a discount is what you get with NextEra Energy Inc (NYSE:NEE) right now. As of this writing, NextEra stock’s price is down by 40% from its 52-week high and down by 23% over the past month.

NextEra Energy Inc is a behemoth clean-energy utility company with a current market cap of $106.8 billion.

The company, which has been around since 1925, provides clean energy through its subsidiary, Florida Power & Light Company, the largest electric utility in the U.S., with about 5.8 million customer accounts across Florida. (Source: “About NextEra Energy,” NextEra Energy Inc, last accessed October 12, 2023.)

In the green energy segment, NextEra Energy Inc owns NextEra Energy Resources, LLC. This business, along with its affiliates, is the world’s biggest generator of renewable (solar and wind) energy and a major player in battery storage.

Through its subsidiaries, NextEra produces electricity from seven commercial nuclear power units in Florida, New Hampshire, and Wisconsin.

For income seekers, NEE stock’s dividends are as steady as they come. The company has paid dividends for 53 consecutive years, and it has raised its dividends for the last 27 years. The consistent dividend growth makes NextEra Energy stock a dividend aristocrat and a dividend king.

In March, the company raised NEE stock’s quarterly dividend by 10% from $0.425 to $0.4675 per share. (Source: “Dividend Information,” NextEra Energy Inc, last accessed October 12, 2023.)

NextEra Energy Stock Looks Set to Bounce Back

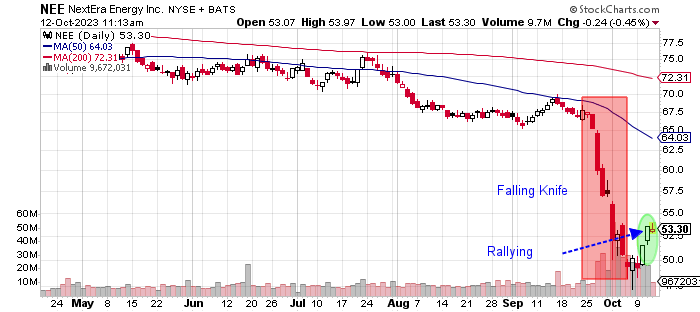

NextEra Energy Inc’s share price broke down from its sideways channel in late July and early August. This was followed by a major sell-off in late September, when NEE stock plummeted in a falling knife pattern, a bearish technical move that a stock often needs time to recover from.

Now, however, NextEra Energy stock appears to be rallying. The trading action will likely be mixed, but if NEE stock can hold and gain some oversold buying, a move toward its 50-day moving average (MA) of $64.02 could be in play, followed by a move toward its 200-day MA of $72.31, then a move toward $80.00.

In my view, the selling of NextEra Energy stock was overdone. In the meantime, patient investors can collect its dividends and wait for its share price to rise.

Chart courtesy of StockCharts.com

High Revenue Growth & Profitability

Utility companies are known to generate steady revenues and profitability while paying out nice dividends. That has been the case with NextEra Energy Inc.

The company reported revenue growth from $19.2 billion in 2019 to $20.9 billion in 2022. Its revenue growth rate of 22.8% in 2022 was far higher than in the previous two years.

Analysts estimate that NextEra Energy will increase its revenues by 21.0% to $25.4 billion in full-year 2023, followed by smaller growth of 5.3% to $26.7 billion in 2024. (Source: “NextEra Energy, Inc,” Yahoo! Finance, last accessed October 12, 2023.)

| Fiscal Year | Revenues | Growth |

| 2019 | $19.2 Billion | N/A |

| 2020 | $18.0 Billion | -6.3% |

| 2021 | $17.1 Billion | -5.2% |

| 2022 | $20.9 Billion | 22.8% |

(Source: Ibid.)

On the bottom line, NextEra Energy Inc has been consistently profitable on a generally accepted accounting principles (GAAP)-diluted earnings-per-share (EPS) basis.

Analysts expect NextEra Energy to report adjusted earnings of $3.12 per diluted share for full-year 2023, followed by $3.40 per diluted share for 2024.

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2019 | $1.93 | N/A |

| 2020 | $1.48 | -23.3% |

| 2021 | $1.81 | 22.3% |

| 2022 | $2.10 | 16.0% |

(Source: Ibid.)

Moving to the funds statement, NextEra Energy Inc has largely reported negative free cash flow (FCF) due to the company’s capital expenditures and dividends.

| Fiscal Year | FCF | Growth |

| 2019 | -$2.9 Billion | N/A |

| 2020 | $224.0 Million | 107.7% |

| 2021 | -277.0 Million | -223.7% |

| 2022 | -$1.5 Billion | -434.3% |

(Source: Ibid.)

A major cost risk for NextEra Energy is the high interest rate environment. Interest rate hikes drive up the debt-financing costs that are associated with utility companies’ significant capital expenditures. Although I view this as a major risk for the company, the situation will improve in time.

NextEra Energy Inc had a debt of $72.2 billion on its balance sheet at the end of June. (Source: Ibid.)

A high debt is typical of utility companies. I don’t see any problems for NextEra, given its profitability and ability to service its debt.

NextEra Energy Inc’s Piotroski score—an indicator of the company’s balance sheet, profitability, and operational efficiency—shows an acceptable reading of 6.0. That’s above the midpoint of the Piotroski score’s range of 1.0 to 9.0.

Moreover, NextEra Energy had a strong interest coverage ratio of 7.6 times in 2022. The following table shows that the company can easily cover its interest expense because of its significantly higher earnings before interest and taxes (EBIT), so I don’t expect any problems.

| Fiscal Year | EBIT | Interest Expense |

| 2019 | $6.09 Billion | $2.25 Billion |

| 2020 | $4.36 Billion | $1.95 Billion |

| 2021 | $4.45 Billion | $1.27 Billion |

| 2022 | $4.42 Billion | $585.0 Million |

(Source: Ibid.)

NEE Stock Churns Out Steady Dividends

NextEra Energy stock’s quarterly dividend of $0.4675 per share, which was paid in September, translates to a yield of 3.63%. NEE stock’s five-year average dividend yield was lower, at 2.13%, due to the higher historical share price.

NextEra Energy Inc’s payout ratio of 44.1% is manageable and will allow the company to continue paying dividends.

Given the company’s expected earnings over the next two years, NextEra Energy stock’s dividends will likely continue to rise.

| Metric | Statistic |

| Dividend Growth Streak | 53 Years |

| Dividend Streak | 27 Years |

| 7-Year Dividend Compound Annual Growth Rate | 12.0% |

| 10-Year Average Dividend Yield | 2.6% |

| Dividend Coverage Ratio | 2.3 |

The Lowdown on NextEra Energy Inc

NextEra Energy has broad institutional ownership, with 3,071 institutions holding 79.9% of the company’s outstanding shares. Furthermore, company insiders purchased a net 25,352 shares of NextEra Energy stock over the last six months. (Source: Yahoo! Finance, op. cit.)

With its current price weakness and its rising dividends, NEE stock looks compelling.