NexPoint Stock: 10.4%-Yielding Alternative Bank Stock Already Up 22% in 2023

Why NREF Stock Is Attractive

Those who need to borrow money might not like rising interest rates, but financial institutions such as banks and mortgage real estate investment trusts (mREITs) certainly don’t mind. Your financial pain is their gain. One mREIT that has been performing well as of late is NexPoint Real Estate Finance Inc (NYSE:NREF), a commercial real estate finance company.

The Dallas, TX-based mREIT primarily focuses on properties in the top 50 U.S. metropolitan statistical areas. NexPoint’s portfolio is geographically diverse, with a bias toward the Southeast and Southwest (i.e., Texas, Georgia, and Florida). Combined, those areas account for approximately 49% of the portfolio’s exposure. (Source: “3Q 2022 Financial Supplement,” NexPoint Real Estate Finance Inc, October 27, 2022.)

Multifamily, single-family rental, life sciences, and self-storage properties represent 53.9%, 42.1%, 2.5%, and 1.5%, respectively, of the company’s debt portfolio.

NexPoint Real Estate Finance Inc particularly focuses on properties that are stabilized or that only require limited deferred funding to support leasing or the ramp-up of operations, for which most of the capital expenditures are for value-added improvements. NexPoint’s portfolio has minimal exposure to construction loans, no heavy transitional loans, no for-sale loans, and no loans in forbearance (as of this writing).

NexPoint’s outstanding portfolio comprises 83 investments worth $1.7 billion.

“Through our commitment to investing in high-quality assets backed by prudent sponsors, we’ve built a resilient credit profile that is well-positioned to continue to perform in this rising interest rate environment,” said Matt McGraner, the mREIT’s chief investment officer. (Source: “NREF Announces Third Quarter 2022 Results, Provides Fourth Quarter 2022 Guidance,” NexPoint Real Estate Finance Inc, October 27, 2022.)

NexPoint Real Estate Finance Inc Set to Perform Well in Rising Interest Rate Environment

For the third quarter of 2022, NexPoint reported a net loss of $8.7 million, or $0.54 per diluted share, compared to net income of $25.2 million, or $1.17 per diluted share, in the same prior-year period. (Source: Ibid.)

The decrease in net income was a result of lower prepayments in the third quarter and mark-to-market adjustments to the company’s commercial mortgage-backed securities. The company’s interest income increased in the quarter by 14% year-over-year, driven by a 76-basis-point increase in its average yield on investments. (Source: “NexPoint Real Estate Finance, Inc. (NREF) Q3 2022 Earnings Call Transcript,” Seeking Alpha, October 29, 2022.)

During the third quarter of 2022, NexPoint Real Estate Finance Inc originated or purchased nine investments with $113.0 million of outstanding principal, with a combined current yield of 8.3%. The company redeemed or sold four investments with $27.5 million of outstanding principal for a total net loss of $731,000.

For the fourth quarter, NexPoint expects to report earnings available for distribution at a midpoint of $0.53 and cash available for distribution at a midpoint of $0.52.

NexPoint Stock Maintains Quarterly Dividend of $0.50/Share

In the third quarter of 2022, NexPoint Real Estate Finance Inc paid dividends of $0.50 per share, for a yield of 10.4%. The company’s cash available for distribution in the quarter was also $0.50 per diluted share, compared to $0.62 in the same period of 2021. The decrease in cash available for distribution was the result of the aforementioned lower prepayments.

At the end of the third quarter, NexPoint’s year-to-date cash available for distribution was $2.69 per diluted share, compared to $1.57 in the same period of 2021, for an increase of 72.1%. The year-to-date dividends ($1.50 per share) were 1.8 times the company’s cash available for distribution.

For the fourth quarter, NexPoint Real Estate Finance Inc’s board declared a dividend of $0.50 per share.

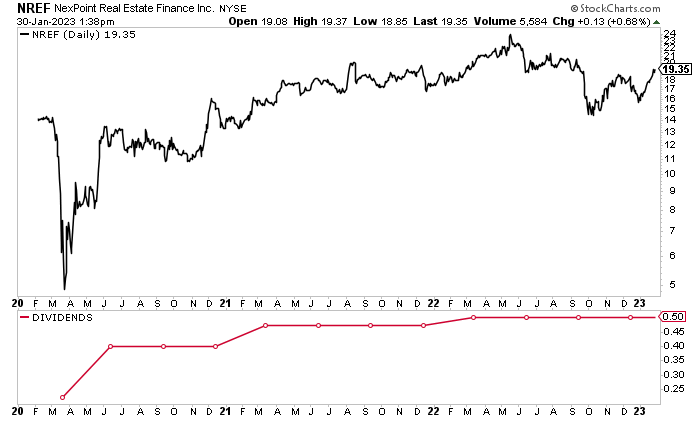

NREF stock only went public in early 2020, which was terrible timing. Nevertheless, the stock has rebounded from its pandemic lows and is trading up by roughly 35% from where it was in early 2020. As of this writing, NexPoint stock has jumped by 22% year-to-date, 13% over the last three months, and 7.5% year-over-year.

Chart courtesy of StockCharts.com

Where will NREF stock go from here?

There are some concerns that interest rates going up to seven percent will have a big impact on housing affordability and, therefore, the occupancy rates in NexPoint Real Estate Finance Inc’s single-family rental and multifamily portfolio.

Despite—or because of—the rising interest rates, the mREIT has seen retention rates for affordable rental housing go from 45%–50% to 55%–56%. That percentage is expected to climb further.

The shortage of construction financing means the supply of affordable housing is going to decrease, with the multifamily housing supply peaking in late 2023. As a result, NexPoint Real Estate Finance Inc’s management believes that 2024 and 2025 will be “pretty good years for both equity investors in this space and on the credit side.” (Source: Seeking Alpha, October 29, 2022, op. cit.)

This bodes well for NexPoint stock’s price and dividends over the coming years.

The Lowdown on NexPoint Real Estate Finance Inc

As explained above, NexPoint Real Estate Finance is a commercial real estate finance company with a geographically diverse portfolio that’s primarily made up of single-family rental and multifamily rental properties.

In the third quarter of 2022, the company continued to perform well in each of its investments and asset classes. Its portfolio has an average remaining term of 5.6 years, is 93% stabilized, has a weighted average loan to value of 68.1%, and has an average debt service coverage ratio of 1.8 times.

Thanks to its weighted average remaining term, NexPoint Real Estate Finance Inc will enjoy a stable and transparent earnings stream for the next five-plus years. Over that time period, management will use its deep relationships and investment platforms to continue generating returns for NREF stockholders.