NexPoint Real Estate Finance Inc: 8.8%-Yielder Reports Q1 Earnings Beat

NREF Stock Price Up 24% & Dividend Up 5.3% Year-Over-Year

Inflation is on pretty much everyone’s mind these days—and for good reason. U.S. inflation hit 8.5% in March, its highest level since 1981. (Source: “Consumer Price Index Summary,” U.S. Bureau Of Labor Statistics,” April 12, 2022.)

That comes after inflation in the U.S. jumped to 7.9% in February. At that point, it was at its highest level since 1982. (Source: “Consumer Price Index Summary,” U.S. Bureau Of Labor Statistics,” March 10, 2022.)

Price increases have hit many categories, including essentials like rent, food, and gas. It’s only going to get worse over the near term, with prices far outstripping even the biggest wage gains. Economists think it could be years before inflation drops to pre-COVID-19 levels of less than two percent.

This has led investors to shine a spotlight on stocks that provide inflation-busting dividends.

Admittedly, it’s not difficult to find ultra-high dividend stocks right now. With inflationary pressure, rising interest rates, and the war in Ukraine taking a bite out of stock prices, dividend yields are bound to rise.

The key is to find stocks that perform well in a rising interest rate environment—not only that, but stocks that are bullish and provide inflation-trumping dividends. You get all of that with NexPoint Real Estate Finance Inc (NYSE:NREF).

NexPoint is a commercial real estate finance company that primarily focuses on the multifamily, single-family rental, self-storage, and life sciences sectors. The properties are predominantly located in the top 50 metropolitan statistical areas. The company focuses on properties that are stabilized or those with minimal transitional business plans. (Source: “1Q 2022 Financial Supplement,” NexPoint Real Estate Finance Inc, last accessed May 2, 2022.)

NexPoint’s portfolio currently comprises 70 investments worth $1.6 billion. The single-family rental, multifamily, life sciences, and self-storage categories represent 44.0%, 53.7%, 2.1%, and 0.2%, respectively, of the company’s debt portfolio. As of this writing, there are no loans in forbearance.

Q1 Earnings & Revenue Beat

NexPoint announced that its revenue in the first quarter ended March 31, 2022 was $23.2 million, a 276% improvement over the first-quarter 2021 revenue of $6.2 million. (Source: “NREF Announces First Quarter 2022 Results, Provides Second Quarter 2022 Guidance,” NexPoint Real Estate Finance Inc, April 28, 2022.)

The company reported first-quarter net income of $18.7 million, or $0.81 per diluted share. That’s compared to $25.1 million, or $1.26 per diluted share, in the same prior-year period.

NexPoint Real Estate Finance Inc’s earnings available for distribution (available for paying dividends) in the first quarter were $27.1 million, or $1.23 per diluted share, a year-over-year increase of 186%. Wall Street analysts were looking for earnings of $1.17 per share.

The company’s cash available for distribution in the first quarter was $34.9 million, or $1.58 per share, compared to $9.0 million, or $0.47 per share, in the same prior-year period.

Matt McGraner, NexPoint Real Estate Finance Inc’s chief investment officer, commented, “Once again, NREF delivered another strong quarter for our shareholders, generating $1.23 per diluted share of earnings available for distribution, an increase of 186% compared to the same period last year.” (Source: Ibid)

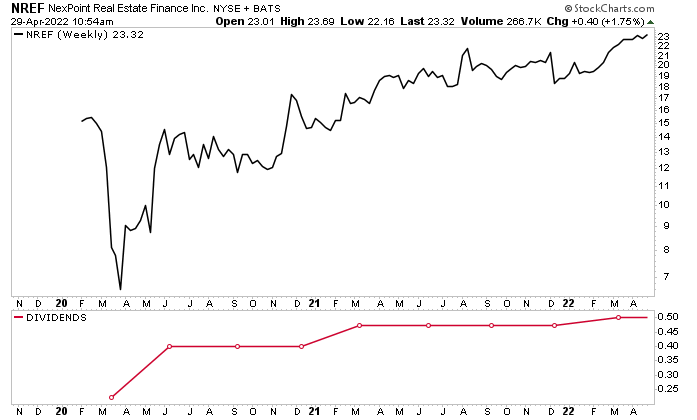

The company’s consistently strong revenue and earnings have helped juice NexPoint stock. As of this writing, NREF stock is up by:

- 21% over the last three months

- 25% year-to-date

- 24% year-over-year

Chart courtesy of StockCharts.com

For the second quarter of 2022, NexPoint Real Estate Finance Inc expects to report earnings available for distribution at a midpoint of $0.55. The company also expects to report cash available for distribution at a midpoint of $0.64.

“As we enter a period of potential instability with rising rates and inflation, we believe our defensively constructed portfolio and diversified capital stack will prove to be resilient in turbulent environments,” said McGraner. (Source: Ibid)

NexPoint Real Estate Finance Inc Declares $0.50 Quarterly Dividend

NexPoint has raised its dividend in each of the last three years. In February, the company announced that it was raising its quarterly dividend by 5.3% year-over-year from $0.475 to $0.50 per share. (Source: “NexPoint Real Estate Finance, Inc. Announces 5.3% Increase in Quarterly Dividend,” NexPoint Real Estate Finance Inc, February 17, 2022.)

In April, the company’s board maintained its quarterly payout at $0.50 per share, for a yield of 8.9%. (Source: “NexPoint Real Estate Finance, Inc. Announces Quarterly Dividend,” NexPoint Real Estate Finance Inc, April 28, 2022.)

The payout ratio is just 48.4%, so the dividend is both safe and poised for additional growth.

The Lowdown on NexPoint Stock

NexPoint Real Estate Finance Inc is a great commercial finance company with a strong balance sheet and diverse portfolio of real estate investments. It consistently reports strong earnings and revenue growth.

The company’s outlook is bullish, with interest rates and the demand for alternative banks both on the rise. While NREF stock’s price will no doubt experience periods of volatility, investors can take solace in its reliable and growing, ultra-high-yield dividends.