New Residential Investment Corp: Is This 11.3% Yield Safe?

Can You Count on This Payout?

I write off most high-yield stocks that cross my desk. But every so often you find one that looks interesting.

Today’s post is about the latter. New Residential Investment Corp (NYSE:NRZ) pays a quarterly dividend of $0.50 per share. On an annual basis, that comes out to a yield of 11.3%.

So it’s no surprise that readers ask me to review this stock so often. But can such a high yield possibly be safe? Let’s dig into the financials.

You don’t need an MBA to wrap your head around New Residential’s business, first off.

The firm has structured itself as a mortgage real estate investment trust (mREIT). It borrows cash and then invests those funds into higher-yielding mortgages.

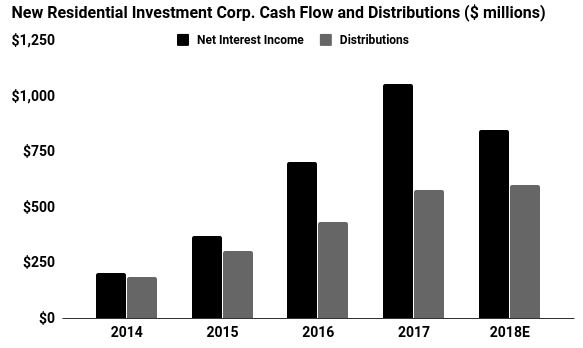

Its profit comes from the difference between these two interest rates, called net interest income (NII). In 2017, the trust’s NII topped $1.1 billion. That more than covered the $580.0 million paid out to unitholders.

New Residential’s financials have started to deteriorate, however.

In recent months, short-term interest rates have soared. The yield on longer-term mortgages, in contrast, has barely budged.

As a result, New Residential’s profit margins have started to shrink. For 2018, analysts project that the trust’s NII will only top $850.0 million.

That number could get worse, too. As the U.S. economy recovers, Wall Street expects that the Federal Reserve will continue hiking interest rates. That will raise New Residential’s borrowing costs and eat into profits.

The good news here?

New Residential’s lower projected NII still comfortably covers the partnership’s distribution.

(Source: “Investor Relations,” New Residential Investment Corp last accessed October 17, 2018.)

If New Residential can match Wall Street’s expectations, the trust will pay out 71% of its profits as dividends in 2018. That’s a big bump from its 56% payout ratio last year, but still inside my comfort zone.

In other words, we can see some early warning signs, but nothing that will put the distribution in danger…yet.

Investors will need to keep a close eye on New Residential’s NII. If it continues to drop, the mortgage trust’s payout ratio could get dangerously high. That would make me nervous.

But for now, this 11.3% yield looks safe.