New Residential Investment Corp: Can You Count on This 11.7% Yield?

Is This 11.7% Yield Safe?

You can make a lot more money investing in “pick-and-shovel” businesses than betting on a booming industry itself.

Pick-and-shovel firms provide tools and services to a thriving sector, rather than betting everything on a single project. In many cases, these stocks present the safer (and often more lucrative) investment opportunity.

Take New Residential Investment Corp (NYSE:NRZ). Rather than directly investing in residential loans, the company provides mortgage services to lenders (collecting payments, paying taxes, etc.).

This quiet niche doesn’t get much attention in the press, but it’s an enormously profitable business that has paid big dividends for shareholders. And with a yield now topping 11.7%, New Residential has started to catch the eye of ordinary income investors.

But can such a high payout possibly be safe? Let’s find out.

NRZ Stock Financials

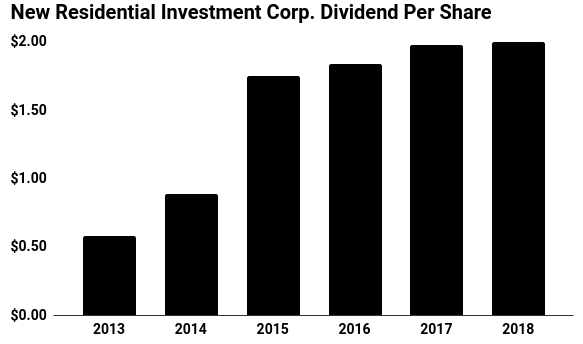

New Residential Investment Corp has a short but impressive dividend history. Since going public in 2013, management has boosted the distribution every year. Over that period, the payout has grown threefold.

I like that kind of track record. It signals management’s commitment to rewarding shareholders, which bodes well for investors down the road.

Today, the business stands in fine financial health.

During the third quarter, NRZ stock delivered $0.63 in core earnings per share. Over that same period, the company paid out $0.50 per share in distributions.

That comes out to a payout ratio of 79%. Generally, I like to see a payout ratio of 80% or lower. So NRZ stock’s distribution, while elevated, still leaves some wiggle room to stomach a bad year or two.

Moreover, I project the company’s cash flows to surge in the coming year.

Mortgage service agreements tend to generate fee income until the loan matures or gets refinanced. But with interest rates rising, homeowners have started to refinance fewer and fewer mortgages.

That’s great news for New Residential Investment Corp. Without the fear of mortgage refinancing, the company can continue to milk its existing deals for steady cash flow. That will likely result in growing profits (and dividends) for the foreseeable future.

(Source: “New Residential Investment Corp. (NRZ),” Yahoo! Finance, last accessed November 27, 2018.)

In other words, New Residential is one of the few income investments that will actually benefit from rising interest rates.

The big risk here? Yields.

Most analysts assume that a hot economy will result in higher interest rates, but an unexpected slowdown could put those plans on ice. Lower interest rates would cause a spike in refinancing activity, which would clip the company’s profits.

Investors also need to keep an eye on the spread between short- and long-term interest rates. New Residential Investment Corp borrows money for selective investment opportunities from time to time. If short-term rates rise too quickly, that could hurt earnings.

That said, the company still generates plenty of cash flow for the time being. It’s making lots of money providing services to the financial industry, rather than actually lending to households.

That’s the benefit of investing in a “pick-and-shovel” option like NRZ stock.