What You Need to Know About Rising Interest Rates

Janet Yellen Delivers Relief for Seniors

Despite what you’ve been told, the orange-haired man in the White House is not the most powerful person on Earth. That title goes to the 5’2″ 70-year-old lady who heads the Federal Reserve: Janet Yellen.

On Wednesday, the Fed chair approved her second interest rate hike of 2017. As investors had anticipated, she increased the benchmark rate a quarter-point. The new range will be between one percent and 1.25%, up from the previous range of 0.75% to one percent. (Source: “Federal Reserve issues FOMC statement,” Board of Governors of the Federal Reserve System, June 14, 2017.)

On top of the rate hike, the central bank announced that it will begin reducing its balance sheet. During the financial crisis, the Fed bought billions of dollars in bonds and mortgage-backed securities to stimulate the economy. The May 2017 Fed meeting minutes indicate that Yellen will begin offloading these positions later this year.

“The Committee continues to expect that, with gradual adjustments in the stance of monetary policy, economic activity will expand at a moderate pace, and labor market conditions will strengthen somewhat further,” wrote the Federal Open Market Committee (FOMC) in a policy statement. “Inflation on a 12-month basis is expected to remain somewhat below 2 percent in the near term but to stabilize around the Committee’s 2 percent objective over the medium term.” (Source: Ibid.)

I know central bankers aren’t supposed to be the life of the party, but—my god—Janet Yellen has the personality of a potato. I think the U.S. dollar dropped on this statement out of sheer boredom.

So, what the heck does all this mean for the average American?

First, despite what the drama divas in the media say, the U.S. economy is rockin’ and rollin’. Yellen would only raise rates if she believed that business conditions will keep improving. All of which is good news for Main Street, because steady growth comes with more jobs and higher wages.

The Atlanta Fed predicts that total output will increase at an annualized 3.2% clip in the second quarter. Prices for goods and services rose two percent year-over-year last month, closing in on the Fed’s target. In other words, a “Goldilocks” economy—not too hot and not too cold. (Source: “Atlanta Fed raises U.S. second quarter GDP growth view to 3.2 percent,” Reuters, June 14, 2017.)

Second, savers look like the big winners. Conservative investors have earned zilch on their savings for years. Now, with the Fed stepping off of their necks, we should start seeing higher interest rates on saving accounts and bank certificates of deposit.

Bondholders, however, get crushed. As new notes get issued, the low coupons on old securities look less attractive. This has already sparked a big sell-off in the bond market, which could get worse in the months ahead.

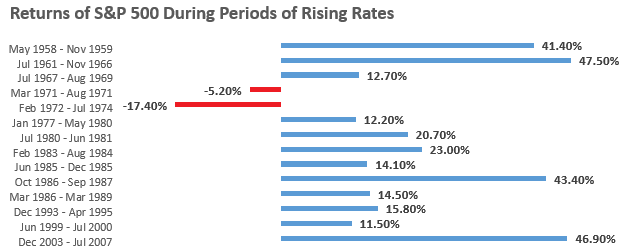

Finally, the stock market, perhaps counter-intuitively, does well during these periods. Many analysts fear that equities will crash once the Fed jacks up borrowing costs. Slower growth also slows profits, which crimps stock prices further.

The data doesn’t bear this out, however. During the previous rate hike cycle between 2004 and 2007, the stock market actually rose. In fact, equities tend to do quite well during periods of higher interest rates.

(Source: Yahoo! Finance)

You shouldn’t be surprised; rising interest rates typically coincide with growing sales and profits. You don’t need a PhD to know that this tends to result in higher stock prices.

All of which raises the question, what do we do now?

The answer? Meh. My approach is to avoid debt, hoard lots of cash, and own shares of wonderful businesses. That way, you’re ready for whatever the Fed might throw our way.

Janet Yellen can move the market with a sneeze. Dividend-paying stocks, though, should keep throwing off income no matter what happens in Washington. When your time horizon is measured in decades, where interest rates go over the next few years doesn’t matter.