National Retail Properties, Inc.: 4.5%-Yielder Has Raised Dividends for 32 Consecutive Years

Consider NNN Stock for Income & Growth

If you’re looking for a stock that provides consistent dividend growth and share-price gains—and a company that’s taking advantage of the post-pandemic economic recovery—National Retail Properties, Inc. (NYSE:NNN) might be the perfect opportunity.

Admittedly, having the word “retail” in its name might scare off a lot of investors. After all, traditional brick-and-mortar stores are slowly becoming a thing of the past. Fortunately, National Retail Properties, Inc. didn’t get that memo.

National Retail Properties is a real estate investment trust (REIT) that acquires, invests in, and develops high-quality properties that it leases to retailers under long-term (15–20 years) triple net leases. (Source: “Investor Update: November 2021,” National Retail Properties, Inc., last accessed November 25, 2021.)

With a triple net lease, the tenant is responsible for all expenses, including property taxes, building insurance, maintenance, and utilities. In essence, National Retail Properties banks the base rent and has no obligation to spend money on the property.

Why would anyone sign up for a triple net lease? The landlord has a lower initial cost with a triple net property, which means it can offer lower rents. Don’t shed a tear for National Retail Properties, Inc., though. It builds rent increases into its contracts.

The company’s diverse portfolio comprises 3,195 properties leased to more than 370 tenants in more than 30 industries. National Retail Properties’ aggregate gross leasable area is approximately 33.1 million square feet (equal to about 573 football fields) in 48 states. The REIT’s properties are most concentrated in Florida, Illinois, North Carolina, Ohio, and Texas.

Top 10 Industries of National Retail Properties, Inc.’s Tenants

- Convenience Stores: 17.6%

- Automotive Services: 12.1%

- Restaurants (Full Service): 9.9%

- Restaurants (Limited Service): 9.0%

- Family Entertainment Centers: 5.9%

- Health and Fitness: 5.1%

- Theaters: 4.5%

- Recreational Vehicle Dealers, Parts, and Accessories: 4.0%

- Equipment Rental: 3.2%

- Automotive Parts: 3.1%

A few of National Retail Properties, Inc.’s biggest tenants are Denny’s Corp (NASDAQ:DENN), Goodyear Tire & Rubber Co (NASDAQ:GT), Sunoco LP (NYSE:SUN), and Wendy’s Co (NASDAQ:WEN).

Despite concerns about the retail environment during the COVID-19 pandemic, National Retail Properties’ occupancy rate was excellent. From 2003 to Q3 2021, the company’s occupancy rate never fell below 96.4%. Over the same time frame, the overall REIT industry’s average occupancy rate never rose above 93.7%.

Again, the main reason for National Retail Properties’ high occupancy rate is its reliable, high-quality, diverse tenant list. This has helped the company report fabulous financial results and provide NNN stockholders with one of the most enviable dividends on Wall Street.

Strong Q3 Results & Business Outlook

During the third quarter, National Retail Properties’ revenue increased by 13.7% year-over-year to $180.3 million. Its net income jumped by 52% to $75.4 million, or $0.45 per share. (Source: “Third Quarter 2021 Operating Results and 2022 Guidance Announced by National Retail Properties, Inc.” National Retail Properties, Inc., November 2, 2021.)

The REIT’s funds from operations (FFO) and CORE FFO both went up by 17% to $124.6 million, or $0.71 per share. Its adjusted FFO advanced 23.5% to $131.7 million, or $0.75 per share.

The company ended the third quarter with $543.5 million of cash, no amount drawn on its $1.1-billion bank line, and no debt maturities until 2024.

During the quarter (which ended September 30), National Retail Properties, Inc. collected approximately 99% of its rent due, plus 99% of its rent due in October. The company also maintained high occupancy levels of 98.6%, with a weighted average remaining lease term of 10.6 years.

Also during the third quarter, the REIT invested $246.8 million in properties, including 49 acquisitions at an initial cash yield of 6.4%. It also sold 27 properties for $30.5 million, realizing gains of $9.5 million.

Jay Whitehurst, CEO, noted, “Our impressive performance positions us to once again raise guidance for 2021 and to announce 2022 guidance that reflects our long-term strategy to consistently produce mid-single digits growth per share on a multi-year basis.” (Source: Ibid.)

For 2021, National Retail Properties, Inc. raised its core FFO guidance range from $2.75–$2.80 to $2.80–$2.84 per share. Management expects the company’s 2021 adjusted FFO to be in the $3.00–$3.04 range.

For 2022, the company announced core FFO guidance of $2.90–$2.97 per share and adjusted FFO guidance of $2.99–$3.06 per share.

5-Year Annual Dividend Growth Rate of 4%

As a REIT, National Retail Properties, Inc. is legally obligated to return at least 90% of its earnings to its investors, which it does in the form of reliable, growing, high-yield dividends. National Retail Properties stock’s five-year average annual dividend growth rate is four percent.

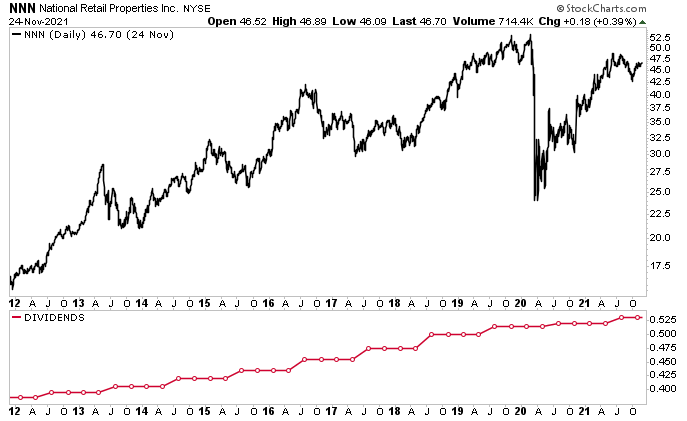

NNN stock’s long-term performance is even more impressive. Over the last 25 years, NNN shareholders have enjoyed an average total return of 12.2%. The company has increased its dividends for 32 consecutive years, the third-longest winning streak of all REITs and 99% of all public companies.

In October, National Retail Properties, Inc.’s board declared a quarterly dividend of $0.53 per share, or $2.12 on an annual basis, for a yield of 4.5%. (Source: “Common Dividend Declared By National Retail Properties, Inc.” National Retail Properties, Inc., October 15, 2021.)

The payout ratio on the adjusted FFO is approximately 69%.

While National Retail Properties stock has been on a great run for much of the past 30 years, its growing, high-yield dividends have provided investors with shelter during economic storms and stock market volatility. Even during the worst economic climate in 100 years, NNN stock was able to provide investors with a raise.

Chart courtesy of StockCharts.com

If a global pandemic and one of the sharpest economic contractions can’t derail National Retail Properties, Inc.’s dividends, what could? Not much, it seems.

That doesn’t mean there isn’t room for growth. National Retail Properties stock hasn’t fully recovered from the March 2020 stock market crash; it needs to climb an additional seven percent to do that.

That said, this high-yield dividend stock has been having a great year. As of this writing, NNN stock is up by 20% year-to-date and 21.5% year-over-year.

The Lowdown on National Retail Properties, Inc.

When it comes to real estate, location is important, but so are tenants. That’s why National Retail Properties, Inc. continues to do so well.

The company has a high-quality, diverse property portfolio (that avoids malls and strip plazas), a strong acquisition strategy, continuous high occupancy and rent collection figures, and a rock-solid balance sheet. That has helped National Retail Properties stock provide safe and growing high-yield dividends and significant capital gains.