National Health Investors Stock at 52-Week High: More Gains to Come?

Why NHI Stock Has Been Rising in Value

Inflation data continues to show cooling, and this will allow the Federal Reserve to begin cutting interest rates this year.

The environment of high interest rates has hurt capital-intensive businesses, including real estate investment trusts (REITs). But there are expectations that interest rates will move to the downside this year, which should help reduce the carrying costs of debt and drive margins and profits higher.

Take the case of mid-cap REIT National Health Investors Inc (NYSE:NHI). Due to its significant capital spending, it should benefit from declining interest rates. REITs like National Health Investors grow via acquisitions, and they need to borrow capital to do so.

Founded in 1991, the company is focused on senior housing and medical facilities. National Health Investors’ holdings comprise independent-living housing, assisted-living facilities, memory care communities, entrance-fee communities, skilled nursing facilities, medical office buildings, and specialty hospitals. (Source: “Investor Relations,” National Health Investors Inc, last accessed March 14, 2024.)

The company’s network includes 194 properties scattered across 33 states. (Source: “Properties,” National Health Investors Inc, last accessed March 14, 2024.)

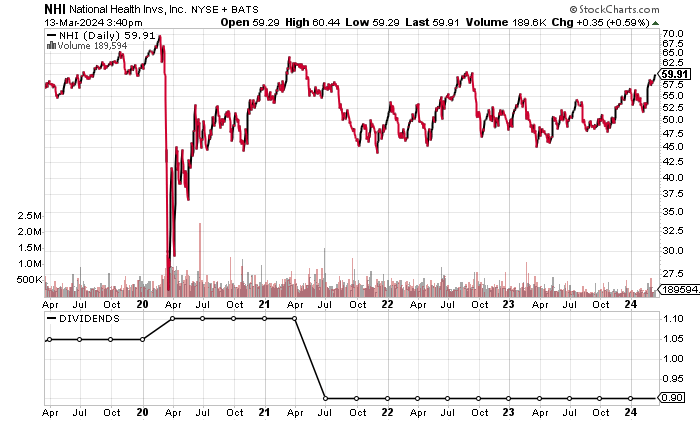

National Health Investors stock reached a 52-week high of $60.40 on March 13, meaning it went up by 16.8% over the previous year and 15.2% over the previous month.

Chart courtesy of StockCharts.com

34-Year Dividend Streak Should Continue

For income investors who are looking for steady dividends and some capital appreciation, shares of National Health Investors Inc could be ideal. NHI stock has paid steady dividends for 34 consecutive years, and that streak should continue.

Note, however, that the company hasn’t changed its quarterly dividend of $0.90 per share since management cut it from $1.10 per share in August 2021. (Source: “NHI Dividend History,” Nasdaq, last accessed March 14, 2024.)

As of this writing, National Health Investors stock has a dividend yield of 6.0%.

| Metric | Value |

| Dividend Streak | 34 Years |

| 7-Year Dividend Compound Annual Growth Rate | 0.0% |

| 10-Year Average Dividend Yield | 7.2% |

| Dividend Coverage Ratio | 1.2 |

Strong Financial Results in 2023

In 2023, National Health Investors Inc increased its revenues by 12.8% to $322.4 million, its highest level since 2020. As the following table shows, National Health Investors’ revenues have been hovering around the $300.0-million level.

Analysts expect this to continue. They estimate that National Health Investors will report revenues of $313.4 million for 2024 and $326.3 million for 2025. (Source: “National Health Investors, Inc. (NHI),” Yahoo! Finance, last accessed March 14, 2024.)

| Fiscal Year | Revenues (Millions) | Growth |

| 2019 | $318.0 | N/A |

| 2020 | $325.5 | 2.4% |

| 2021 | $292.5 | -10.2% |

| 2022 | $285.8 | -2.3% |

| 2023 | $322.4 | 12.8% |

(Source: “National Health Investors Inc.” MarketWatch, last accessed March 14, 2024.)

National Health Investors has been generating extremely high gross margins, in excess of 95%.

| Fiscal Year | Gross Margins |

| 2019 | 98.2% |

| 2020 | 97.1% |

| 2021 | 96.1% |

| 2022 | 96.5% |

| 2023 | 96.4% |

National Health Investors Inc’s bottom line has been inconsistent, based on generally accepted accounting principles (GAAP) profitability.

The REIT’s five-year GAAP-diluted earnings-per-share (EPS) high was $4.14 in 2020. That was followed by two straight down years, prior to a 110.7% jump in 2023.

The company’s earnings situation is expected to soften, with analysts predicting $2.81 per diluted share in 2024, followed by a bounce to $3.02 per diluted share in 2025. (Source: Yahoo! Finance, op. cit.)

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2019 | $3.70 | N/A |

| 2020 | $4.14 | 12.1% |

| 2021 | $2.45 | -41.0% |

| 2022 | $1.48 | -39.4% |

| 2023 | $3.13 | 110.7% |

(Source: Ibid.)

National Health Investors Inc’s free cash flow (FCF) has been positive, which supports NHI stock’s dividend stream.

| Fiscal Year | FCF (Millions) | Growth |

| 2020 | $232.0 | N/A |

| 2021 | $210.8 | -9.1% |

| 2022 | $185.3 | -12.1% |

| 2023 | $180.7 | 2.5% |

(Source: Yahoo! Finance, op. cit.)

National Health Investors Inc has a debt of $1.1 billion on its balance sheet, but I don’t expect any significant problems, given the REIT’s high FCF and profitability. (Source: Yahoo! Finance, op. cit.)

The company has managed to cover its interest expenses with higher earnings before interest and taxes (EBIT). Its interest coverage ratio of 3.4 in 2023 was healthy.

| Fiscal Year | EBIT (Millions) | Interest Expense (Millions) |

| 2020 | $234.8 | $49.5 |

| 2021 | $160.1 | $48.1 |

| 2022 | $107.9 | $42.4 |

| 2023 | $190.0 | $55.5 |

(Source: Yahoo! Finance, op. cit.)

National Health Investors’ Piotroski score, which is an indicator of a company’s balance sheet, profitability, and operational efficiency, is a strong reading of 7.0, which is just below the high end of the Piotroski score’s range of 1.0 to 9.0.

The Lowdown on National Health Investors Inc

Income investors can enjoy National Health Investors stock’s consistent dividends and the opportunity to benefit from some share-price appreciation.

NHI stock recently hit a 52-week high but remains well below its record high of $91.12 in February 2020.

If National Health Investors Inc can grow its earnings and FCF, I would expect the REIT to increase its dividends.