Obscure Dividend Stock Keeps Beating the Market

This Dividend Stock Has Soared 751% Since 2009

If you ask people to list the top investments of the past decade, they’d likely say biotech or electric vehicles. Few, however, would likely mention this obscure dividend stock: WD-40 Company (NASDAQ:WDFC).

The San Diego maker of the definitely non-glamorous lubricant and rust protector product of the same name has trounced the broader market.

Since the start of 2009, shares have posted a total return, including dividends, of 751%.

Those numbers put WD-40 Company in a pretty elite league of stocks. Shares have crushed the performance of Silicon Valley titans like Alphabet Inc (NASDAQ:GOOG), Oracle Corporation (NYSE:ORCL), and Cisco Systems, Inc. (NASDAQ:CSCO).

So, why has such a dull business performed so well?

WD-40 Company’s success comes down to the timeless nature of its product.

The business’ almost cult-like followers have invented thousands of uses for the lubricant “WD-40” spray over the years—exterminating roaches, quieting squeaky door hinges, cleaning crayon marks from walls…

I can’t predict what type of gadget people will love next year. But I can easily imagine my grandkids and great-grandkids buying a blue-and-yellow can of WD-40.

WD-40 Company’s Secrets to Success

Why should investors love such a simple business?

Lower costs.

High-flying tech companies have to plow billions into research each year. WD-40 Company, however, can sit back, making the same great product for customers. With less in the way of expensive research to fund, more dollars flow to the bottom line.

This results in jaw-dropping returns.

In 2016, the business generated $0.33 in profit on every dollar of debt and equity invested in the business. It earned out $0.32 on the dollar in 2017, $0.31 in 2018, and $0.27 in 2019.

This puts it in the league of elite dividend stocks like Colgate-Palmolive Company (NYSE:CL), The Walt Disney Company (NYSE:DIS), and Procter & Gamble Co (NYSE:PG).

But here’s what separates WD-40 Company from your typical dividend stock: management sticks to their kitting.

When most companies saturate the market with their core product, they often expand into new industries or make expensive acquisitions. Unfortunately, this often dilutes the profits of the core business.

Peter Lynch called this process “diworseification,” and it can destroy shareholder returns.

The Coca-Cola Company (NYSE:KO) shares sputtered in the 1970s when management went into the movie business with the purchase of Columbia Pictures. More recently, AT&T Inc. (NYSE:T) has trailed the market for years following recent expansions into satellite television and the Mexican wireless market.

WD-40 Company, however, has avoided this problem.

Over the years, management has acquired a handful of household brands such as “Carpet Fresh,” “2,000 Flushes,” and “3-In-One Oil.” But for the most part, they’ve stuck to making the types of products you’d find in the garage or under the kitchen sink.

By opting to milk a handful of incredibly profitable businesses, executives have kept profits fat and returns high.

So what does management decide to do with all of the profits? For the most part, they pay it out to shareholders.

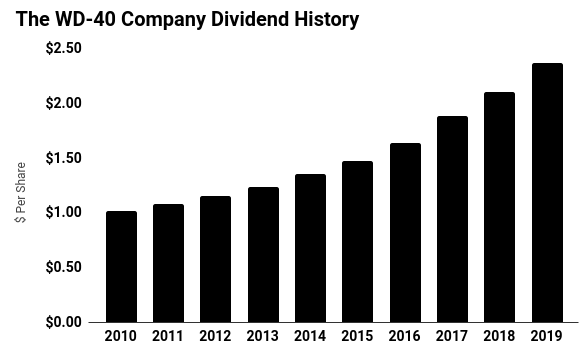

The WD-40 Company has paid dividends without interruption since 1979. Today, shares pay a quarterly distribution of $0.61 apiece. That comes out to an annual yield of 1.3%.

Source: Yahoo! Finance

Executives return an enormous amount of money through buybacks, too.

Over the past decade, management has reduced the total number of outstanding shares by about one-fifth. This increases the remaining investors’ claim to future earnings, boosting the value of each individual share.

In a nutshell, WD-40 Company is another one of those obscure businesses quietly making shareholders wealthy. This dividend stock has posted out-sized returns over the past decade. And as long a management sticks to what they know best, I think shares could deliver out-sized returns over the next decade, too.