Nasdaq Inc: New Stock Market Royalties Quietly Making Investors Rich

Nasdaq Inc’s New Business Could Send Its Shares Soaring

If you want to make a lot of money in the stock market, then it pays to invest in something new.

Wall Street always looks forward, searching for the next crop of new products or services. And those who can spot such innovations early can often lock in outsized returns.

In most cases, these opportunities come from young firms in emerging industries. But they can also come from established companies reinventing themselves with new products or new management teams. Think of Apple Inc. (NASDAQ:AAPL), which delivered triple-digit gains for investors in the early 2000s when CEO Steve Jobs launched a string of revolutionary products.

You see the same theme in my paid advisory Passive Monthly Income.

Shares of American Tower Corp (NYSE:AMT) have posted a 38% return as carriers beef up their networks to handle 5G mobile technology. Hershey Co (NYSE:HSY) has soared 60% as the company has evolved in the past two years from a pure chocolate maker into a snack foods Goliath. Walmart Inc (NYSE:WMT) has jumped 129% with the launch of its e-commerce business.

But you want to know the best part? All of these firms have passed on much of their higher profits to shareholders in the form of dividend hikes.

Case in point: Nasdaq Inc (NASDAQ:NDAQ). The company, like the name implies, owns and operates the Nasdaq stock exchange. In addition, management has acquired eight other European stock exchanges.

But in recent years, the company built a lucrative business around selling financial data and technology. This has created a growing stream of royalty income. And for savvy income investors, that could be a source of lucrative returns.

New Stock Market Royalties

Admittedly, owning a stock exchange is no longer a cash cow.

In the past, entering the business required a large upfront investment. And traders searching for liquidity had little reason to take their business to any upstart competitor.

This resulted in a duopoly between the Nasdaq and the New York Stock Exchange. And for those incumbent firms, the situation represented a veritable license to print money.

But as stock trading became digitized, it has become easier to build an exchange from scratch. A modern trading floor amounts to a handful of servers stored in a warehouse, not the open pits of the old days.

This allowed upstarts like BATS and Direct Edge to steal market share by offering faster and better execution. Institutions have also shifted their orders to dark pools (private exchanges operated by investment banks) in order to avoid public disclosures of their trades.

As a result, the Nasdaq’s share of daily trading volume dropped from 52% in 2006 to 30% in 2013. And as you can see in the chart below, the company’s stock price fell in lockstep.

Chart courtesy of StockCharts.com

The company’s fortunes, however, have started to change.

In recent years, Nasdaq has evolved from a stock exchange into a data and technology company, providing information that investors need to conduct trades. This includes key market numbers such as real-time quotes, historical trades, and market liquidity (a ranked list of the best bid and ask prices from all participants trading a particular stock).

Historically, exchanges gave this data away to boost volume, kind of like how Home Depot Inc (NYSE:HD) offers free renovation seminars that conveniently feature its products. Now, Nasdaq views this wealth of information as a profit center. The company earns rich royalties from web sites, online brokers, investment banks, trading desks, data vendors, and others.

How profitable is this business? Very.

Last fiscal year, Nasdaq’s information services generated $753.0 million in royalties. From this total, $0.64 out of every dollar earned in sales flowed to the bottom line in operating income. Overall, data now accounts for 40% of Nasdaq’s operating income, up from only 20% a few years ago. (Source: “Investor Presentation September 2019,” Nasdaq Inc, last accessed October 30, 2019.)

This income stream could explode in the coming years. First, the most obvious way to make more money is by raising prices. Nasdaq is the sole supplier of a critical service. This means customers have little choice but to cough up more dough each year on demand.

Furthermore, Nasdaq Inc can pad its profits further by buying niche data providers. We’ve seen this already with management’s acquisition of eVestment in 2017, Quandl Inc. in 2018, and Cinnober in 2019.

Nasdaq executives then earn a quick return on investment by jacking up prices and pushing these new product offerings through the company’s global customer base.

But Nasdaq’s royalty income offers something far more valuable than just a fatter bottom line.

The “Rocket Fuel” of Investment Returns

Data services come with the two favorite words of any investment analyst: recurring revenue.

Bear with me here. I know a lot of readers get lost when I throw out too much investment jargon. But this business feature serves as a kind of investment “rocket fuel.” And if you understand this concept, you can make fortunes in the stock market.

You see, operating a stock exchange is an unpredictable business. During periods of extreme market volatility, trading volumes rise and the fees that those trades generate explode. That explains why Nasdaq shares held up pretty well during the last financial crisis.

But during periods of relative calm, the company’s income stream dries up. Analysts hate unpredictable earnings. For that reason, cyclical stocks like miners, automakers, and oil drillers often trade at low price-to-earnings multiples. Nasdaq is no exception.

The company’s transition to a data service provider solves this problem. Nasdaq’s subscription model generates steady, recurring revenues that roll in like clockwork. So not only is the company making more money, investors will pay a higher multiple for those same earnings because they become more predictable.

That one-two combination has resulted in explosive returns at other companies. Take Adobe Inc (NASDAQ:ADBE), for instance. In 2012, the company adopted a monthly subscription model for its popular “Photoshop” software, rather than selling licenses for $2,500 a pop.

Over the next six years, Adobe’s profit per share tripled while the stock’s forward earnings multiple jumped from 12 to 36. For investors, that resulted in a 793% capital gain.

We’ve seen transitions to recurring revenue business models result in comparable gains at companies like Autodesk, Inc. (NASDAQ:ADSK), Intuit Inc. (NASDAQ:INTU), and Cadence Design Systems Inc (NASDAQ:CDNS).

The same thing could play out at Nasdaq Inc.

At the moment, Wall Street values the company like a cyclical stock exchange at 19-times 2020 profits. Over the next five years, management aims to grow the company’s earnings per share at a high single-digit annual clip.

But over that period, recurring data royalties will account for a larger and larger share of the company’s bottom line. That will push analysts to start comparing Nasdaq to other financial services companies—like MSCI Inc (NYSE:MSCI), S&P Global Inc (NYSE:SPGI), and MarketAxess Holdings Inc. (NASDAQ:MKTX)—which trade between 25- and 35-times forward earnings.

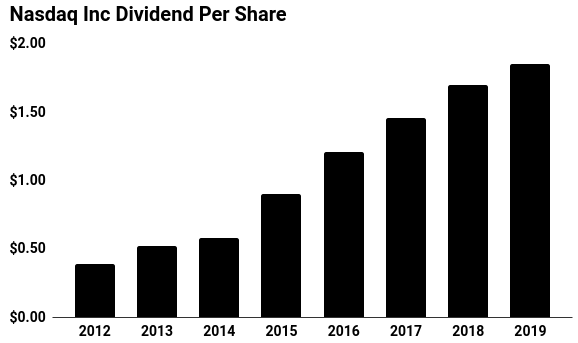

Even if my multiple expansion thesis doesn’t play out, investors will still get well paid. Over the past six years, Nasdaq has tripled the size of its distribution. Today, Nasdaq shares pay a quarterly dividend of $0.47 apiece, which comes out to an annual yield of about two percent.

(Source: “Nasdaq, Inc. Common Stock (NDAQ) Dividend History,” Nasdaq Inc, last accessed October 30, 2019.)

Management also pays out buckets of money to investors through the company’s stock buyback program.

Nasdaq executives spent $377.0 million on stock repurchases in 2015, $100.0 million in 2016, $203.0 million in 2017, and $394.0 million in 2018. In combination, this raises the total shareholder yield, or the amount spent on both dividends and buybacks, to almost five percent. (Source: “Investor Presentation September 2019,” Nasdaq Inc, op. cit.)

The Bottom Line on Nasdaq Inc

Wall Street’s official motto could be, “Out with the old, in with the new.”

Investors can earn outsized capital gains when companies adopt new products, new management teams, or new business models. And as those growing profits flow to the bottom line, that often translates into lucrative income streams.

Nasdaq Inc could be in the middle of one such transformation. Over the past decade, the business of running a stock exchange no longer represents a cash cow. But management is in the middle of transforming the business from a digital trading pit into a data and service behemoth.