Collect an Indirect 13.7% Yield from “Uncle Sam”

This Trust Pays Out 13.7%

Each spring, we have to complete the infuriating, often stressful, practice of filing taxes. If you forget to dot an “i” or carry a one, more than likely someone from the IRS will be contacting you.

But you know what really grinds my gears? It seems that each year our friends on Capitol Hill take a bigger bite out of my salary. And after each layer of government gets their teeth into my income, each paycheck seems to get smaller and smaller.

Thankfully, there are answers. Of course, there’s no way to get out of taxes completely, but there is one way for you to get a little money from the IRS rather than the IRS always taking money from you.

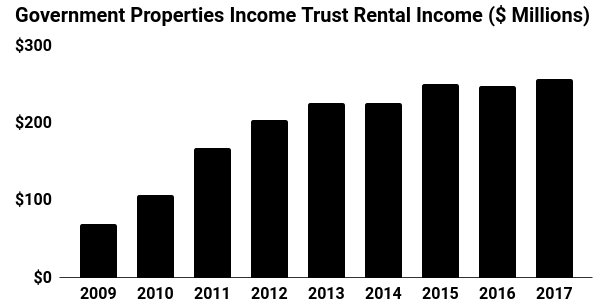

Government Properties Income Trust (NASDAQ:GOV) represents one of my favorite income streams. Like the name kind of hints at, this business owns office buildings and leases them out to the government. And while you can’t call it the most exciting business around, institutional investors have long prized this partnership for a few reasons.

You have the best tenant around, to begin with.

Most landlords struggle to find good renters that pay their bills on time. And even if they do get a decent applicant, tenants rarely want to sign a long-term lease.

Needless to say, the government has a lot more “rent money” than the typical person on Craigslist. By square footage, the IRS is Government Properties Income Trust’s biggest tenant. The partnership’s next-biggest renters include the Centers for Disease Control and Prevention (CDC), the Federal Bureau of Investigation (FBI), and the United States Citizenship and Immigration Services (USCIS).

I probably don’t need to tell you this, but government agencies tend to pay their bills on time. They also have a pretty steady source of income and won’t be “going out of business” anytime soon. For GOV unitholders, this results in a steady stream of income that they can project out far into the future.

Moreover, GOV makes a lot of money on these government contracts. Tenants often sign long-term leases, usually 10 years or longer. And unlike typical apartment leases, GOV bakes inflation, rent hikes, and property tax adjustments right into their contracts.

(Source: “Investors,” Government Properties Income Trust, last accessed March 28, 2018.)

Most of these profits go straight into investors’ pockets. Last quarter, executives paid out a quarterly distribution of $0.43 per unit. Based on the partnership’s current price, that comes out to an annual yield of 13.7%.

Of course, nobody can call Government Properties Income Trust a sure thing. A bump in interest rates will increase borrowing costs. GOV shares have sold off in recent months on fears that government cutbacks could slow revenue growth.

That said, management has prepared the business well for possible rate hikes. Namely, executives have maintained that a light debt load can lock in today’s low rates through long-term bond issues. And while lower levels of government spending might reduce the pace of future distribution hikes, investors today get well compensated with such a high, upfront payout.

If anything, it’s just nice to get a check back from the IRS once in a while.