MPLX Stock: Inflation-Trouncing 9.5%-Yielder Raises Payout Again

MPLX Stock Has Been Soaring Since March 2020

2022 was one of the worst years for the S&P 500, which ended the year flirting with a bear market. That wasn’t the case with energy stocks, though. They rallied by approximately 50% in 2022, with all 23 energy stocks in the S&P 500 notching up big gains. But to find the energy stocks with the biggest gains in terms of share price and dividends, you need to look outside the S&P 500.

MPLX LP (NYSE:MPLX) is a great place to start. The company is a diversified, large-cap master limited partnership formed by oil and gas behemoth Marathon Petroleum Corp (NYSE:MPC). MPLX owns and operates midstream oil and natural gas infrastructure and logistics assets. It also provides fuel distribution services. (Source: “About MPLX,” MPLX LP, last accessed January 6, 2023.)

MPLX’s assets (which are in key U.S. supply basins) include:

- A network of crude oil and refined product pipelines

- An inland marine business

- Light-product terminals

- Storage caverns

- Refinery tanks, docks, loading racks, and associated piping

- Crude and light-product marine terminals

- Crude oil and natural gas gathering systems and pipelines

- Natural gas and natural gas liquid (NGL) processing and fractionation facilities

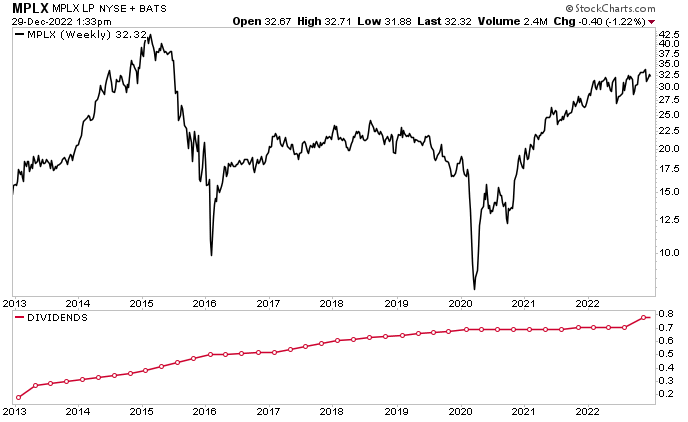

Thanks to industry tailwinds, MPLX LP has been able to continue announcing superb financial results and strong guidance, which has helped juice its share price and dividend yield. MPLX stock has soared since bottoming in March 2020. As of this writing, this dividend stock is up by:

- 21% year-over-year

- 80% over its pre-pandemic level

- 548% since March 2020

Chart courtesy of StockCharts.com

MPLX LP Has Hiked Dividends for 10 Consecutive Years

Not only has MPLX stock’s share price been ripping higher, but so too has its distributions. In early November 2022, management declared a quarterly distribution of $0.775 per unit, for an inflation-crushing yield of 9.5%. This represents a 10% increase over the second-quarter 2022 distribution of $0.705 per unit. (Source: “Distributions,” MPLX LP, last accessed January 6, 2023.)

MPLX has raised its distribution every year since the company went public in 2013. Moreover, in the third quarter of 2021, it paid a special dividend of $0.575 per unit. That was despite being in the worst economic crisis in 100 years. Not many companies were doing that in 2020 or 2021.

| Year | Dividend Per Unit |

| 2022 | $3.10 |

| 2021 | $2.78 |

| 2020 | $2.75 |

| 2019 | $2.69 |

| 2018 | $2.53 |

| 2017 | $2.29 |

| 2016 | $2.05 |

| 2015 | $1.82 |

| 2014 | $1.41 |

| 2013 | $1.16 |

(Source: Ibid.)

Q3 Net Income Jumps 78%

MPLX stock is able to provide investors with stable, growing distributions because the company makes a ton of money.

In the third quarter of 2022, MPLX’s net income jumped by 78% year-over-year to $1.4 million. Meanwhile, the company’s adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) were $1.5 billion, compared to $1.4 billion in the third quarter of 2021. In the third quarter of 2022, MPLX generated $1.0 billion in net cash from operating activities, $1.3 billion of distributable cash flow, and $22.0 million in adjusted free cash flow after distributions. (Source: “MPLX LP Reports Third-Quarter 2022 Financial Results,” MPLX LP, November 1, 2022.)

Also during the third quarter of 2022, MPLX stock returned $935.0 million of capital to unitholders through $755.0 million in distributions and $180.0 million in unit repurchases.

As of September 30, 2022, MPLX had $121.0 million in cash, $2.0 billion available on its bank revolving credit facility, and $1.5 billion available through its intercompany loan agreement with Marathon Petroleum Corp.

The Lowdown on MPLX Stock

As mentioned earlier, when it comes to share-price gains and dividend growth, energy stocks were the biggest winners of 2022. That momentum is expected to continue this year, which is great news for MPLX stockholders.

MPLX LP has a large and growing amount of midstream energy infrastructure and logistics assets. Thanks to wonderful financial results and lower capital spending, the company has been able to generate exceptionally high cash flow, allowing it to pay growing, high-yield dividends and buy back its own shares. There’s every reason to believe that this trend will continue in 2023.